As bitcoin prices continue to rise, why hasn't Ethereum kept pace?

Bitcoin's recent performance has challenged the entire market to improve its competitiveness, but so far there is a gap. For example, while Ethereum, the second-largest mainstream cryptocurrency on the market, has been growing, it's not on the price chart as high as Bitcoin. What does that ultimately lead to? Well, that keeps ethereum's short-term performance weakening.

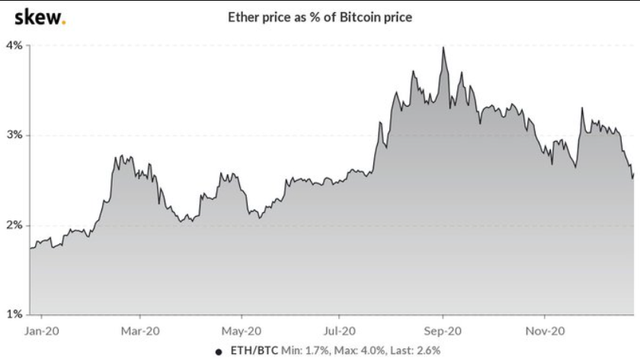

According to data provider Skew, the price of Ethereum has now dropped to a six-month low relative to Bitcoin.

As early as January 2020, the ETH/BTC level has dropped to 1.7% on the figure on the Skew. Although 2.6 per cent at the time of writing is well above the January 2020 figure, the performance is still a six-month low.

Despite these setbacks, the larger Ethereum community remains positive about the relative growth of digital assets.

Ethereum gained the upper hand in July as digital assets emerged from consolidation. Back then, the DeFi craze in Ethereum caused the market to outperform Bitcoin. However, compared to Bitcoin, Ethereum's performance continued to decline as the BTC rally began and the DeFi hype faded away.

Since then, the market's second-largest digital asset has been forging a new path for itself, and ethereum's correlation with Bitcoin has been declining since July. While there has been a recent recovery, there is still a gap from the levels seen in the first half of the year.

The drop in correlation provides an opportunity for it to execute independently and even escape the sudden sell-off in the Bitcoin market, as is evident when analyzing the chart below from CoinMetrics, a data provider.

Looking ahead, when Bitcoin stabilizes, the value of Ethereum may get a chance to bounce of its own. As the Ethereum ecosystem moves forward, cryptoassets will become major players through their intrinsic value.

The year 2020 has finally set the direction for ETH 2.0. As it moves into a new mode, ETH will be burned rather than wired to transaction verifiers, which will provide a strong support for deflation and thus contribute to the way assets grow, Ethereum will enable participants to secure transactions, and settlement will add value.

Such developments have separated Ethereum from other cryptocurrencies on the market, and with more such developments coming, other cryptocurrencies are likely to continue to operate independently, especially if their correlation with Bitcoin does not climb to the level previously set, which is something to watch.