Trillionaire's Basic Budget

Ladies and Gentlemen I have bad news. YOU SPEND WAY MORE MONEY ON STUFF THAN YOU SHOULD! We're going to walk through about what you should be doing with your income. Reading through this article you might look at the suggestions and say " I couldn't be happy living on those numbers" or "that isn't possible where I live/work". I ask you to understand that everything in life is a CHOICE and that includes where you live, where you work, who you associate with, and whatever lifestyle you think you might have earned.

I know for many of you, this advice won't be easy to hear. To be honest, just a few years ago I would have myself been put off by this post. After finished 6 years of college (bachelors + masters in engineering) I felt like I had suffered enough and was ready to enjoy life. Whenever I wanted something, I usually bought it. When house shopping, I looked for the house I wanted, not the house I NEEDED. Probably worst of all, I felt I had "earned" it all despite much of it being out of my price range. I then spent the next few years overly stressed by where my financial habits had gotten me, and loathed the position I put myself in.

I hope that this article inspires some healthy self-reflection about your regular spending habits and reminds you that life is more about what you accomplish, what you experience, and who life happens with than a few extra square feet of space, a few extra options on a car, or extra TV channels that won't add much to your life. These percentages are meant to be slightly flexible based on preferences, but one percentage should stay constant. As we stated in our retirement investing post, 15% of your Post Tax Income should be invested. After that, if you want to spend 30% on housing and 5% vehicles, you are more than able to flex these percentages a little.

One caveat: You won't see any budgeting in here for debt, outside of mortgage and car payment. If you have made choices in your life to generate debt, those payments need to fit into your "Discretionary Spending". You should try to keep this area around 25% because life is meant to be enjoyed, and most people enjoy concerts, traveling, sporting events, ...etc more than they like paying bills.

Housing

Housing price vary greatly from city to city, but your CHOICE in which city to live in should not be a significantly negative affect on your ability to generate wealth and success in your life. Things such as rent/mortgage, insurance, taxes, and utilities are important to our lives, but getting greedy about what is needed vs wanted is the downfall of many people. If you aren't able to meet the guidelines outlined for housing, you should look at sharing expenses (roommate or significant other) or moving to a different city or neighborhood.

As a general rule of thumb the following things should occupy less than ~25% of your after tax monthly income. If you are a we (a couple) then it is your JOINT after tax monthly income.

25% of After Tax Monthly Income:

- Mortgage/Property Tax/HOA Fees or Rent

- Insurance

- Utilities (Heat, electric, water)

- Services (Maid, lawn care, maintenance...etc)

- Budgeting for repairs (roof, furnace, A/C..etc)

Vehicles

With the coming rise of Driver Assistance Technology (DAT) and Autonomous Driving, people are going to be more compelled than ever to get the newest vehicle with the latest and greatest features. To be totally honest, I think you should absolutely get those things, as long as you keep your total vehicle costs less than 10% of your after tax monthly income. Most of you will look at this list and not realize how significantly 1 large repair can affect this number. A single $2000 repair can add ~$170/month onto the budget.10% of After Tax Monthly Income:

- Car Loan/Lease Payment (For the record I'm a fan of leases)

- Insurance

- Gas

- Annual registration fees

- Maintenance and repairs.

Regular Entertainment

Believe it or not TV, internet, Netflix, Hulu, HBO, whatever other "Life Essentials" aren't actually life essential. The average person spends FAR too much money on this area. When making your budget, be sure to keep all entertainment expenses less than5% of After Tax Monthly Income:

- Cable/Internet/Home Phone

- Entertainment Subscriptions: Netflix, Hulu, HBO, Showtime..etc

- One time entertainment purchases: Movie rentals, Theater outings, Video Games and Systems, or other..etc

Health, Nutrition, and Fitness

This is an area that can vary wildly from person to person, but since we are talking purely financial in this article, it will be focused in that area.10% of After Tax Monthly Income:

- Grocery Bills

- Eating out/Take out (breakfast lunch or dinner)

- Coffee Shop Purchases

- Supplements

- Gym Membership

Medical, Dental, Eye care, and Personal Care

These expenses tend to be the most significant and unprepared for as people age in their life. As young people we get used to the concept of not needing to budget much for health concerns. Then one day children, health problems, aging eyes and teeth, or injuries from refusing to slow down start to unexpectedly creep into your finances. Its better to prepare for these things ahead of time and have some extra money lying around later.10% of After Tax Monthly Income:

- Health/Dental/Eye Insurance

- Life Insurance

- Health Savings Account or Flexible Spending Account Contributions (If you don't have one of these you are wrong)

- Hair cuts, deodorant, tooth care, feminine products, children's diapers

Discretionary Spending

This last category is wide open. Some people have debt (school loans or credit cards), some people are saving for a wedding, others for their children's education. Believe it or not there are individuals who don't have to worry about any of that stuff and put that money towards traveling, concerts, or buying material things. Honestly, life is about being enjoyed and lived, within reason, so you should find the means to experience what you enjoy..... AS LONG AS IT FITS THE BUDGET.The remaining 25% of your budget is discretionary

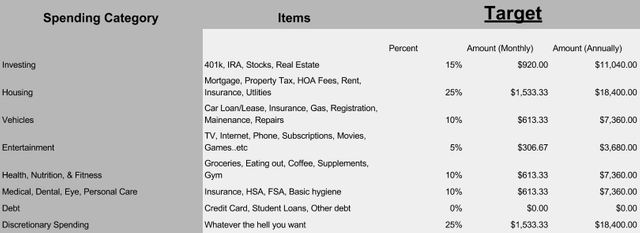

Below is a demo chart showing about what you should be spending based off of a $75,000/ year household income (could be 1 or 2 people) and 20% effective tax rate. Below this is a link to download an excel sheet to modify for your own financials.

Trillionaires-Spending-Assessment

Increasing Spending Amounts

OK, now the first question many of you might ask is, what do I have to do to be able to spend more money? You have two choices:

- MAKE MORE MONEY! Get a second job, get a raise, start your own business, or anything else that makes you more money every year. Winning the lottery will not solve your problems and neither will going to the casino. Be smart with your money, and if your money isn't enough find a way to make more.

- Prioritize Spending - People value things very differently. You may be willing to drive a much older car for a slightly nicer home, or rent out your spare bedroom to travel more. Take a hard look at what you NEED to be happy vs things that are just nice to have.

Original article here: http://www.trillionairesclub.net/trillionaires-basic-budget/

Solid advice, but I would say a trillionaire could spend less in most of these categories. If I'm a trillionaire, my healthcare, housing and transportation needs are not all that different from thousandaires :) the biggest difference would be my savings rate and discretionary income. Hedonic adaptation tells us to continue to spend at the same rate as our income increases, but is that necessary?

Overall I think this is fantastic advice for someone new to controlling their expenses. Thanks for sharing!

Good post, well written and important! I have a tendency to indulge in technology, far too much of my money has historically been spent on Kickstarter or unnecessary tech gadgets... Today I am more cautious!

My first 3 years out of school, I was making more money than I knew what to do with. Luckily I contributed the max to retirement. I had dirt cheap rent and almost no financial obligations besides student loans (modest), but somehow I was living paycheck to paycheck. I was often 1-2 weeks late on rent. It was atrocious how much money I spent, mostly on expensive hobbies.

trillionaires dont care about budgets

we wanna get to a point where we arent bothered by mental constraints

large amounts of modern money (which can be used to buy things online and organize all sorts of insane stuff) will free us to Build and organize busineses!

we need to be free of regulation! peopel should be allowed to build whatever they want! I really hope we can use our money to influence great political change

a steemit political party will be needed