FIRMO: the financial contract on blockchain

Welcome to another contest hosted by @originalworks. To get acquainted more on the recent contest, click here

Introduction

Bitcoin is known for introducing decentralized digital currency that was able to break free of traditional banking system making way for social acceptance of decentralized monetary policy. Ethereum expanded the decentralized monetary system with a virtual machine, supporting smart contracts on blockchain technology.

Firmo protocol executes financial contracts on blockchain and provides a secure ground for contracts on decentralized asset classes. The domain language use in writing contracts are known as FirmoLang which is formally verified, yielding the needed security for smart contracts in finance. All this financial contracts are made without the involvement of a third party and with the emergence of the Firmo Protocol, Firmo is making a path way for the logical evolution crypto market.

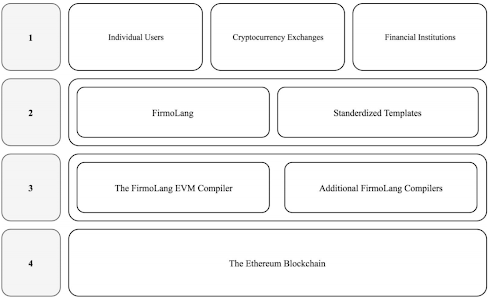

Firmo Protocol stack.

The Firmo protocol makes it possible for firms and organisations to create a secure and automated smart derivatives using FirmoLang programming language making it easier for financial contracts or smart derivatives to be compiled in the ethereum virtual machine (EVM) through FirmoLang compiler. The FirmoLang Compiler outputs bytecode format through intermediate representation.

The Firmo Protocol Stack is made up four groups.

Derivatives

When you hear the term "derivatives", first thing that comes to mind is financial tool. So what's this financial tool used for?? This derivative are tools that give the privileges to organisations, companies, various business, individuals to secure a price point within a particular period of time. This is very vital especially for organisations that rely on only a particular raw materials for production because of the volatility of price. Derivatives is mostly common among traders because they Secure asset at a cheaper rate before it increases, so they can profit.

Going further to explain how the introduction of derivatives to tokenised asset help investors.

- With the introduction of derivatives, traditional market are allowed to secure financial instruments on blockchain. In other words, security and safety are guaranteed.

- More opportunities are opened to investors to benefits from financial instruments in crypto assets and with crypto asset, there is settlement and secure clearing of long and short term financial arrangement.

- Towards the ending of June 2017, the estimated value of counter derivative was $542 trillion in the traditional market. The more reason blockchain need a more suitable and secured infrastructure to aid financial derivatives.

Composition of smart derivatives.

- Deployment of Customized Contracts:

The Firmo Protocol makes it easier for adept users to inspect code and customise smart derivatives in FirmoLang by moving the console in the users interface.

- Deployment of Template Contracts:

The template contract is written in FirmoLang and customized to the service offered by the partner institution. In several situations, the contract might be forwarded for market predictions of peer to peer loans and while other cases, the contract might be for future purposes.

Forward contract.

One of the major purpose of the forward contract is to reduce the risk in a volatile market thereby making it possible for a customer to secure an asset, raw materials for the production of goods and services at a particular period of time in the future with physical settlement of underlying asset. Closely related futures contract are issued as CBOE and NASDAQ in public listed exchanges.

How exchanges or other service providers can use the Firmo Protocol to enhance their offering to their user base.

FirmoLang is a versatile language with an intuitive syntax and have two ways service providers or exchanges can use Firmo protocol to enhance there services:

- The European Vanilla Option

Here, customers are given the option, not obligations, to purchase an available assets at a particular price in the future. Options is used to speculate assets that are highly volatile in various industrial organisation. When counterparties engage in a call option (smart derivatives), the buyers pays a premium to the seller. If the price of the underlying asset do not increase or appreciate above the buyers initial price as well as the premium during maturity stage, the smart derivative can automatically close the position except other instructions was given.

- Vanilla Interest rate swap

In finance, an interest rate swap (IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between the borrower and the lender paid on a nominal amount. The different value between the two interest rates can be changed in multiple ways, with variable maturity periods.

Advantage of zero coverage over current system.

In the current system, the agenda made by the legislatures responsible for blockchain based smart financial contracts haven't been attended to yet, thereby paving way margins, escrows or collateral in Trade and execution of smart derivatives. But with the zero coverage, Firmo protocols allow users to execute smart derivatives with little or no collateral because of the trust In between the counterparties. This is done using "permissioned infrastructure".

The team behind Firmo

Dr Omri Ross who is well known for his skills in blockchain technology and fintech is responsible for the Firmo project alongside Top veterans like Gury Traub and Ariel Laub responsible for the release of various games that are educative.

Summary

The Firmo protocol executes financial contracts on blockchain technology. Contracts are written. FirmoLang is the domain language similar to software built for airplane coordination, that provides a secure platform for financial contracts on decentralized asset classes. FirmoLang compiles directly to Ethereum Virtual Machine bytecode.

For further enquiries visit :

Submitted.

Hi again,

Just read your post about effect.ai and decided to check your profile just to realize that we seem to share a number of interests :)

In particular that we both share a similar passion towards cryptocurrencies and blockchain technology :)

Thx for that quite informative post. Keep up with creating interesting content.

I know it's hard at the beginning to build solid follower base. But just don't give up. Steemits needs solid content builders.

(i upvoted over 30 posts today and my voting power is very low, so I cannot upvote your post this time around, but I will follow you closely).

yours,

Piotr