If Germany out of the euro area, why the euro area has "exit costs"? What are the exit costs?

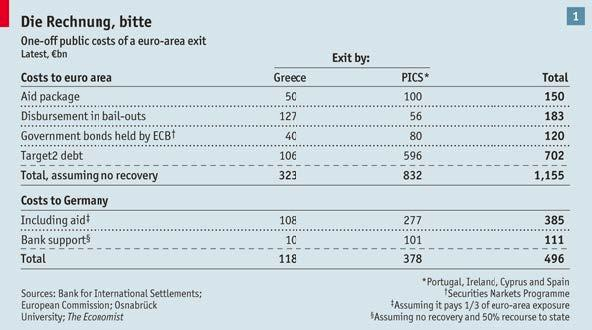

In 2012, when the euro crisis continued to spread, the Economist magazine published an article "The Merkel memorandum", to Germany calculations, estimated "Greece back to Europe" and "PIGS plus Cyprus back to Europe", Germany Direct loss of money. The conclusion is that the cost of the former is 100billion more than the cost of the latter is about 500billion.

At that time, there were many analytical reports on the subject, which were very similar to those of the economists: when they returned to Europe, their debts owed to Germany would be greatly devalued. This is the most direct loss to Germany.

Of course, there are some problems with this report. First, it only counts the financial assets of these countries held by German and German private banks, ignoring the assets held by other private institutions, such as insurance companies and pensions. So this figure should be regarded as the lower limit of the loss. Second, the calculation of these losses is based on the assumptions that exist in the euro area. If the withdrawal of these countries led to the dissolution of the entire euro area, the cost is not just the loss of financial assets.

If the euro area to be dissolved, the increase in the cost of Germany is:

- Depreciation of Target 2 balances for non-PIGS Euro countries;

- Depreciation of private sector assets against non-PIGS euro countries' financial assets;

- no less than the 2008 US subprime mortgage crisis brought about by the economic shock;

- The impact of the new German mark on exports;

- The impact of the single market in the EU, including increased trade barriers, disruption of staff mobility, financial market segregation, negative impact on the German economy.

Assuming that the new Mark is 15% of the short-term value, the long-term 8% increase, the above 1 + 2 about the increase in the cost of 200 billion, 3 caused short-term -5% GDP growth, 4 -4% short-term negative growth, long-term negative growth of -1.5%. 5 more difficult to estimate, ignore.

A conservative estimate of the impact of the dissolution of the eurozone on Germany is the direct depreciation of assets. Short -9% GDP, long-term -1.5% GDP.

Of course, this is only the year we do the estimates, Merkel's economic adviser, ECB economists certainly have done a similar analysis. I believe that the conclusion is that the euro zone disbanded the huge economic impact on Germany.

Do not support the euro area for the German province how much money? The province is ESM / ESFS funds, the Greek rescue money, of course, the money is not presented, is given in the form of loans. Even if all the loss, the amount will be about 220billion. Of course there is an important hidden cost of relief, is the ECB's SMP and OMT projects.

If a country like Italy is in need of relief, the ECB buys Italian bonds in large quantities with his OMT program. When the Italian bankruptcy, the ECB's losses are shared by Germany. So as long as similar to Italy, such a big country bankruptcy does not occur, the cost of supporting the euro in Germany is far less than the cost of dissipating the euro area. As a rational economy, Germany will certainly support the euro.

And then from the political point of view, so that the dissolution of the euro zone, Germany's international influence will naturally be greatly reduced, both within Europe or in the global context.

Although I have mentioned that the creation of the euro, not only for economic considerations, it is in political considerations. The elite political class tried to use the euro as a tool for political unity in Europe. But now the situation is that the power of political unity is getting weaker and weaker. Merkel did not show a strong tendency to promote European integration. But the rescue of Greece in the German people is very unpopular.

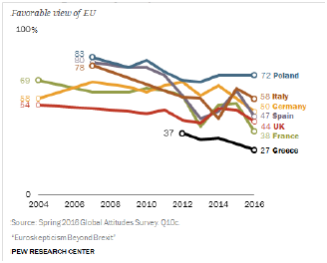

But at the same time, Germany's attitude towards the EU is generally positive. So the German government is facing the dilemma is that if the rescue of Greece, the German people will be dissatisfied; if not save, the results of the dissolution of the euro area, thus affecting the entire EU, the people will be dissatisfied. After weighing, the German government eventually decided to withstand the dissatisfaction of the people, to save the Greek, to avoid the dissolution of the euro zone to bring greater political shocks.