ICO Key Roles End-to-End

Hello everyone!

My name is Olga Novitskaya, I am a project manager on post-ICO marketing projects at Platinum. Thinking of how to start ICO in 2019? Our team can offer the full list of services for your campaign! Visit our site and see:

Moreover, we are glad to announce that our educational project, the UBAI, has already launched a unique ICO campaign. It is going to start the educational revolution and create a new system of data validation that can be used by government institutions, companies, schools, universities, individuals etc. What are the risks associated with any ICO in which you plan to invest? Follow the link to get the answer:

We will expand upon the previous lesson by taking a look at the four key roles involved in an ICO. Legal/Regulatory, Marketing/PR, Sales & Accounting, and the Management of an ICO. We will thoroughly examine a complete ICO journey from end to end, when the idea is first created, the necessary initial steps, where and when each role is expected to function, the contributions, responsibilities, and commensurate remuneration for each role.

Lesson Objectives:

By the end of this lesson you will have learned the following things:

The laws applicable to the operation of an ICO at any time and in any region, including analysis of some real-life scenarios to gain workable practical knowledge in this area.

The risks associated with any ICO in which you plan to invest, stressing the pros and cons of each investment, and the security of each ICO.

Useful tips about promoting, marketing and eventually managing an ICO to make it a success.

Finally, you will have learned everything you need to know about launching an ICO.

Terminology:

Social Media Marketing (SMM): The process of marketing your ICO through social media, e.g.: Facebook, Medium, Twitter, Reddit and BitcoinTalk forums.

Bounty Hunter: An individual who helps raise funds and develop actionable investor interest for an ICO project, for a fee paid by the project.1.

Legal/Regulations of an ICO

1.1 Introduction

The ICO process, as innovative as it seems, and as positively useful as it is, still raises several legal issues. Those are issues we need to discuss at this point in the lessons to help equip you with all the necessary information you need to participate in the ICO space with confidence.

This information is vital because so far in 2018 there has been over $1.5 billion raised by more than 90 ICOs all over Europe, America, and Asia. Since there is no central regulatory body to sanction the parties involved, regulators and legislators are taking an increasingly serious look at how to regulate the industry at the national level. Thus, we need to factually understand and effectively function in a highly fragmented and rapidly shifting legal landscape.

1.1 Introduction

Without sufficient regulation to protect investors and other participants in the industry, the authenticity of ICO fundraising will be called into question.

For example, let’s say because the market is still in its early stages there is a significant degree of under-regulation. If a lack of regulation too frequently leads to investor fraud, it can easily undermine the overall market confidence in ICOs.

1.1 Introduction

Go to the link

The most notable example of significant regulatory scrutiny on ICOs came in early 2018. The U.S Securities and Exchange Commission (SEC) said it may apply Federal Securities Law to some ICOs on a case-by-case basis.

It is likely that more countries will continue to follow the lead of the SEC and begin to regulate the industry more carefully, more strictly. But with a clear regulatory framework, companies will have greater clarity how to launch their own ICO, and investors will be better protected too. The net result of effective regulation should certainly encourage more investors to participate in and promote various ICOs.

1.2 Jurisdictional Laws

This is a major decision and serious challenge faced by most startup firms. Where should operations be located? The location will determine the legal issues involved.

Learn more useful tips on promoting, marketing and eventually managing an ICO after buying our full course!

1.2 Jurisdictional Laws

For instance, if a firm is located in Germany, and their target early supporters reside in Germany, Britain, and France, then their contracts must conform to the contract laws of all the countries involved.

So, if you are working on an ICO project, take time to do a little research on the contract law for the early investor countries, as well as for your own. The terms and conditions of the contracts you use will need to comply with the laws of more than one country, as your lawyer advises.

As the responsible party for the ICO Regulatory and Legal affairs (whether you are an advisor, team member, or consultant), it is your responsibility to be aware of relevant regulations in each country and know how they apply to your ICO. You will be participating in discussions with all members of the team, given the way regulations are involved at almost every level and aspect of the business.

1.3 Specific Region Regulations

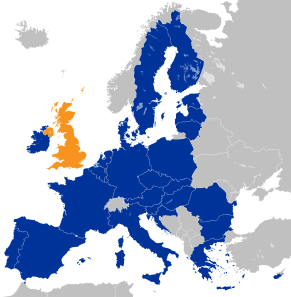

The Eurozone

The European Union Securities and Market Authority took a stricter stance on ICOs recently, declaring that ICOs represent a high risk to investors, and firms dealing with ICOs will be required to satisfy relevant regulatory requirements.

1.3 Specific Region Regulations

This suggests that the EU is ready to embrace America’s position on ICOs, which is a reversal of the Union’s previous position. Thus, currently, ICOs are allowed, but will be subject to future targeted regulations.

The United States of America

We can say America is one of the most economically liberal nations on the planet. Currently, ICOs are certainly allowed in the US, but they are heavily regulated.

ICO rules vary widely from state to state. The state regulations vary from no regulations at all; to requiring deposits equal to, or in excess of, all local transactions; to regulations requiring a special license for a business to engage in any kind of altcoin activities.

1.3 Specific Region Regulations

At the federal level, there are no current regulations banning ICOs specifically, although ICOs are expected to be registered with the SEC, and licensed just the same, whether they are ICOs or not.

1.3 Specific Region Regulations

Asia (Japan, South Korea and China)

In Japan, ICOs are allowed, but subject to very strict regulations.

China and South Korea have gone one step further and completely banned ICOs. Authorities cite the prevalence of scams as the reason behind this decision, threatening to prosecute anyone who violates their laws.

This has attracted many nationals from these strict countries to the ICO-friendly nation of Singapore where they are welcomed and encouraged to create their ICO.

1.3 Specific Region Regulations

1.4 Definition of a Security

Security in this sense indicates that there is a share of stock or financial benefit tied to the token. Since the whole ICO process is unregulated, buying and selling the tokens as securities is a direct violation of most countries’ laws.

In the Howey case, the US Supreme Court created a test to determine what is or is not a security.

The test looks at an investment’s substance, rather than just at its form, as the determining factor for whether it is a security or not. Even if an investment is not labeled a stock or bond, it may still be a security under the law. Full registration and disclosure requirements would apply.

1.4 Definition of a Security

It is also a fatal disadvantage to investors if the token is deemed worthless at any point because the tokens were sold as shares of stock as opposed to utility tokens. Basically, a utility token, (as opposed to a security, which is a share of ownership in expectation of profit), is fundamental to the operations of the business, its processes, and transactions. But this is an extremely important legal distinction we will examine in more detail now.

To be defined as a security, a token must:

Be an Investment of Money: Investors must have paid an actual amount of money (or some other asset of equally clear monetary value) to invest in the token.

Have an Expectation of Profit from the Investment: Investors must have expectations of profit from the business in which they are investing.

1.4 Definition of a Security

Have the Investment of money be in a Common Enterprise: The profit must be expected to, and actually come from, the efforts of others, i.e., the investment is largely or wholly outside of the investor’s control. If the investor’s own actions largely dictate whether an investment will be profitable, then that investment is probably not a security.

When defining your ICO model and token use case, it is of paramount importance that the Legal officer pay attention to whether or not your token is likely to be classified as a security, or even whether it is just dangerously close to being classified as a security.

1.4 Definition of a Security

Securities laws in general are complex and confusing. Different courts may apply different tests for determining whether an investment is in fact a security.

The ICO team is certainly advised to consult with an experienced Securities Lawyer in all cases.

1.4 Definition of a Security

1.4 Definition of a Security

Many ICOs do not accept money from US resident investors specifically because of the possibility of having a loose interpretation of “security” applied to their token.

If the SEC decides the ICO token is a security, then the regulatory framework shifts dramatically, and the team is faced with not only different operating regulations, but also the possibility of jail time and fines for breaking the law.

Learn more useful tips on promoting, marketing and eventually managing an ICO after buying our full course!

Contact me via Facebook or LinkedIn to learn more about Platinum and the UBAI:

hi