Ridiculous Dot Com Bubble Comparison

I feel like I'm taking crazy pills. Am I the only one who thinks that the Dot Com bubble comparison to crypto is way off base? This topic was was the very first post I blogged about when I came here to Steemit 6 months ago.

https://steemit.com/blockchain/@edicted/the-cryptocurrency-bubble-vs-dot-com

I have learned a ton about cryptocurrency since then. I've done hundreds of hours of research. I've changed my mind on a lot of topics, but this one remains firm: you can't compare to Dot Com Bubble to the cryptocurrency market.

Grasping at straws

As we head into this great unknown we can't help but look to the past to guide us. The Halo Effect has us in it's clutches. We are so afraid of committing to crypto because of this past dot com disaster. First, let's take a look at the similarities of these two movements to see why people think they are so alike.

https://hackernoon.com/popping-the-bubble-blockchain-and-cryptocurrency-7130156f91b2

There you have it. The one and only thing that makes people think that crypto is the same as the dot com bubble; a high velocity market cap. Most of us are not capable of looking past this "fact". We are living in artificial scarcity and we can't afford to lose our precious monies. This makes us afraid.

Differences

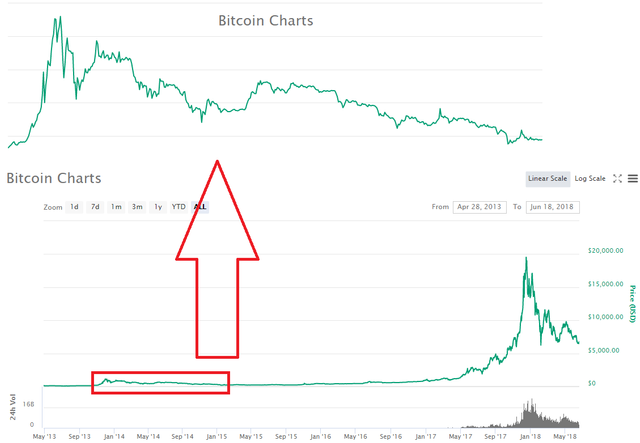

Everything about cryptocurrency is different than the dot com bubble. Look at the graph above. LOOK AT IT! See those numbers on the bottom? Those are years. YEARS! Not one year. Not six months. These are the time frames that we look at crypto in. How many times has Bitcoin died?

Does this graph look familiar? This is our current market, yes? ... NOPE! This is Oct 18, 2013 to Feb 12, 2015 (16 months). Bitcoin starts at $160, peaks at $1133 and crashes to around $200. Bitcoin lost more than a factor of five it's peak value. So which "blockchain businesses" went under because of this "bubble"? Can you say zero?

In the past 6 months Bitcoin peaked at 20K and fell to a hard support line around 6K multiple times. This is closer to a factor of 3. This means that volatility is decreasing. Again, which "blockchain corporations" went under because of this massive loss? None of them. Only the scams die hard.

Market Cap

Did you know that the market cap of the dot com bubble was 3 trillion and fell to 1 trillion? Did you also know that this crash DECIMATED the space? Even the good ideas got crippled and had to give up. Why? Because companies have overhead. Companies have employees. Companies have product. Companies have razor thin profit margins. Companies are in competition. Crypto has none of these attributes.

Blockchains are self funding

Blockchains are money. The comparison to corporations is so far fetched. Just the other day I read that a quarter of a million developers are on the Ethereum blockchain. Do you realize how absolutely insane that is? So how are these developers getting paid? By the ICOs they create, with Ether. This is a system of cooperative capitalism the likes of which we have never seen

Cooperative capitalsim

This is the main reason why comparing the dot com bubble to crypto is absolutely foolhardy. Bitcoin has created new-money millionaires who are uber bullish of crypto. This money trickles down to all the other projects. This is now also true with Ethereum. Basically every exchange has Bitcoin and Ethereum pairs. Bitcoin and Ethereum (and Binance coin and other exchange coins) are breathing life into every project out there. Could you imagine what the dot com bubble would have been like if all the big companies were helping the little guys? That notion is absolutely laughable on a platform of competitive capitalism.

Open source

This is an extension of cooperative capitalism. Many blockchain have and will implement the Lightning Network. There are dozens of technologies that this applies to. Every project is helping every other project.

There can be only one!

This highlander attitude is dead wrong and comes from a rich history of scarcity, competition, and exploitation.

Redundancy

Many people see redundant projects in the cryptosphere and get very worried.

We don't need 50 payment coins. We don't need 20 privacy coins. We don't need X ___ coins.

Well, actually, we do. We are so brainwashed from birth into our current system of competition that we can't understand cooperative capitalism and open source projects. There are hundreds of versions of Linux. They are all valid and they aren't going anywhere. In a competitive atmosphere, redundancy means many projects are going to get eaten alive by the big fish. In a cooperative atmosphere the entire school of fish helps each other and defends one another. At the same time the sick fish will be purged from the school. This concept is foreign to the vast majority of the population.

We could have learned a lot from the Native Americans, but instead we decided to murder them and take their resources. That is the way of the capitalist imperialist. It is an unsustainable way of life based on perpetual cancerous growth and it will come to an end one way or another. Just look at what happened to Rome.

Worldwide support

Imagine you own stock in a company and that company goes under. Can you imagine what would happen if the stock holders could then pick up the pieces of that company and breathe live back into it? That can literally happen with crypto. If the development team abandons the project anyone from anywhere in the world can step in and say, "No, we are making this happen."

Specific Projects

Now it's time to take a look at the dot com companies that actually went under. I got most of my info from this site.

GovWorks.com

A way to interact with local government.

It had all the elements of a tear-jerking fall from grace: company is started by childhood friends (one of them a rainmaker, the other a technical wizard). Friends build multi-million dollar net worths only to lose it all to clashing egos and expectations. Throw in the obligatory theft of company technology and the departure of a crucial partner, and you’ve got all the ingredients for a storybook startup failure.

Flooz and Beenz

LOL! Online digital centralized currencies. Hilarious. Can anyone guess why they failed? This is exactly why Ripple is doomed to fail... although someone may remake XRP with the open source code and decentralize it. This new project would still be Ripple but 1000 times more valid.

WebVan

Online grocery shopping.

By creating a mammoth, $1 billion infrastructure of high-tech warehouses across the U.S., WebVan squandered the $375 million it raised at IPO on growth that its revenue simply could not justify. The other major problem facing WebVan was the already thin profit margins of the grocery business.

Yet another example of how a cryptocurrency could never fail in this way.

eToys

eToys.com committed what has come to be known as a Cardinal Sin of 90’s-era dot coms: spending tons of money on advertising, regardless of whether there is a market for your product or service.

Can you imagine a cryptocurrency going under because they spent all their money on adverting? I can't.

Pets.com

Pets.com dug themselves into an even deeper hole by offering huge shipping discounts to entice people to order. This negated the value of the few orders people did place, as even those were not ultimately profitable. In spite of these obvious red flags, Pets.com managed to raise $82.5 million in a February, 2000 IPO.

Ok so again with the overhead that does not exist in the cryptosphere. Are we seeing a pattern yet? Yet another reminder that the frictionless and permissionless (trustless) nature of the blockchain is far superior to anything we have ever seen.

boo.com

ISP

Boo also underestimated the hassles of being a “global company”, such as dealing with the many different languages and tax structures of the various countries it attempted to do business in.

How does this relate to the perceived crypto-bubble? Again, nothing.

Kozmo

Food Delivery service.

The very thing that made it appealing – free, fast delivery – made the business model unsustainable. It was simply not possible to deliver items that cheap for free and still turn a profit.

Still, again with the overhead. A problem that does not exist in crypto.

It's important to note that this is a service that successfully exists today in the form of Door Dash and other apps. This idea was likely ahead of it's time and required smartphones to survive.

go.com

Not even the mighty Walt Disney Company could insulate itself from the shock of the dot com bust. Their briefly-successful Go.com portal (also known as the “Go Network”) was intended to be an all-service destination a la Yahoo, Lycos, and Alta-Vista.

Unfortunately, being run by Disney placed restrictions (such as bans on mature content) on Go that none of the other portals had to contend with.

HAHAHAHHAHA, they got wrecked because they banned porn. That is fucking classic. Note that you can't ban anything in a decentralized atmosphere. You instead have to incentivize correct behavior. This is why bots can't be purged from Steemit but they can be mitigated.

MVP.com

MVP.com was a website devoted to selling sporting goods on the strength of endorsements from legends like Michael Jordan and Wayne Gretzky.

The $85 million deal was ill-fated, however, as MVP reneged on its promise to pay CBS the promised $10 million per year. Soon after, CBS squashed the agreement and MVP.com was benched for good.

Blah blah blah more overhead and contracts that crypto doesn't have to deal with. It's insane that people compare crypto to dot com. Mind officially blown at this point.

Ug

There are so many more left to do but I give up. You get the idea. Now let's take a look at the blockchain projects.

CO-OP CRYPTOSPHERE

Bitcoin, Bitcoin Cash, Litecoin, IOTA, Nano, etc

Payment coins

There are obviously a lot more payment coins than this, but like I've said previously, redundancy is valid when it comes to cooperative capitalism. What happens if we only had one or two options and they get hacked? We need fallbacks and we need multiple communities. Crypto is all about decentralization. Lot's of redundancy makes sense.

Dash, Monero, Zcoin, Electroneum, Bytecoin, Pivx, zCash, etc

Privacy coins

These projects are massively undervalued because centralized corporations are invading the space and trying to profit off of the transparent nature of the blockchain. Many of these projects achieve their goal of privacy using different technology. This will make privacy coins as a whole very difficult to defeat and exploit.

Ethereum, EOS, Steem, Cardano, NEO, NEM, etc

API and/or Smart Contract coins

These blockchains are arguably the most important in the space. The ability to build apps and new coins on top of an existing blockchain can not be overstated.

ERC-20 Ethereum coins

So many coins. So many projects. It's insane. Very few are currently delivering their promise, which is concerning. Also, they all rely on a network (Ethereum) that has obvious scaling issues. This part of the cryptosphere deserves a lot more attention.

Luckily I've already written about this topic recently.

https://steemit.com/shitcoins/@edicted/my-favorite-erc-20-shitcoins

Now, if you take a step back look at these projects you can see a few patterns.

There is very little redundancy

Many of these projects stand alone in what they are trying to do. Even similar projects like SALT, EthLend, and Maker which all take out loans with crypto as collateral do it in a slightly different way that makes them all separate. EthLend is peer to peer lending. SALT is institutional lending. Maker is smart contract lending AND a stable coin creator. All of these projects look the same at first glance but they are all hugely different when you get down to the details and implementation. There is no competition.They all connect to the cryptosphere and make it stronger.

Sure, these projects aren't delivering yet, but literally everyone in the cryptosphere wants them to succeed. Value gained in a single projects trickles into every other project. The success of these projects strengthens the entire sphere.All of the projects have potential.

Some of the goals of these ERC-20 tokens may be lofty, or even impossible, but none of them are empty. All of these projects are backed by good intentions. The problem is that they start out centralized so if the dev team isn't trustworthy from the start the project is likely to fail because they stole all the fund money. However, it's still not guaranteed to fail if the stake holders are determined to reclaim their investment. Programmers work for free all the time. Just look at Linux operating system.

Conclusion

So many of the dot com companies provided an empty, needlessly redundant service with high overhead and poor management. These are problems that we don't have to worry about. Its much easier to manage a dev team than an entire corporation especially when the foundation of your project is built on top of a tried and true platform that another team is constantly improving (Ethereum and friends).

No one understands the dynamics of cooperative capitalism because it is a system we have never seen before. A brand new open source economy is forming right before our very eyes, yet we are blinded by the past and assume we know what is to come. No one knows. There is no template. This is completely uncharted territory.

This is a great article on the same topic that somewhat agrees with me:

https://hackernoon.com/popping-the-bubble-blockchain-and-cryptocurrency-7130156f91b2

Here's what this article says we should look for before we are actually concerned with a bubble:

Mass media begins focusing not only on Bitcoin (which they already are), but on DLT, on its potential, and on the associated projects. This will signify that a large portion of the population is becoming aware of the underlying technology — far different than today’s situation. CNBC is quickly making this a reality…

A flood of institutional money: hedge funds, retirement accounts, personal savings. This will result in a dramatic market cap increase.

Working blockchain products that are actually supporting large networks of users. As we progress into this development period, it will become clear that many of today’s projects are failing to live up to expectations. The first failed blockchain project will create a snowball effect.

A large influx of private, centralized blockchains produced by existing companies. This will demonstrate that many previously predicted, decentralized DLT solutions will in fact be overtaken by existing, traditional companies, developing their own, private blockchain solutions instead of adopting decentralized, token based platforms. This will likely result in a large reevaluation of what the reality of blockchain actually is.

A market cap between $5 and $10 trillion. Anything of that magnitude any time soon would be very worrying. However, it is important to understand that velocity is what creates a bubble, not total marketcap. A quick run up will almost always be followed by a dramatic crash.

Another thing he doesn't mention is leveraged investments. A bubble can't happen until ma and pa bet the farm on crypto. Actually I guess that's covered by #2. I think this article is very well thought out.

Get a free Bible for your phone, tablet, and computer. bible.com

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by Edicted from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.