Circle / Activation of etherium / US Federal Reserve / Dukascopy / Switzerland / blockchain

Circle Payment Technology has decided to use the market-based digital surveillance tools provided by Nice Actimize for digital financial services to combat market manipulation, a press release said on February 27 this year.

Nice Actimize, one of the subsidiary companies of Nice Software Ltd., provides professional tools for clients in the areas of financial crime, risk and compliance.

Circle will use Cloud Market Monitoring (CMS) to prevent and detect harmful business activities on its own platform, including internal trading, classes and even so-called pump schemes.

In the same vein, Major Advisor and Chief Compliance Officer Robert Pinch commented in a press release:

"Adapting innovative technology solutions, such as Nice Actimize's financial compliance solutions, to meet the potential needs of regulators and protect our assets brings this commitment to Circle."

Corporate platforms such as Circle are currently seeking to allay concerns about manipulating digital currency markets.

Not only Nice Actimize, but also saw Nasdaq succeed in deploying technology to monitor the market in related fields. In January of this year, Nasdaq revealed that seven digital currency markets are currently using their own market monitoring technology.

In the meantime, Solidus Labs announced last month that it had raised $ 3 million to combat market manipulation.

Activation of etherium upgrades officially

Two long-awaited improvements seem to have been officially activated on Pluchen-Ethereum, the world's second largest by market value, without incident, on Thursday.

Specifically, updates to the main network were posted at the 72.8 million block, according to the previously released schedule. Although the upgrade has two names for separate updates, they were later merged into one name.

At 19:57 (UTC), the sixth and seventh system-wide upgrade of the program, called Constantinople and St. Petersburg, was launched on the main network in Block 7,280,000. As we have seen on the monitoring site of the Forkster, the Fork Monitor, there is so far no evidence of a chain split that suggests that part of the Ethereum users are still running old software.

Previous solid hardening of Pluxin Ethereum encountered these setbacks, particularly in 2016, with the Ethereum classic, a group that continued to run an older version of the software when a controversial update was introduced.

As a background, prior to any system-level upgrade or hard partition, mining and contract operators must install a new client software that is automatically updated on the same cluster number. This prevents two concurrent and incompatible versions of the same blockbuster from dividing the wider network.

With the apparent activation, the symbol of St. Petersburg also disrupted part of Constantinople, which was considered last January to host security vulnerabilities that attackers could use to steal money.

According to Ethernodes.org, not all of the users of iThereum have adopted updates. With only 22.3 per cent of Geths and Barretti customers already reported to be in compliance with the Constantinople upgrade.

The goal of this upgrade is to introduce several improvements to the platform, including cheaper transaction charges in some operations on the ethereum network. The total Konstantinoble split was postponed in January due to recent gaps.

The aim of the St. Petersburg upgrade is to delete an earlier update, the Ether (EIP) 1283 proposal, from the Ethereum test networks, as security holes have been identified.

With the launch of Constantinople and St. Petersburg updates, four different EIPs have been officially launched on the Ethereum network, one of which introduces a new "corner case" that affects the stability of the smart contract.

In January of this year, many digital currency exchanges supported the upgrade of the Ethereum network, including kraken and Coinbase, while Binance, Houbi and Okex monitored the event before attempting to implement it for the first time.

At the time of the press, the price of Ethereum reached $ 136.45 per coin, the second place in the coinmarketcap ranking for digital currencies by market value, which currently stands at $ 14.3 billion.

The US Federal Reserve is considering the implementation of this decision regarding the Pitcairn

The Federal Reserve (Fed) is considering listing the BTC market crash this year as one of the "salient risks" to be observed in supervisory stress tests. The possible adjustment was disclosed as part of the policy statement published on the Federal Government's Official Journal The official Federal Register reported Thursday.

The Fed's annual supervisory stress tests provide a framework for covered companies to conduct internal stress tests. This was mandatory under the Dodd-Frank Wall Street Reform Act (which took effect in 2010), which was presented as a direct response to the 2008 financial meltdown.

For the tests, the Fed Board of Governors identifies three scenarios: "Baseline, Negative, and Severely Harmful". The "Company Budget" produces risk weighted assets, net income, post-stress capital levels, regulatory capital ratios according to each .

In the new policy statement, the Board noted that it is making its tests dynamic enough, by increasing the scenarios with risks that it sees as prominent this year, in particular, one commentator said:

"The Board recommended that extraordinary shocks, such as the war with North Korea, the collapse of the Betquin market, or the large losses caused by the trader's misconduct, be considered in his scenarios."

Any of these other proposed amendments, if accepted, will become effective as part of the Council's stress test policy by 1 April 2019. In a summary of its policy functions, the Board also clarified:

"Together, the Dod-Frank supervisory stress tests aim to provide management, boards of directors, the public and supervisors with forward-looking information to help measure the potential impact of stressful conditions on the ability of these large banks to absorb losses while meeting their obligations to creditors and other counterparties and to continue lending" .

As mentioned, Randall K. Mr Quarles, the governor and vice chairman of the Federal Reserve Supervisory Board, and the new chairman of the Financial Stability Board (FSB), said this month that the growth of digital currency transactions as asset class "may challenge any framework." Pointing out that the Financial Stability Board has:

"I decided to conduct a review of its framework to assess weaknesses, to ensure that we are at the forefront of assessing the vulnerability of financial stability.

Dukascopy warns clients of a company that is a partner with the bank

The Swiss-based digital bank, Dukascopy, has warned clients of GCG Asia, a company that allegedly claims to have a license to be the licensed bank, as published on Feb. 27.

In the announcement, Dukascopy Bank, which claims to be the first regulated bank to launch its initial digital currency offering, warns that neither Dukascopy nor any of the Dukascopy Group companies have relations with GCG Asia, although the latter claims otherwise. Warning:

"GCG Asia uses the name Dukascopy and its logo, deceptively, to attract customers / investors, without the permission of Dukascopy Bank, we are taking action against this dishonest organization."

In January, Bitstamp, a digital currency exchange with the Swiss currency bank, signed BitTamp to support BTC transactions on behalf of Dukascopy. Customers will be able to send BTC to their accounts, convert them into the US Dollar, and trade in the Swiss currency market.

Earlier, related sites reported, many cases of so-called cloning companies are doing business while claiming to be or be associated with well-known companies. Last August, the FCA warned investors about a "clone" of FairVox Capital Limited. Fair Oaks Crypto, which uses the registration data of companies licensed by the regulator, aims to overcome potential fraud to reach victims by claiming to represent FairOx Capital.

In the same month, FCA issued another warning about "fraudsters" associated with digital currencies, claiming that it was an FCA-approved company that the rogue company, Good Crypto, had claimed to have provided "false details or mixed with some of the correct details of the registered company" Status Arup Corporate Finance.

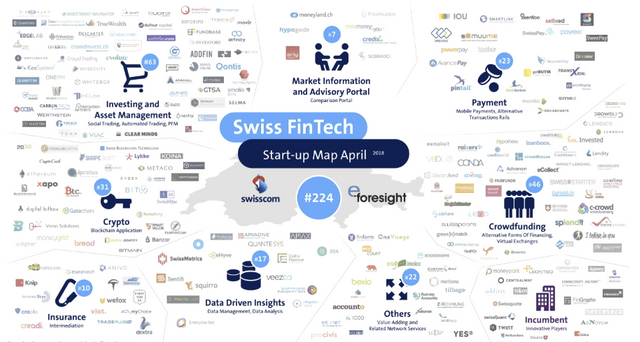

The financial technology market is growing in Switzerland by 62 per cent in 2018

Switzerland's financial technology market grew 62 per cent in 2018, according to a recent study by the Lucerne University of Applied Sciences on 27 February.

The Lucerne University of Applied Sciences conducted an in-depth review of the Swiss market for financial technology for the fourth time. The report, "IFZ FinTech Study 2019", reveals that on a global level, Zurich and Geneva are still in second and third place for the best cities for fintech, respectively. The country's financial technology sector grew by 62 per cent over the previous year.

According to the analysis, Switzerland had 356 financial technology companies in 2018, compared to 220 companies a year ago. Growth is said to depend on DLT companies, which represent a triple increase in number. More specifically, of the total 356 companies, 122 are in Distributed Ledger Technology, 66 in Investment Management, 56 in Banking Infrastructure, 42 in Deposit and Lending, 36 in Paying, and 34 in Analytics.

The research also cites several ICO companies in Switzerland's financial technology sector with the following:

"In general, a total of $ 386 million was raised last year from 15 CSOs, a decrease in both the number and size of this funding.The largest company in 2018 was Envion, which received nearly $ 100 million, followed by Nexo , And SwissBorg, for $ 52.5 and $ 50 million, respectively.

According to a recent report by the ICO Service ICObench Rating, Switzerland became the second country in terms of the amount of money raised through flags in the fourth quarter of 2018, and was said to have raised $ 238 million.

Earlier in February, the president of the Swiss Crypto Valley (CVA) announced that the declining digital currency market had damaged Switzerland's position as the global bloc of the world. Haudenschild also pointed out that "great ideas are frozen because they can not find this funding," adding: "We need to bridge this by returning investors," and "making Switzerland open and easy for companies to invest in blockchain projects

Moscow offers a project to use blockchain in electronic voting

MOSCOW, March 26 (Xinhua) - The Moscow City Council, capital of Russia, has submitted a bill on the use of blockbuster technology in the electronic voting system, the Russian news agency TASS reported Tuesday (February 26th).

Moscow City Council, a local parliament of the Russian capital, intends to protect the process and the results of electronic voting in the next election through the use of blockbuster technology, announced the news by one of the authors of the relevant bill, the ruling party deputy Russia Dmitry Viatkin.

Fiatkin said that the technique will allow the storage of personal data of voters and the results of voting separately, adding:

"It will be impossible to connect it, that's exactly how the plucchin technology works," he said, adding that the plucchin technology would help avoid electoral fraud.

Last December 18, Russia held successful regional elections with 40,000 participants in Saratov Oblast through the Polycin-based electronic voting system, which was developed by Kaspersky Lab in 2017.

Last month, the National Center for Electronics and Computer Technology in Thailand announced the development of an electronic voting system, also backed by the technology of the blockin, according to news sites in the country on January 3.

In May of last year, Cointelegraph published an analysis explaining the pros and cons of the potential use of plucchin in electoral processes.

It seems that the technology of the proxies has come close to finding a suitable place in a new field, namely the field of election and electronic voting, where some countries have relied on it, confirming the success of its experience, while other countries plan to use it in the future in this field which is always characterized by fraud and bribery and other issues Associated with the elections.

https://www.ci.moscow.id.us/

https://www.circle.com/tn/

https://blog.ethereum.org/

https://www.federalreserve.gov/

https://www.dukascopy.com

https://www.uas.bayern/

@juanmanuellopez1 @moghul @coolguy222 @newageinv @gowealth @blessed-girl @cruis @lexymaine @alokkumar121 @aceandnotes @darlenys01 @rafique1953 @marvyinnovation @wems @ajks @alaisguineasis @amnlive @kimmysomelove42 @praditya @tommyl33 @samryan @vickykarma @brightsun @oppongk @kryp70kn1gh7 @hobo.media @theticket @royer94 @bradley028 @nummulshrma @maxijgcomm @maikelblogo @mrblu @nancymj @petervi @mcoinz79 @missabigail @saludoalalma @mcnestler @moarafatshow @gargi @luis402 @rem-steem @shahzadeh @sumon-ar-vines @naijauser @yantrax @josema.saborido @khan.dayyanz @shapescooper @aceofhearts @marcocosta @rvag5 @fusroj @cashlane @borrowedearth @michaeljn @kchitrah @mitchhunter @nataliaeline @cherlianny @unknownphoton @unclefz @gardengranny @bettyamv @ghostwriter9 @wandrnrose7 @nancybriti @missladybug @shirophantomhive @rvag5 @ankitjnv @marvyinnovation @tommyl33 @gowealth @ustaadonline @daio @brightsun @mzubairch @lightestofideas @amit1995 @starapple @treodecimo @edinhazard @maxijgcomm @wasito @mariita52 @maroni55 @nataliaeline @ajtech2596 @keithf @wesleyvanderstel @grainsofsand @mariita52 @naijauser @castleirwell @juanmanuellopez1 @moghul @coolguy222 @newageinv @gowealth @blessed-girl @cruis @lexymaine @alokkumar121 @aceandnotes @darlenys01 @rafique1953 @marvyinnovation @wems @ajks @alaisguineasis @amnlive @kimmysomelove42 @praditya @tommyl33 @samryan @vickykarma @brightsun @royer94 @bradley028 @nummulshrma @maxijgcomm @maikelblogo @mrblu @nancymj @petervi @mcoinz79 @missabigail @saludoalalma @mcnestler @moarafatshow @gargi @luis402 @shahzadeh @sumon-ar-vines @naijauser @yantrax @josema.saborido @khan.dayyanz @shapescooper @aceofhearts @marcocosta @rvag5 @fusroj @cashlane @borrowedearth @michaeljn @kchitrah @mitchhunter @nataliaeline @cherlianny @unknownphoton @unclefz @gardengranny @bettyamv @ghostwriter9 @wandrnrose7 @nancybriti @missladybug @shirophantomhive @ankitjnv @marvyinnovation @tommyl33 @gowealth @ustaadonline @daio @brightsun @mzubairch @lightestofideas @amit1995 @starapple @treodecimo @edinhazard @maxijgcomm @wasito @mariita52 @maroni55 @nataliaeline @ajtech2596 @keithf @wesleyvanderstel @grainsofsand @mariita52 @naijauser @castleirwell @isabelpereira @nulifeiq @royer94 @yaleal @ushmil @nisiryan0522 @reveurgam @certain @kkins @nurseanne84 @robertyan @xtophercruzeu @theureview @anil566 @freedomanytime @clayrawlings @zetacoin @goldheart @artoftherhyme @jiujitsu @don-thomas @arsl14 @vishalmajumdar @thehippierays @kemc @aple @orgoniteog @abrish @zydane @cathynsons @shashiprabha @katebobkova @tramelibre @sanjoea @savedanimals @kshahrck @filmyworld @syedahmed1010 @iknoweverything @hashzone91 @bernard4ve @afruza @fareed974 @leidy3 @whyaskwhy @genesisleal @arrozymangophoto @omikhatun @roxacolher @roger5120 @ranggayusuf @simonpeter35 @zanoni @enjoycompany @joshvel @artelita @aknirob @tithelis @aanish118 @richatvns @claxpsaba @blueeyes8960 @inspiration101 @skaran1411

Please join communities and refrain from tagging bloggers you don't know.

I invite you to join #freewriters at @mariannewest and @freewritehouse. Tagging like this is considered spam on steemit and will result in downvotes and eventually banning of repeat accounts. For more help try @minnowsupport to assist with community. They are here to guide newbies. For your success.

https://discordapp.com/invite/dpGVBcy

Posted using Partiko Android