Peer-to-peer smart derivatives for any asset over any network!

Taurus0x Overview

Distributed off-chain / on-chain protocol powering smart derivatives from end to end, for any asset over any network.

Background of Taurus0x

Remember around September 2017 when the world lost its cool over Bitcoin prices? It was nearly an ideological war for many. It occurred to me to create an app for people to bid on Bitcoin prices, and I would connect that app to a smart contract to execute bids on the blockchain. It took me a long couple of weeks to figure out how many licenses I would need to acquire to run such a business in the United States. It became evident that market making is a huge undertaking and is better off decentralized in a an open-standard protocol to generate liquidity.

The protocol needed to be fully decentralized as a primary requirement. Why? because I believe in the philosophy of decentralization and creating fair market makers, governed by a public community. It is the right thing to do in order to create equal opportunity for consumers without centralized control and special privileges.

It comes at no surprise to anyone at this point that the vast majority of “ICOs” were empty promises. Real life utility was and is a necessity for any viable project. Transitioning from a centralized world to a tokenized and decentralized one cannot be abrupt. The protocol needed to support both worlds and allow for a free market outcome as far as adoption. Scalability-wise and as of today, Ethereum could not handle a real-time full DEX that could compete with advanced and well-known centralized exchanges. And quite frankly, maybe it’s not meant to. This is when the off-chain thinking started, especially after witnessing a couple of the most successful projects adopting this approach, like Lighting and 0xProject. The trade-off was the complexity of handling cryptographic communications without the help of the blockchain.

I had met my co-founder Brett Hayes at the time. I would need another 3 or 4 articles to explain Brett for you.

To the substance.

What is Asymmetrical Cryptography?

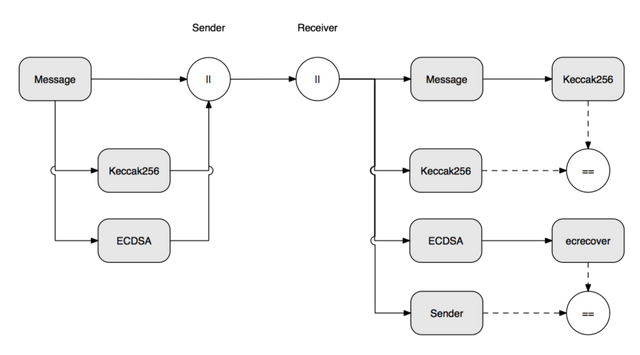

Asymmetrical cryptography is a form of cryptography that uses public and private key pairs. Each public key comes with its associated and unique private key. If you encrypt a piece of data with a private, only the associated public key may be used to decrypt the data. And vice versa.

If I send you a “hello” encrypted with my private key, and you try to decrypt it with my public key (which is no secret). If it decrypts fine, then you are positive that this “hello” came from me. This is what we call digital signatures.

The figure below is from Taurus0x whitepaper and describes the chosen digital signature algorithm (ECDSA).

What are Smart Derivatives?

Well, what are derivatives in the first place?

In the financial world, a derivative is a contract between two or more parties based upon an asset. Its price is determined by fluctuations in the underlying asset. The most common underlying assets include stocks, bonds, commodities, currencies, interest rates and market indexes. Futures contracts, forward contracts, options, swaps, cryptocurrency prices and warrants are common derivatives.

Smart Derivatives are smart contracts that behave like financial derivatives. They possess enough information and funds to allow for execution with guaranteed and trusted outcomes.

What is Taurus0x?

Taurus0x is a distributed off-chain / on-chain protocol powering smart derivatives from end to end. Taurus0x is both asset and network-agnostic. The philosophy is to also become blockchain-agnostic as more blockchains come to life.

Distributed = fully decentralized set of smart contracts and libraries.

Off-chain = ad-hoc protocol not limited to a blockchain.

On-chain= trusted outcome without intermediaries.

Asset-agnostic = supports any asset, not limited to cryptocurrency.

Network-agnostic = contracts can be transmitted over any network (email, text, twitter, facebook, pen and paper, etc.)

Who can use Taurus0x?

Taurus0x protocol is ultimately built to serve end consumers who trade derivative contracts. Participants may engage in a peer-to-peer derivative contracts among each other without the need for a house in the middle.

The Taurus0x team and advisory realize that the migration from a centralized world to a decentralized one cannot be abrupt, specifically in FinTech. Taurus0x is built to support existing business models as well as C2C peer-to-peer. Exchanges who want to take on the derivative market may use an open-source protocol without worrying about building a full backend to handle contract engagement and settlement. Taurus0x Exchanges would simply connect participants to each other, using matching algorithms.

Taurus0x intends to standardize derivative trading in an open way. Having more exchanges using the protocol allows for creating public and permission-ed pools to generate compounded liquidity of contracts. This helps smaller exchanges by lowering the entry-to-market barrier.

How does Taurus0x work?

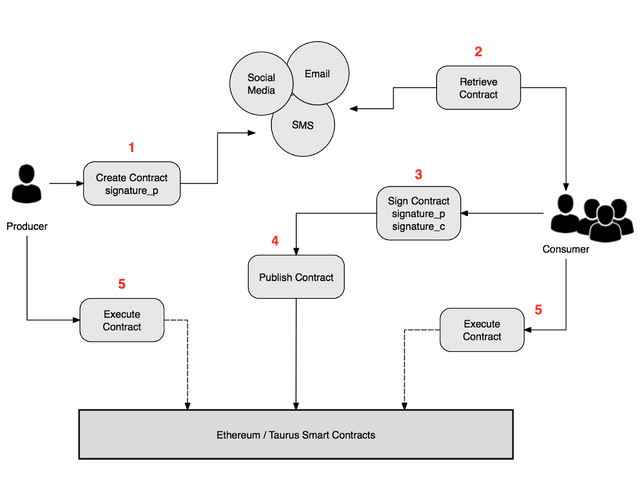

The process is simple and straightforward. Implementation details are masked by the protocol making it very easy to build on top. The first 2 steps represent off-chain contract agreement, while 3 and 4 solidify and execute the contract on-chain.

1- Create

A producer creates a contract from any client using Taurus0x protocol, whether from an app, a website or a browser extension. The producer specifies a condition that is expected to happen sometime in the future. For example, I (the producer) might create a binary contract with the following condition:

Apple stock > $200 by July 1, 2018 with a premium of 10 TOKENs (any ERC20 token)

The contract will be automatically signed with my private key, which confirms that I created it. I can then share it (a long hexadecimal text) with anyone over any network I choose.

2- Sign

When the consumer receives the signed contract, they will be able to load it via any client using Taurus0x. If the consumer disagrees with the producer on the specified condition, they will go ahead and sign the contract with their private key. Back to our example above, the consumer would think that Apple stock will remain under $200 by July 1, 2018. Now that the we have collected both signatures, the contract is ready to get published on blockchain.

3- Publish

Anyone who possesses the MultiSig contract and its 2 signatures can go ahead and publish it to the Ethereum blockchain. That would most likely be either the producer, the consumer or a party like an exchange in the middle hosting off-chain orders. As soon as the contract is published, Taurus0x proxy (an open-source smart contract) will pull necessary funds from participating wallets into the newly created Smart Derivative. The funds will live in the derivative contract until successful execution.

4- Execute

If at any point before the contract expiration date the specified condition becomes true (i.e. Apple Stock > $200), the producer can go ahead and execute the derivative contract. The contract will calculate the outcome and transfer funds accordingly. In this binary derivative example, the producer will receive 20 TOKENs in their wallet upon executing the contract. If the expiration date comes and the producer had never successfully executed the contract, the consumer may execute it themselves and collect the 20 TOKENs.

This figure is from the Taurus0x whitepaper depicts the process:

Summary

Taurus0x is a highly versatile and modular protocol built using Ethereum-based smart contracts and wrapper JS libraries to bootstrap developer adoption. While Smart Derivatives are the first application of Taurus0x, it is worth noting that the protocol is not limited to cryptocurrencies or even derivatives for that matter. It is an ad-hoc and scalable contract management solution meant to guarantee trusted outcomes in the future based on conditions specified today. The semi off-chain nature of the protocol helps remediate Ethereum’s scalability limitations and makes it a viable product.

Finally, the plan for Taurus0x is to be governed by a Decentralized Autonomous Organization or DAO as outlined in the roadmap on https://taurus0x.com. This is an area of research and development as of today. Decentralization does not fulfill its purpose if governance remains centralized, therefore it is without compromise that Taurus0x follows a decentralized governance structure.

Author: Rawad Rifai — Co-Founder, Taurus0x

Congratulations @taurus0x! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!