Blockchain landing application series the world's first real estate securities pass the STO road

Blockchain landing application series the world's first real estate securities pass the STO road

Recently a property in New York has been funded in the market through a pass-through method mainly based on the US Securities and Exchange Commission's financing exemption clause for SMEs. In addition there are many projects in the market that focus on the establishment of a standardized securities pass compliance agreement through automated smart contract integration which also reflects the current many project parties and industry insiders seeking An attempt on the road to compliance or a self-constraination is not an inspiration for countries to manage future encrypted assets.

I. Background overview

In October 2018 a 12-unit building in East Village Manhattan New York became the first large-scale real estate project to be certified and successfully issued at Ethereum. The property is currently valued at more than $30 million and is designed and distributed primarily by traditional financial companies and blockchain startups Propellr and Fluidity. This innovative approach to financing is designed to eliminate the cumbersome processes and time of traditional bank financing and is more operative and transparent for project parties and stakeholders.

In the eyes of many people the biggest significance of this pass-through project is to improve the liquidity of large-scale assets. Fluidity mainly uses a trading terminal called AirSwap for this pass. The project party declares that investors can choose between the legal currency and the crypto assets and allow the compliant secondary market to appear without any transaction costs.

Blockchain landing application series the world's first real estate securities pass the STO road

Image source AirSwap

Second compliance and supervision

Propellr a registered securities broker in the United States uses its financial and capital market experience to gain greater asset liquidity through the crypto-asset sector. It is worth noting that in the process of the real estate certification the project has different from the previous initial issuance financing. The project party has reflected more respect and attention to legal supervision from design to distribution trying to pass the self. A compliant approach increases credibility.

The current financing and trading of crypto assets in the United States is primarily intended to operate in accordance with the Securities and Exchange Commission (SEC) Reg D Rule 506(c). Reg D stipulates a number of registration exemptions for the purpose of allowing small companies to raise funds for the sale of equity or claims to specific investors eliminating the need to register with the SEC and generate the cost of public offerings. The most recent major revision of Reg D was implemented in 2013 and the US SMEs that were raised through Reg D alone in 2016 reached $4.2 trillion.

Although the rules are not intended for digital cryptographic assets they are a non-mandatory regulatory provision for SMEs to open financing channels in a highly liberalized capital market in the United States. However many companies that intend to issue cryptographic passes through compliance channels are trying to raise funds for projects in this way replacing the high cost of private equity and the huge uncertainty in the initial issuance.

Whether the certificate is another form of "securities" or a form of securitization pass is still a viable way to still have greater uncertainty. From the details of the project financing distribution and management it can be seen that it is significantly different from the previous issuance of the certificate. The regulations mainly related to securities financing are as follows

The issuing company cannot promote securities through public promotion or advertising.

Buyers of securities need to conduct compliance investor verification requiring investors to have sufficient financial base and investment risk identification capabilities.

The issuing company needs to disclose project-related document information including the company's auditable financial statements on time and in the investor.

The Regulations do not limit the limits on the company's assets raised but the types of securities issued through the Regulations are still restricted securities and such securities are not sold for six months or one year after they are issued without registration.

It is worth noting that companies that meet the rules do not need to register with the SEC at the time of the issuance of the securities. They only need to submit a form electronically after the first sale which includes the company sponsor management personnel and project details. The form can be queried in the official website of the SEC.

In the blockchain industry for crypto-equity issuers raising funds in this way still needs to consider the following issues

How is the issuance of securities passes and fundraising? It appears that the registration of the Reg D rules through the SEC does not require registration but the securities pass exchanged by the investor is not subject to regulatory approval if it is publicly traded on the encrypted asset trading platform.

How do blockchain startups achieve information integrity disclosure? Most blockchain companies are still in their infancy and the nature of blockchain projects means that there is currently no standardized material in the traditional sense for review.

How to solve the geographical restrictions of investors? The transaction of encrypted assets has the characteristics of globalization. The single standard and supervision method in the United States is relatively low in enforceability for investors in other places. Whether it has reference significance remains to be verified by the market.

In general the implementation of encrypted asset financing through a US SEC clause is seen by many as a viable path. However considering the independence and diversity of the US capital market and the degree of freedom the different laws and regulations of the states cannot be simply regarded as a means of financing approved by the regulatory authorities. To a certain extent this also reflects the anxiety of most people in the blockchain industry and the current status of seeking recognition through a variety of ways. At present most projects and industry insiders are trying to seek compliance or a self-constrained and it is not an inspiration for countries to manage the future encryption assets.

Third the securities pass operation process example

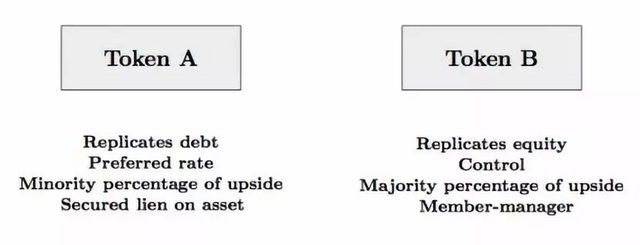

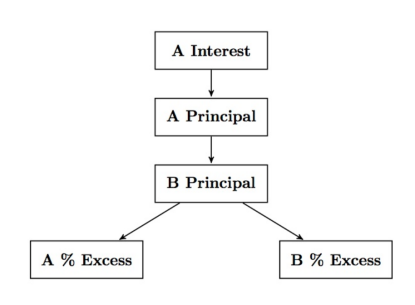

In the first pass of the New York real estate securities certification Fluidity designed a securities pass liquidity optimization framework called Two Tokenwaterfall to solve the problem of liquidity and equity claims arising from real assets. Equity and claims (A-Token stands for debt B-Token stands for equity) are replaced by designing two different pass categories to cover the capital classes involved in asset transactions. The sum of the values of the two types of certificates will be equal to the price of the underlying assets while the same ratio of certificates also represents part of the ownership of the assets.

Blockchain landing application series the world's first real estate securities pass the STO road

Source Fluidity

For the holder of the securities pass when a trading event occurs the cash flow is automatically generated and automatically flows to the creditor's income/equity income according to the type of the pass. In contrast to traditional securities this cash flow is very fluid and is effective immediately when the rights and responsibilities occur without waiting for a specific redemption time. In addition due to the simultaneous issuance and integration of equity and creditor characteristics the capitalization of specific assets will be more comprehensive and it will also increase the diversity of investors' holdings of assets.

In practice since the holder of the equity pass is usually the issuer the issuer will generate a profit-optimized share in the actual business for a longer period of capital use and lower cost. The holders of the debt-based certificate can trade in a smaller and flexible manner in the capital investment of the securities pass because of the mortgage return of the actual assets and the potential for the increase in the value of the assets and are not subject to the intermediary or the bank. limit.

Blockchain landing application series the world's first real estate securities pass the STO road

Source Fluidity

Fourth the future of the securities pass market outlook

A number of innovative protocols have emerged prior to Ethereum to address the compliance requirements for cryptographic assets. The compliance of cryptographic assets is a necessary condition for both investor protection and the underlying assets of the Certified Mark. These rules also have special significance for combating money laundering and preventing financial system criminal activities.

Different from traditional financial supervision blockchain projects can use their technical characteristics to achieve automation compliance in the future. For example blockchain technology can be used to improve financing efficiency and expand trading boundaries and can be intelligently contracted for real-time monitoring in operations. It is foreseen that future automation in the IT and financial industries will become a new service. Standards it is now also possible to see that different startups in the industry are trying to establish automated securities pass compliance standards

ERC-1400

The purpose of the ERC-1400 standard specification is to make the securities pass more credible while complying with the ERC-20 and ERC-777 standards and will ensure that the securities pass complies with the regulations. The main features of this standard in Github's discussion include

Standard interface for querying and verifying transactions

Asset Mandatory Transfer Option

Standardized issuance and redemption

Binding of identity information to the holder

Need to "sign" data to verify transactions on the chain etc.

S3

The Securities Pass Standards Framework established by OpenFinanceNetwork specifically mentions Reg S Reg A and Rule D in Github that will comply with US SEC regulations for securities.

Its protocol consists of two main components one of which contains the certification form of the certificate and the other contains the core logic of the certificate. The core logic component (called DelegateERC20) acts as a proxy for all the pass logic processed by another smart contract. The smart contract called TokenFront allows itself to be called by another smart contract contract implementing a two-stage clearing and settlement protocol. The agreement has a fixed smart contract address and only the designated owner of the registry can update the regulatory service which requires the central agency to act as the administrator of the regulatory review.

R-Token

The encrypted digital asset company Harbour created a distributed automation compliance protocol called R-Token. The agreement has three parts divided into three different smart contracts. The actual digital asset pass is based on the ERC-20 standard which is embedded with the regulatory inspection of the pass itself with the help of two other smart contracts. When creating a smart contract for the pass the service registry will be attached to the pass. Before any asset transfer the certificate will be checked against the service registrar and the service registrar will map it to the regulatory body. Accurate compliance checks are also embedded in the regulatory body to ensure that both parties are eligible to complete asset transfers based on their wallet address and transfer amount.

DS Protocol

The DS protocol initiated by the Secutitize platform is designed to create a life-cycle securities pass compliance service for issuers investors and trading platforms. The agreement includes three main services to ensure compliance trust services registration services and compliance services. In addition to pre-asset transfer checks similar to other protocol standards they also provide Dapps with the ability to integrate with the DS protocol. This additional feature is primarily handled by trusted third parties to assist Dapps project parties in compliance with investors. Investor certification. The DS agreement through the Registry Service will view investor information at a more granular level not just whether the investor is eligible to trade.

At present most of the compliance agreements for these securities passes are still in the stage of integrated development for smart contracts mainly by imposing certain rules and restrictions on the issuers and holders of encrypted assets to meet compliance requirements. Many of these protocols usually only add some extra functionality to the ERC-20 Passport interface. For example for asset transfer inspection allowing administrators' public access and transfer restrictions on problem accounts the overall trend is biased towards modular automated protocol development but it will take some time to complete.

Overall having an automated compliance audit on the blockchain and a clear identity concept have some positive help for the current industry development. This is not only limited to qualified investor review or anti-money laundering verification but more to ensure that all parties involved in the crypto asset cannot break this objective and immutable rule. A complete compliance system is not only for the protection of investors but also for the objective requirements of a securities pass from design to exit.