Managing Finances: The 50-30-20 Rule

“Beware of little expenses; a small leak will sink a great ship.” -Benjamin Franklin

It's easier to spend money rather than earning it. There are strategies on how we can manage our finances base on our financial goals. Take note when making a goal it must be S.M.A.R.T. - Specific, Measurable, Attainable, Realistic and Time bound. For example, I want to own a car five years from now. Base on the given goal we can then manage our finances by saving and investing portions of our income in order to achieve the GOAL.

In this blog, we will discuss about the 50-30-20 rule. Just a basic plan that anyone can apply but needs consistency and discipline. Saving is not only about doing it but it needs "commitment" since having a goal means having a long term plan.

What is 50-30-20 rule?

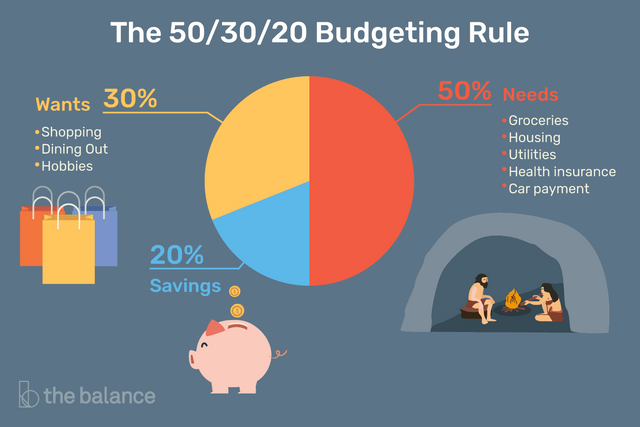

It's a way of dividing your monthly income into 3 main parts: 50% EXPENSES, 30% WANTS and 20% SAVINGS. simple right? it's the simplest rule anyone can follow. It can help lessen the expenses and compress to only major needs but doesn't hinder from treating oneself with wants.

It is advisable to have a separate ATM card for the wants and savings. This is to further track the in and outs of the money thus lessen any future complications such as spending money that is strictly reserved for savings.