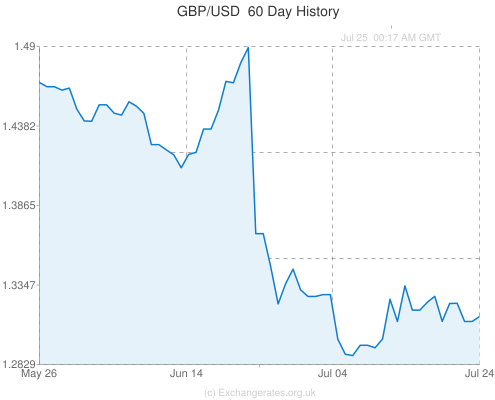

The British Pound a month after the Brexit!

When Britain voted to exit the European Union on June 23, the British pound was battered instantly on the same day by over 11%. It traded at a low of $1.323 in early hours on June 24th, dropping overnight from its peak of $1.50 the previous day. The world’s financial markets were also plunged into turmoil. This became a brutal flogging for investors who had betted that the U.K. would vote to stay.

The pound is currently exchanging at $1.31, the lowest in 31 years. This has triggered a worldwide transfer of capital into the normally secure Swiss franc and the yen. And it is not over yet because strategists foresee further substantial loss of value for the pound, especially following the new Chancellor Phillip Hammond’s contradictory remark that monetary policy is the front line defense for the UK economy.

Failure of the European Union

Brexit depicts a deep weakness in the European Union: the failure of its political leaders create and protect the story of a meaningfully true European identity and single destiny. The dream of a united Europe originated from a history of horror that ended in the WWI and WWII. Yet Europeans have forgotten this and nationalism still mires them today. Before Brexit, the European elites failed to convince Brits and the EU at large, that there were deeper reasons for remaining in the EU associated with core values, history and shared vision. Moreover, as David Cameron said in his farewell speech to the EU, had EU leaders granted UK control over migration, Brexit could have been avoided.