Managing Expectations: Questioning Metcalfe's Law

Conventional wisdom suggests that cryptocurrency value follows Metcalfe's Law, increasing in proportion to the square of the number of users (or wallets). A 2006 article from IEEE Spectrum, Metcalfe’s Law is Wrong, calls that claim into question.

Introduction

pixabay license: source

Apparently, I came across this article some time ago and saved it to read later, then promptly forgot all about it. Now, however, I came across it in my bookmarks and actually managed to read it.

Despite the attention-grabbing headline, the article by Bob Briscoe, Andrew Odlyzko, and Benjamin Tilly doesn't really claim that Metcalfe's Law is wrong. The math that goes into Metcalfe's Law is sound, but the authors take issue with the assumptions that are necessary in order to apply the concept to the Internet. In short, they say that it is a mistake to assume that every new connection in an Internet network has equal value.

Instead, the authors argue that there is a form of continuously diminishing returns on new connections. When the network is small, new connections add large values, but when the network gets larger, new connections have proportionately less impact. To illustrate, they give the example from Walden, where Henry David Thoreau wrote, "We are in great haste to construct a magnetic telegraph from Maine to Texas; but Maine and Texas, it may be, have nothing important to communicate."

If Metcalfe's Law hold's true, it means that value growth for a network follows a quadratic curve, far outpacing the linear growth of costs. Instead of Metcalfe's Law, however, the authors argue that Internet network value growth should be seen as proportionate to n log (n).

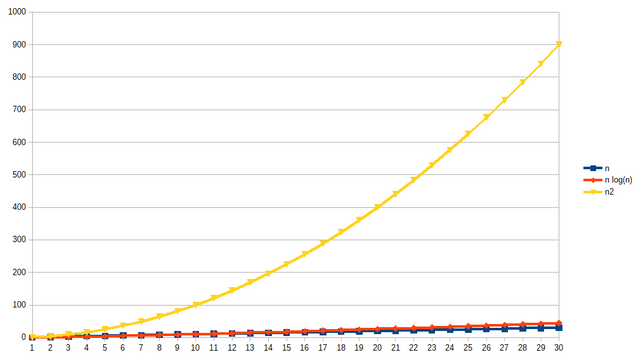

Many of us who are familiar with Steem's curation curves across the years will already know the differences between the curves that this article is discussing, but a graphical illustration may still be useful. This one was produced in LibreOffice.

The yellow curve is the quadratic curve that would be one factor of a growth formula that's based upon Metcalfe's Law. The orange curve is the n log(n) curve that the authors propose as a factor. The blue curve is the linear growth curve that acts as a factor in the growth of costs.

Even under the n log(n) curve, the value of the curve still outpaces linear growth, but the difference is nowhere near as significant.

As this essay will cover, the arguments that this 2006 paper applies to the Internet may also apply to blockchain technologies. In upcoming sections, this essay will: Define Metcalfe's Law and describe the background that led it to be applied to the Internet; Describe the arguments against applying it to the Internet, and how those same arguments fit blockchain valuation; and Describe the reasoning that led to n log (n) for a proposed valuation formula.

What is Metcalfe's Law

In general terms, Metcalfe's Law was an attempt to quantify the idea that a network becomes more valuable when it connects to more people. This can be applied for networks of all types: social media contacts, telephone numbers, web pages, Internet routing, or even blockchain wallets.

The original formula was created by Robert Metcalfe, who is also widely known as the inventor of Ethernet. Metcalfe established the formula some time around 1980 and George Gilder named it Metcalfe's Law in 1993. Metcalfe points out, however, that the formula was created for a very specific purpose, saying: "The original point of my law (a 35mm slide circa 1980, way before George Gilder named it...) was to establish the existence of a cost-value crossover point—critical mass—before which networks don’t pay. The trick is to get past that point, to establish critical mass."

After Gilder named it and proclaimed its importance to the so-called "New Economy", the FCC chairman at the time - Reed E. Hundt, coupled Metcalfe's Law with Moore's Law, saying that the pair of laws "give us the best foundation for understanding the Internet."

The law rests on the foundation that in a network of n nodes, each node can connect to (n - 1) other nodes. Thus, every new node adds (n - 1) new connections. Since n (n - 1) is roughly equivalent to n2 for large values of n, this means that if every connection is equal in value, the value of the network is proportional to n2.

Importantly, however, Metcalfe was focused on the early start-up period of a network when he established this formula.

What's wrong with applying Metcalfe's Law to the Internet (and blockchain)?

As noted above, the authors' primary objection to Metcalfe's Law as a growth description for the Internet is its assignment of equal value to all new connections. Instead, the authors argue that different connections have different values, and that as the size of the network grows, the value of new connections shrinks.

Building on the example from Thoreau, the authors appeal to intuition, noting that people in Maine and Texas actually did have things to say to each other, but nowhere near as much as people in closer locations like Boston and New York City. The authors note that even Metcalfe, himself, raised this objection to some uses of the law bearing his name.

Further, the authors argue that if Metcalfe's Law were true, then companies during the early days of the Internet would have exerted enormous efforts into a first priority of interconnecting with other networks, in order to realize the promise of quadratic growth from interconnecting with large numbers of users. Since that didn't happen, the authors are forced to conclude that the law did not describe an economic reality.

In more recent times, the existence of walled gardens at Facebook and Google suggests that the actual financials still don't support the claim that Metcalfe's Law describes real-world value growth.

Finally, I'll note that these same arguments apply to blockchain. Certain blockchains do aim to interconnect blockchains as their own value proposition, but for most blockchains that does not appear to be a high priority. If interconnecting Steem and EOS, for example, would lead to a quadratic gain in value, it would be the number one item on both platform's priority lists. Since neither platform seems to be pursuing that course of action, it follows that the internal financial projections don't lend support to Metcalfe's Law as an unqualified value-growth description.

Where does n log(n) come from?

The authors note that value is a vague and amorphous concept and that there is no way to mathematically derive n log(n) as a proper description of value growth, but they argue that the formula fits real world observations from 1990 through the time that the article was written (2006). The crux of their argument is this:

We admit that our n log(n) valuation of a communications network oversimplifies the complicated question of what creates value in a network; in particular, it doesn’t quantify the factors that subtract from the value of a growing network, such as an increase in spam e-mail. Our valuation cannot be proved, in the sense of a deductive argument from first principles. But if we search for a cogent description of a network’s value, then n log(n) appears to be the best choice.

Further, they point out that many real-world phenomenon wind up following Zipf's Law. Zipf's law suggests that the kth ranked element in a series has 1/k times the value of the first element.

It's worth noting that Steem specifically refers to Zipf's Law in its white paper, lending some support to the n log(n) growth valuation here on this block chain (at least before the existence of communities -- see below).

Further, the authors argue that popularity might be considered as a measure of value, and many observers have noticed that popularity tends to follow a Zipf's Law sort of distribution.

The authors argue that if Zipf's Law applies to telecommunications networks, then that leads directly to their n log(n) proposal. To illustrate this, they ask readers to consult our intuitions and look at our own e-mail inboxes. E-mails from one person, might have the highest priority, but e-mails from others go straight to the spam folder without reading. It would be absurd to argue that e-mails from all people are equal in value. If the value of messages from the most important person is assigned a value of 1, e-mails to others might well follow a Zipf's Law type of decay in value to a minimum that is near zero.

Conclusion

In my opinion, these authors - coupled with the experience of the subsequent 14 years, made a compelling argument that Metcalfe's Law should not be used to describe the value growth of an Internet network. Additionally, I think that their intuitive argument for the n log(n) formula is plausible, although I'd like to see some actual financial observations to back their claims. All of this leads me to suspect that Metcalfe's Law might also be overstating the value growth of blockchain networks after they pass a certain size.

Before closing this article, I'd like to highlight a few other points from the article that didn't fit neatly into the sections of my article.

First, the authors point out that the growth of a broadcast network is believed to grow linearly in proportion to cost, so none of this discussion applies to broadcast networks. This growth rate is known as Sarnoff’s Law.

Secondly, the authors brought forward another equation, known as Reed's Law. Reed's law suggests that networks that allow the formation of groups (like Steem communities) grow in value at a rate of 2n - doubling with every new user - which is even faster than the growth that is claimed under a Metcalfe's Law regime. The authors point out the absurdity of applying this without restriction by noting that at some point, adding a single user would increase the network value by more than the size of the global economy, but it's worth noting the observation that a network's value may grow faster if it enables groups to form.

Finally, I'd like to highlight this important clarification from the source article:

Note that these laws are growth laws, which means they cannot predict the value of a network from its size alone. But if we already know its valuation at one particular size, we can estimate its value at any future size, all other factors being equal.

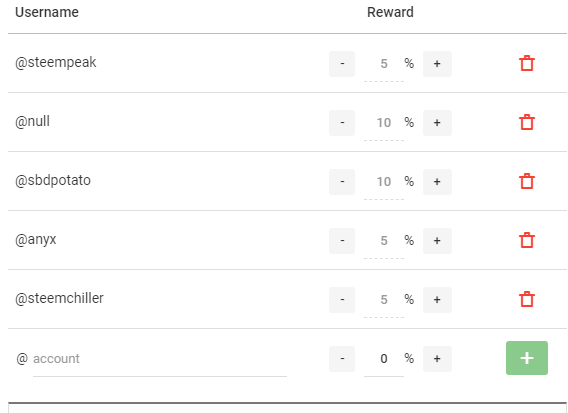

Beneficiaries:

Thank you for your time and attention.

As a general rule, I up-vote comments that demonstrate "proof of reading".

Steve Palmer is an IT professional with three decades of professional experience in data communications and information systems. He holds a bachelor's degree in mathematics, a master's degree in computer science, and a master's degree in information systems and technology management. He has been awarded 3 US patents.

Steve is also a co-founder of the Steem's Best Classical Music Facebook page, and the @classical-music steemit curation account.

Follow in RSS: @remlaps, @remlaps-lite

We should separate the different causes to measure the value of a crypto :

Interconnecting EOS and Steem is an interesting idea. Today, I have to send my Steem to an exchange to buy some EOS. Most Steem users will want to try an EOS dApps, somedays.