More things you must know about stable coins; is it really a holy grail?!

Trading altcoins against the most commonly used pairs Bitcoin (BTC) and Ethereum (ETH) is getting less and less popular as the prices of both coins keeps falling lower and lower.

Before, in most of the second half of 2017, taking a loss with altcoins could be possibly compensated by rising prices for ETH and BTC. Now however, one faces bearish double sided risk. Losing the value of your altcoin and if you didn’t time your buys right, you are also facing the possibility of extending your loss by the depreciating value of BTC or ETH.

So, are stable coins a better choice in today’s bear market? Recent articles even call stable coins “a holy grail of crypto”.

After Tether (USDT) currently the largest “stable” trading coin by daily volume and first mover on the Ethereum block Maker Dao, other new projects are coming to play such as Trust token and Havven.

Then there is also Hybrid block, a project which is according to their website promising to become a one stop trading ecosystem with a downloadable trading terminal and HybridFX, a tool to create digital tokens backed by native fiat money.

Stable coins are known to be backed by underlying assets to hold 1:1 value. This can be fiat money, gold, or also digital currency (in the case of Havven). These reserves should provide price stability for the coin, giving that the underlying assets are secured and by itself do not heavily fluctuate.

But there are factors which need to be considered and understood when you want to invest or trade with stable coins:

Liquidity risk

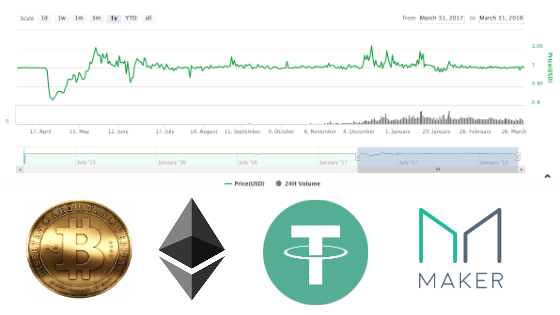

As one of the main providers of liquidity in the crypto market, Tether is by trading volume a big player, it ranks 2nd after Bitcoin at the moment.

This means that any adverse event can seriously distort and drag down the market if there is a “run on the bank”.

Trading volume of Tether is even often times higher than its market cap, as can be seen in below graph, which is a snapshot taken from Coinmarketcap of 30th of March 2018. It shows that there is a total volume of 2,764 million USD with a market cap at that time of 2,262 million USD. This indicates that there is a lot of demand for this coin.

Now other stable coins are still too small to cause the same effect as Tether, but investors who are realizing that Tether is not trustless and highly centralized will poor in there money eventually in some other stable coin to look for the “new holy grail”.

Non-anonymous

To comply with anti-money laundering rules and regulations investors who deposit fiat money to exchange for stable coins need to register for KYC (Know your customer).

There is no anonymity with stable coins.

The only way to stay anonymous in trading stable coins is to keep those coins on (decentralized) exchange wallets.

Counterparty risk

If I would have a large stake in a stable coin and I would want to redeem back to fiat currency and suddenly realize that the money jar is empty, I would be very unhappy. A lack of transparency and audit trails will increase this risk. Counterparty risk does not exist for coins like bitcoin and Ethereum, where market prices are determined without a middle man by supply and demand for the coin on an exchange.

Hacks and attacks

To pass an audit the creators of “fraudulent” stable coins could rent the private keys of exchanges to appear creditworthy but in reality do not own those funds. This is also called a key rental attack. Decentralized projects with a transparent audit trail can reduce this risk, but the risk remains of a possible attack on the vault where the reserves are kept, or by vulnerabilities in the smart contracts which are meant to function to keep the assets safe in the first place.

What do you think?

This is the second post by @pzee01.

If you like this post please leave a comment, upvote and resteem. I am planning to make regular post on a daily basis so follow me if you want to see more!

Have a great day all!

This post has received a 0.93 % upvote from @booster thanks to: @pzee01.

hello i followed you

follow me back

thanks

Thank you!

Please, check out https://coincheckup.com. All informations about crypto are updated earlier than on coinmarketcup. Greetings :)