Can Auto loan deliquencies impact the US financial system?

Are you scared of rising auto loan delinquencies?

Is there any reason to believe this increase in bad loans prefigures another credit crisis in the making?

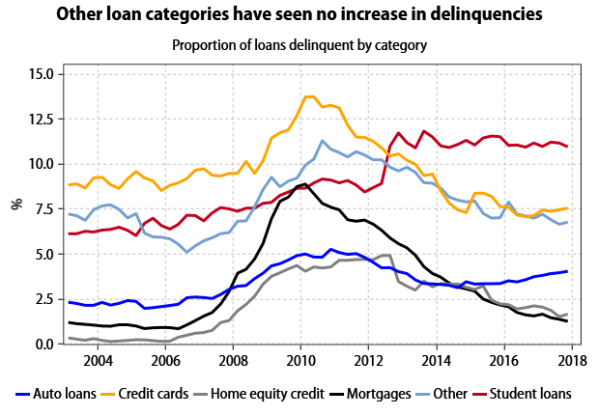

Thankfully not: souring auto loans would only inflict injury on the broader economy if 1) they made up a large portion of total credit outstanding in the economy and if banks were heavily exposed to the sector, or 2) they were a symptom of crumbling consumer credit quality across the board. Neither is the case.

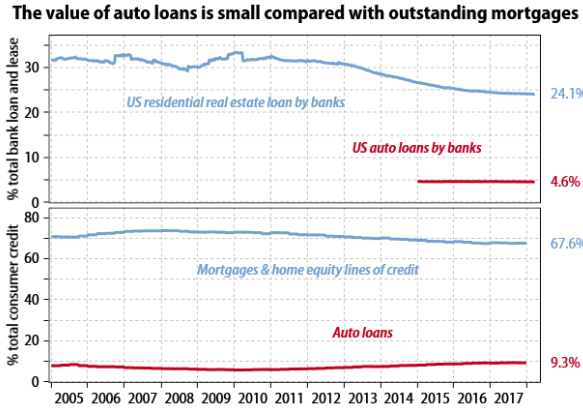

Despite the quick rise in the auto loans outstanding to US$1.2trn in this cycle, car loans are a tiny proportion of total bank lending and remain small compared with overall consumer credit.

Auto loans make up only 9% of total bank loans to consumers (including mortgages)

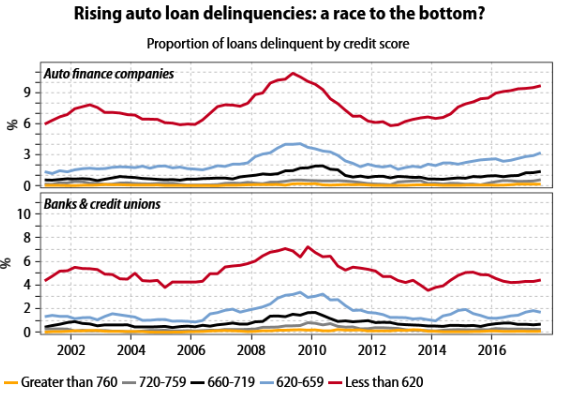

The rise in the auto loan delinquency rate since 2014 can be explained largely by more aggressive lending by car finance companies to new subprime borrowers.

As the chart above shows, the increase in delinquency rates is concentrated among auto loans extended by finance companies to borrowers with the lowest credit ratings.

Conclusion

Investors need not fear that the recent rise in auto loan delinquency rates prefigures a broader credit crisis.

Now, let's just hope Wall St. hasn't invented some kind of new CDO for auto loans, and then sold these new "assets" to all kinds of investors (pension funds, sovereign wealth funds, etc..)

Hopefully they did not repeat this mistake again. Nevertheless, this sector is too small to impact as much as Subprimes did. Take care.

thanks for the information

This post has been upvoted and picked by Daily Picked #31! Thank you for the cool and quality content. Keep going!

Don’t forget I’m not a robot. I explore, read, upvote and share manually ☺️

Interesting, I thought the auto debt bubble delinquency would have a larger impact. I thought it would be part of a larger domino effect like in 2009.

Appreciate your post.

Hello There,

Thanks for this great analysis.

To my point of view, I agree with you this topic will not lead to a global market collapse but it will help whatever will be the future crisis we'll face.

Consumer psychology is the first key attention points to understand the global picture we'll live in a couple of years.

Have a great day,

Laurent