Investment Funds That Offer Cryptocurrency Exposure See Big Gains

These days bitcoin continues to outperform many traditional assets as the decentralized currency has become the premiere digital asset class of the 21st century. There are many ways individuals can obtain bitcoins and hold the appreciating investment themselves. However, there are also other traditionalized methods where people can invest in cryptocurrencies through trusts, self-directed IRAs, hedge funds, and other investment vehicles.

In 2017 Bitcoin Visibility Increases Among Mainstream Investors and Traditional Fund Managers

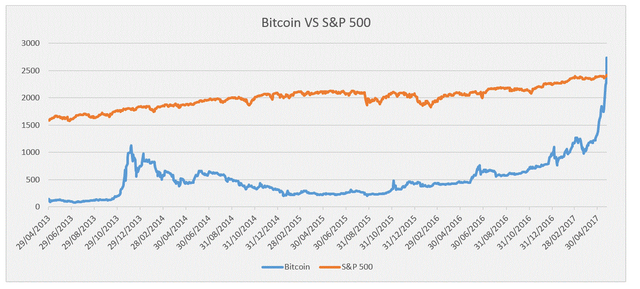

Bitcoin’s performance as an asset class continues to outshine traditional investments like stocks, precious metals, and the bond market. Just recently the well-known mainstream financial publication Bloomberg called bitcoin an “exchange traded fund (ETF) on steroids.” Furthermore, people have found that there are other ways to invest in bitcoin which are similar to traditional individual retirement accounts (IRA), or stock market investments. This includes cryptocurrency based investment trusts, exchange-traded notes and many more types of methods.![]

( )

)

So far in 2016 and the past six months of 2017 cryptocurrency funds have soared in value considerably compared to traditional assets. Some of these traditional investment rails just offer bitcoin while others offer a basket of cryptocurrencies that can sometimes outperform one single digital asset if managed properly.

I have been looking for something like this. Particularly for superannuation