What is DAO and How it Works

Most of the times, smart contracts are compared to vending machines. But try to think about a vending machine that not only takes money from you and gives you a snack in return but also automatically re-orders the goods. This machine also orders cleaning services and pays its rent without any actions from the outside. It has no managers and all processes were pre-written into the code.

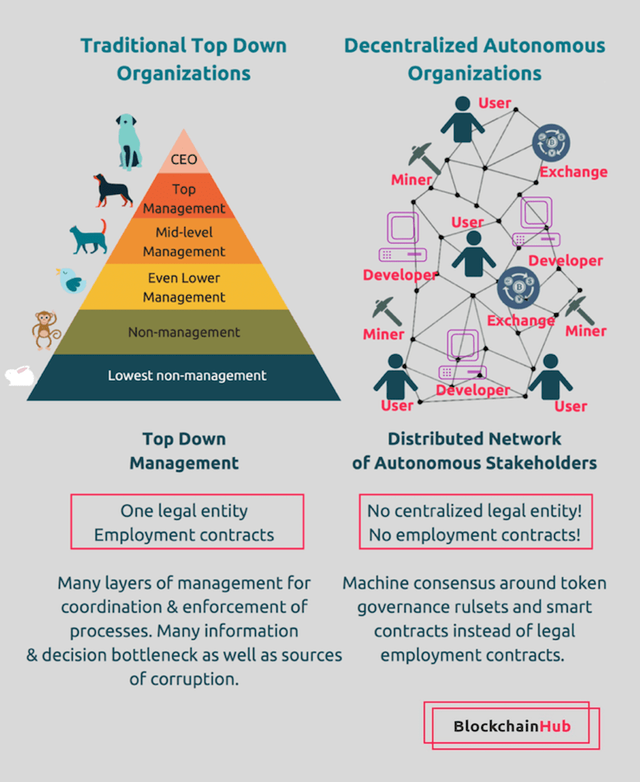

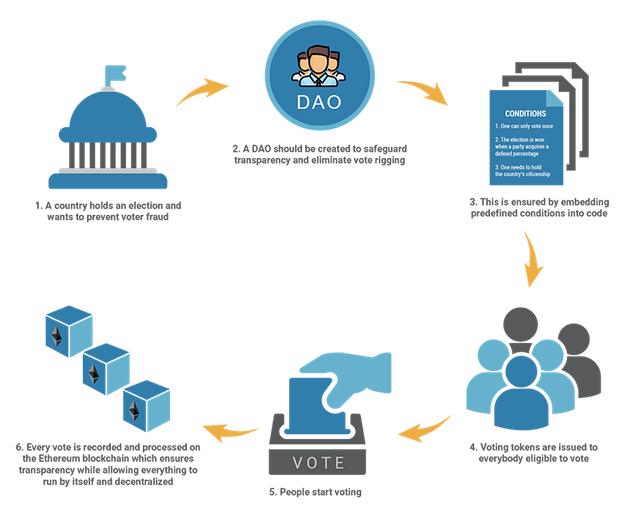

This is the simplest explanation of how DAO works. A DAO (Decentralized Autonomous Organization) can be seen as the most complex form of a smart contract, where the bylaws of the decentralized organization are embedded into the code of the smart contract, using complex token governance rules.

Governance

Governance is the way rules, norms and actions of how people interact with each other are structured, sustained, regulated and held accountable. It regulates the process of decision-making among the actors involved in a collective problem that leads to the creation, reinforcement, or reproduction of social norms and institutions. The degree of formality depends on the internal rules of a given organization and, externally, with its business partners. As such, governance may take many forms, driven by many different motivations and with many different results. Governance refers to all processes of governing, whether by a government, market or network, family, tribe — formal or informal — through the laws, norms, power or language. DAOs aim to disrupt traditional governance structures of all kinds, and challenge the way we currently think about governance.

https://blockchainhub.net/dao-decentralized-autonomous-organization/

DAO is a fully virtualized through software. A DAO materializes as a smart contract — a piece of code — executed on top of an increasingly opaque stack of distributed networking and consensus technology. To be fully operational DAO needs a set of rules according to which it will operate. Those rules are encoded as a smart contract, which is essentially a computer program, that autonomously exists on the Internet, but at the same time it needs people to perform task that it can’t do by itself.

Once the rules are established, a DAO enters a funding phase. This is a very important part for two reasons. Firstly, a DAO has to have some kind of an internal property, tokens that can be spent by the organization or used to reward certain activities within it. Secondly, by investing in a DAO, users get voting rights and subsequently the ability to influence the way it operates.

When a DAO is fully operational, the decisions on how its funds will be spent are made by reaching a consensus. DAO stakeholders can make proposals regarding its future. In order to prevent the network being spammed with proposals, a monetary deposit could be required to make one.

The stakeholders vote on the proposal. To perform any action, the majority of stakeholders needs to agree on doing so. The number of stakeholders required to reach an agreement is specified in its code. These decisions can be:

- Fire the CEO or just Change the CEO;

- Hire a vendor to get his/her service;

- Hire a lawyer;

- Pay certain ethers/USD to someone as a salary or bonus;

- Issue the share to someone because that person/address is adding more value.

Problems with DAO

Participation of all shareholders is a problem. Just like in the real world, a lack of voting participation has been documented. The legal status of this type of business organization has not been decided on by lawmakers. Currently the term for such an organization is a “general partnership” which means that every participant is liable for any legal actions and debts the company may face.

Startups trying to operate as DAOs are in need of a legal framework that allows them to conduct business not only within the closed world of a blockchain network but to interact with the physical world, the world of traditional financial instruments and that of intellectual property. To achieve this goal, two major barriers need to be overcome.

Firstly, startups need to know which kinds of regulations apply in which jurisdiction when selling cryptographic tokens, that may in some form represent a stake in future profits. The potential applicability of contemporary securities regulation is self-evident. Secondly, startups need a workable legal contractual framework, which allows DAOs to be embedded into our current institutional framework around the three above-mentioned fields of physical and intellectual property as well as traditional finance.

Both of those open problems are tough because they require a lawyer’s intuition in a field, that has before only ever been the subject of science fiction literature. To an appreciable extent, however, partial answers may be developed by a suitably staffed entity, that is experienced in solving complex compliance issues arising in areas such as international private, financial, trade, corporate and tax law.

Another hardship that arises is the difficulty of changing the code of a DAO or the smart contracts once deployed in the blockchain. On one hand, this is good because one single entity cannot change the rules, but the disadvantage is that debugging cannot be done. This is what happened with The DAO company, attackers slowly drained all funds by simply exploiting a bug in the system. The head coders of Ethereum reversed all transactions but the best way to handle such an event in the future is up for debate.

Existing DAOs

- Aragon — community governed decentralized organization whose goal is to act as a digital jurisdiction;

- Colony — infrastructure for the future of work: self-organizing companies that run via software, not paperwork;

- Thetta DAO Framework — An open-source DAO framework. Thetta provides out-of-the-box modules to build the DAO.

Of course, DAO is a great concept, but there are too many questions left unanswered. There is a number of DAOs starting to work now and we will probably find these answers in the process.

References

- What is DAO https://cointelegraph.com/ethereum-for-beginners/what-is-dao#how-daos-work

- Decentralized autonomous organization — What is a DAO company? https://medium.com/universablockchain/decentralized-autonomous-organization-what-is-a-dao-company-eb99e472f23e

- What is a DAO? https://blockchainhub.net/dao-decentralized-autonomous-organization/

- Aragon — https://aragon.org/

- Colony — https://colony.io/

- Thetta DAO Framework — https://web.thetta.io/

Your post had been curated by the @buildawhale team and mentioned here:

https://steemit.com/curation/@buildawhale/buildawhale-curation-digest-10-01-18

Keep up the good work and original content, everyone appreciates it!