The Best Rewards Credit Card in the Business: How to Fly Free and Get Great Benefits

It all started with a tweet:

"Amigos: Is there a good rewards Credit Card that you recommend? Have been using the Delta Skymiles card, but just gives 1 point per $1."

I had heard that there are ways to get free flights and great benefits with certain credit cards, so I wanted to do some research.

For the last 1.5 years I had experimented with one card in particular: The Gold American Express Delta Skymiles card. The membership fee is waived for the first year and then it's $99 per year after that. It's the entry level card and gets you 2x points per dollar for anything related to travel and dining, and 1x point per dollar on everything else. Oh, you also get free bags when you travel.

I used it religiously, putting everything on the card. My hope was that, by the end of the year, I'd have enough points to get a few free tickets so we could see our family in Florida.

Swipe.

Insert.

Swipe.

Repeat.

After using it for a solid year, my wife and I assembled and prepared to purchase plane tickets. Turns out, we had only amassed around 50 thousand points, and they could only be used on Delta flights. We looked online.

sigh

The total for my family of 4 to fly from Michigan to Florida for Christmas would be around $1,850. And the 50 thousand points? Well, those were good for a discount of about $150 off each ticket. That brought the total to $1,250. My wife did a quick search on United. The total for the same flights on United would be around $1,200.

Did you catch that?

I had essentially wasted a year's worth of effort using that credit card. Suffice it to say that my wife was not happy with me. There had to be a better way. I was interested in actually getting some free flights and some much better benefits.

Back to the tweet.

One day I was speaking with my neighbor and he tells me, "Hey, so I saw your question on Twitter about credit cards." I had no idea he followed me. "I have a system I use, which you may find useful to get a lot of points," he said.

We arranged to have lunch together later that week.

My neighbor at the start of the conversation: "So what's your goal in wanting one of these credit cards?"

Me: "I'd like to be able to fly free, or at least get some decent discounts and good benefits. That's my goal. What's yours?"

Neighbor: "We like to go to Europe once or twice a year. And we're at the age (he's in his 50's) where we like to fly comfortably. So we usually fly business or first class using points from this system I've been using."

Me: "How many points do you actually have right now?"

Neighbour: "400,000 points."

You better believe I was all ears at that point. And I should clarify that he and his wife are regular income kind of people. His wife is a professor and he works in the IT industry.

Fast forward several weeks.

I had assimilated what he had shared. I had read dozens of articles online about the system and seen a good handful of videos on YouTube. I was thoroughly convinced. As an aside, whenever I do something, I research it to death. You can ask my wife. :)

So are you ready to hear about the credit card system?

It's called the Chase Credit Card Trifecta. You'll need to Google that.

At the bottom of the post, I'll include some helpful videos and resources that helped me.

Part One:

It begins with the best travel credit card on the market: the Chase Sapphire Reserve card. I researched them all. This one came out on top.

Here's what it actually looks like:

The first thing you notice about the card is that it's not plastic like a normal credit card. It's metal. There is some heft and weight to it.

Next, I'll move on to the great benefits of the card and describe how it fits into the system.

It starts with a 50 thousand point bonus if you're able to meet the requirements in the first 3 months. This is about $1,500 worth of free flights.

You earn 3x points on travel on dining, as opposed to just 2 points like the AMEX.

There's a $300 annual travel credit. Things that are counted towards this credit are Uber or Lyft rides, airplane tickets, car rentals, high way tolls. So that means that if you take an Uber ride, the cost is immediately placed on your credit card as a credit. Or if you spend $400 on an airline ticket, they immediately credit back $300.

Complimentary Airport lounge access. Have you ever been at an airport and seen someone slip into one of those nice airport lounges? This one gives you and guests traveling with you free access to the Priority Pass airport lounge. Over 1,000 airports around the world have them. In my next post, I'll give a review of my first experience trying it out a few weeks ago. But what's really nice is that this credit card gives you access to the highest level of membership Priority Pass offers.

Trip cancellation insurance

Trip Delay Reimbursement. This one is pretty huge. Have you ever had a delayed flight? About a year ago I had a layover at the Atlanta Hartsfield airport. There was a storm passing through, and my flight got delayed about 12 hours. Another time, I was traveling internationally and the flight got canceled. I ended up having to spend the night at the airport, trying to sleep in a seat by the gate. If I would have had this card, I wouldn't have gone through any of that. After a 6 hour delay, a $500 benefit kicks in. I could rent a car and spend the night in a hotel with food covered. Boom.

Rental Car Protection

Usually, when you rent a car, they try to convince you to get one of their collision protection plans, which are often quite pricey. Whenever you decline, your own car insurance becomes the primary in case of an accident. With the Chase Sapphire, they become the primary in case of an accident with a rental car, not your own car insurance.Get a TSA Pre-Check or Global Entry membership for free. This one is pretty sweet as well. There have been times in which the security line at the airport takes 30 minutes to get through. Sometimes longer. But the TSA line? Those are always incredibly short. People breeze right through. And if you're cutting it close on time to catch your flight, 20 or 30 minutes is the difference between missing the flight and getting on. There are many more benefits as well.

Ok, ready to hear the cost of the card? Don't be scared away: $450 per year.

I know what you're thinking right now. That's insane. I think those were my wife's exact words, in fact.

That's a lot of money, and you'd be correct in that assessment. But hear me out for a few minutes. You just need to logically think through what you're saving. After walking my wife through the numbers and seeing the potential, she also became convinced.

This post is not intended to be an exhaustive list of all the ways you can save. I can do that in another post. But right off the bat, if you spend at least $300 per year in travel-related purchases, then the membership essentially becomes $150 per year. And if you add up all the benefits you can get, it more than covers the cost of the card. Check out this article.

If we were to stop there, this credit card would still be worth it for me, because of all the exceptional benefits and service you receive. But what really makes this system work great is when you pair it with one or two other cards.

Part Two:

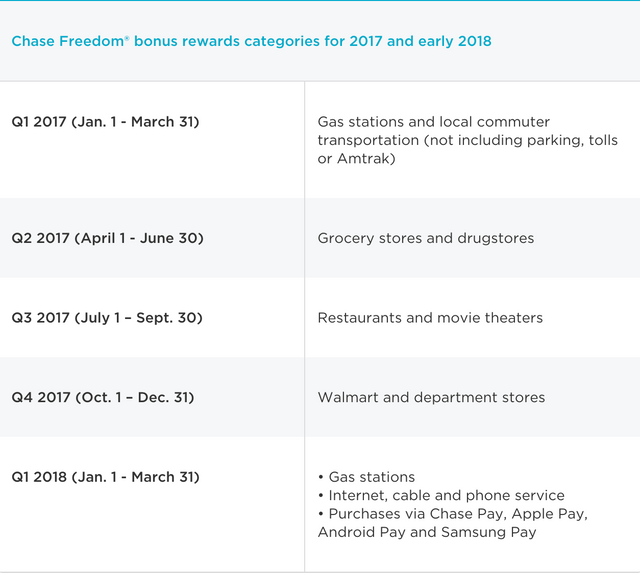

Remember, this is called the Chase Credit Card Trifecta. The second card in this system is the Chase Freedom Card. With the Sapphire Reserve, you get 3 points on travel and dining, but only 1 point on everything else. That's where this other card shines. With the Chase Freedom Card, you earn 5x points per dollar on a rotating category of items.

Note the chart below.

In those quarters, if you need anything from those categories, you use the Chase Freedom card. So how does this help you amass a lot of points? Here's the real genius. Points within a family of Chase cards can be easily transferred to the other. So points you amass on this card can be transferred to the Sapphire when you're ready to redeem them.

Part Three

We could stop where we are and have a fantastic system. Some people stop with those two and do really well. But my neighbor told me about one more card that can be added: the Chase Freedom Unlimited Card.

This card is really simple: you earn 1.5x points on every purchase. That's it. So for travel and dining, use the Sapphire Reserve. For anything within the rotating category of items, use the Chase Freedom. And for anything else, use the Freedom Unlimited.

I confess I don't yet have the Freedom Unlimited and I don't know if I'll add it. I'm going to give it a go with these two first.

A final note:

The premise of this whole system is that you need to stop being loyal to an airline, and you start being loyal to a credit card system.

Getting status with an airline is pretty hard unless you have to travel for work. I usually travel several times per year professionally, speaking and presenting in different places, and I travel a minimum of twice a year with the family. Even with that, I'm not able to get status that makes it worth it to remain loyal to an airline. So why stay loyal? I won't. Instead, through a system like this, you can earn enough points so that you can buy the kind of ticket you actually want.

And just for reference, I'm not looking to buy business or first class tickets. But, I wouldn't mind getting free economy tickets or really good discounts using points for United's Premium Economy seats or Delta's Comfort Plus, for example.

Keep In Mind...

A system like this is only useful if you pay your credit card off in full every month. You need to treat it like a debit card. So you'll want to check your balance about every two weeks and pay off what is there. If you don't pay it off completely every month things can really get out of hand.

Finally, in my next post, I want to give a review of the Priority Pass lounge membership, which we got for free with the Sapphire Reserve. Our experience going into one of these is what fully convinced my wife that the card was worth it.

By the way, if you think you might actually want to apply for the card, would you mind using this link? It will send some bonus miles my way if you meet the requirements and are accepted. You'll also get 50 thousand bonus miles when you complete the signup and meet the requirements.

So what about you? Do you have any travel-related credit cards? What are ways you've discovered to get discounts on travel? Do you have any questions about the system?

Extra Resources:

This video below is a little long, but it's excellent. It helped convince me to take the plunge.

Also, check out the one below. He analyzes a lot of variables.

And here's a great write up by the Points Guy.

Image by gratisography

I wish the usage of credit card can be well welcomed and enforced here in this part of the world. It will really booster the cash-free policy of my country - Nigeria

The issues of bag theft with lots of currency in it can be reduced and also the pollution and misuse of the currency itself can be easily abolished

@passionate-star

How do things work concerning credit cards in Nigeria?

@leaderinsights, Great post!!! Guess I should use this system to fly for cheap/free to Hawaii!!

Thanks for the comment :)

Yeah, give it a go!

Good work at this post

Thanks so much.

This cards are going to worth its value so far they will be accepted internationally and also be useful for any transaction.

Right. Yeah, they can be used internationally and there are no international fees, which is nice.

The main reason most people use credit is that they do not have the cash to pay the total cost of an item or service at one time. Another reason is that it may be easier to pay for an item through regular installment payments.

Credit card usage should be accepted in Nigeria

Well, that's not the thesis of the post, actually. In the post, I mention that I only recommend paying off the card every month. Using this credit card system is not about not having the cash. It's about accumulating points so that you can make your money work for you. If you let it go beyond a month you'll be charged interest, so it wouldn't be worth it.

Well taken

Great post and very helpful as I am actually looking into this at the moment. I was tempted by an airline card but this makes me reconsider. I'll have to review the details at length, but thanks so much for writing this!

Yeah, that's really the premise of this program, that you stop being loyal to one airline and instead you become loyal to a credit card system. Like I mention in the post, after having a disappointing experience with a Delta Skymiles card, and after hearing the system explained by my neighbor, I decided to really invest in and work this system. Happy to chat and tell you more about it. I can say this right now: this card has some really amazing benefits.

It would be great if we could chat about it. I really need to figure out a good card to invest it.

Let's plan on it, then. Happy to walk you through the whole system and share everything I know.

I think I've finally decided that I'm going to give this a try.