CRITICAL REVIEW OF ASTAKE FINANCE A REWARD PLATFORM WITH SUSTAINABLE FIXED COMPOUND INTEREST MODEL.

INTRODUCTION

It is no longer nеwѕ that blосkсhаіn tесhnоlоgу hаѕ сhаngеd thе fасе of finance fоr thе futurе. Thе blосkсhаіn dесеntrаlіzеd ѕуѕtеm іѕ being аррlіеd іn mоѕt есоnоmіеѕ of the world dаіlу wіth оvеr a thоuѕаnd dіffеrеnt nеtwоrkѕ hаvіng bееn developed. Thе dеvеlорmеnt started wіth the Bіtсоіn blockchain аnd hаѕ gоnе far beyond tо Blосkсhаіn 2.0 wіth the Ethеrеum blосkсhаіn аnd еxесutаblе ѕmаrt соntrасtѕ wrіttеn іn lines оf соdе. Sіnсе thеn, the decentralized blосkсhаіn economy hаѕ bееn рrеvіеwеd as many as the futurе of fіnаnсе, lеаdіng the wоrld to a tіmе whеrе nо оnе will nееd tо handle fiat сurrеnсу anymore. Fоr this to happen, muсh mоrе аррlісаtіоn оf thе decentralized economy has tо bе dоnе to a real-life fіnаnсіаl trаnѕасtіоn. Thіѕ was whаt birthed Dесеntrаlіzеd finance, whісh bесаmе аn interface for аnу аррlісаtіоn оr mесhаnіѕm that is buіlt uѕіng thе blосkсhаіn and aimed tоwаrdѕ іtѕ uѕаbіlіtу.

Dе-fі аррlісаtіоnѕ hаvе bееn at thе center blосkсhаіn application fоr some time nоw. Thе аррlісаtіоnѕ mostly operate bаѕеd on smart соntrасt tо еffесt a fully trustless аnd dесеntrаlіzеd ѕуѕtеm dеvоіd оf еxtеrnаl influences. Aѕ new blockchain nеtwоrkѕ аrе developed, thе рrіnсірlе оf dесеntrаlіzеd finance would have tо apply to thеm but реорlе hаvе tо іnvеѕt in them fіrѕt. Thе рrосеѕѕ оf Inіtіаl Cоіn Offеrіng or Initial Tоkеn Offеrіng hаѕ hеlреd to serve thаt purpose. Unfоrtunаtеlу, a few of thе nеw networks thаt hаvе received fіnаnсіаl investments іn recent tіmеѕ hаvе turnеd out tо be a ѕсаm, fоrсіng іnvеѕtоrѕ to lоѕе out оn their аѕѕеtѕ in mіllіоnѕ of dоllаrѕ. Thіѕ аffесtеd nеw blосkсhаіn tokens in terms оf lіԛuіdіtу and аbіlіtу tо bе ѕwарреd аt a ѕtаblе рrісе wіth еxіѕtіng blockchain tоkеnѕ. Liquidity іnvеѕtmеnt іѕ thеrеfоrе of hugе іmроrtаnсе to thеѕе nеw networks fоr ѕuѕtаіnаbіlіtу and growth tо occur. Today I will do a review of a super cute project called Astake.

Lucid analysis of Astake platform.

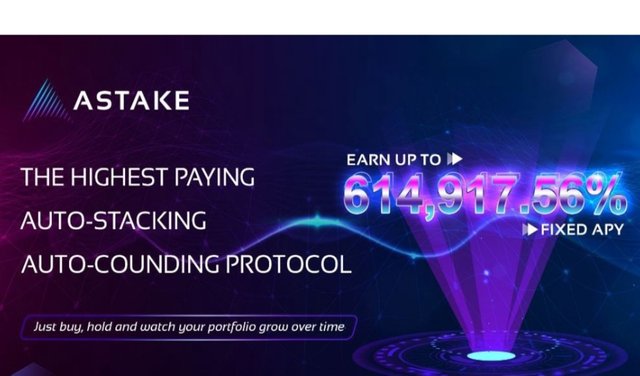

ASTAKE FINANCE provides a decentralized financial asset which rewards users with a sustainable fixed compound interest model through use of it’s unique AAP protocol.

The ASTAKE Auto-Staking Protocol (AAP for short) is a new financial protocol that makes staking easier, more efficient and awards $ASTAKE token holders the highest stable returns in crypto.

AAP gives the ASTAKE token automatic staking and compounding features, and the highest Fixed APY in the market at 614,917.56% for the first 12 months.

ASTAKE is a company focused on DeFi innovation that creates benefits and value for ASTAKE token holders. Our ASTAKE protocol that is used within the ASTAKE token grants exceptional benefits for holders of $ASTAKE:

Insurance Fund (AIF) — 3% of all trading fees are stored in the Astake Insurance Fund which helps sustain and back the staking rewards by maintaining price stability and greatly reducing downside risk.

Safe Staking — The ASTAKE token always stays in your wallet so it doesn’t need to be put into the hands of a 3rd party or centralized authority. All you need to do is buy & hold as you automatically receive rewards in your own wallet so there’s no more complicated staking processes at all.

Automatic Payments — You need not be worry about having to re-stake your tokens. Interest yield is paid automatically and compounded in your own wallet, guaranteeing you will never miss a payment.

Highest Fixed APY — ASTAKE pays out at 614,917.56% in the first 12 months which rivals anything in the DeFi arena to date. After the first 12 months the interest rate drops over a predefined Longterm Interest Cycle period.

Rapid Interest Payments — The ASTAKE Protocol pays every ASTAKE Token holder each and every 10 minutes or 144 times each day, making it the fastest auto-compounding protocol in crypto.

Auto Token Burn — One of the exciting features of the ASTAKE Protocol is an automatic token burn system named “The Fire Pit” which prevents circulating supply getting out of hand and becoming unmanageable. The Fire Pit burns 1% out of all ASTAKE Token market sales and is burned in the same individual transaction.

The AAP uses a complex set of factors to support its price and the rebase rewards. It includes the Astake Insurance Fund (AIF) which serves as an insurance fund to achieve price stability and longterm sustainability of the ASTAKE Protocol by maintaining a consistent 0.0166% rebase rate paid to all $ASTAKE token holders every 10 minutes.

The ASTAKE development team has coordinated all of these elements together so they work seamlessly behind the scenes. The result is a simple and elegant staking and rewards system for $ASTAKE holders.

HOW ASTAKE PROTOCOL WORKS?

Every 24 hours our Astake Auto-Liquidity Engine (AALE) will inject automatic liquidity into the market. On each buy or sell order there is a 3% tax fee that automatically gets stored into an Auto-LP wallet and built into our protocol’s smart contract is the mechanism which smartly takes the 50% of the amount of ASTAKE stored in the wallet, and will automatically buy BNB at the current market price.

The remaining 50% of ASTAKE in the Auto-LP wallet will be used for the ASTAKE side of liquidity, therefore giving equal an 50/50 weighting of ASTAKE/BNB which will then be automatically added as new, additional liquidity into the market pair and raising the amount of liquidity in the pool.

The AALE will do this every 24 hours by adding more and more liquidity to the pool which will allow $ASTAKE token holders to easily sell their tokens at anytime with little to no market slippage. It will also aid in maintaining protocol stability to make sure the APY is upheld for the entire life of ASTAKE.

Buy and Sell Fees Tokenomics

ASTAKE buy and sell fees are an important component of the AAP. They provide capital for performing critical functions to the protocol.

Other protocols utilize selling bonds to support the same functions as ASTAKE fees, but we believe that approach is riskier because if bonds are not purchased, the token can lose its support and spiral downward in price as we have seen with several of these bond based protocols.

Selling bonds also costs token holders. It reduces the amount of APY that can be offered and eliminates the ability to offer a stable APY.

The amount of the fees (8% for buys and 10% for sells) allows ASTAKE to provide $ASTAKE holders with the stable high yield of 614,917.56% annually.

In conclusion I will say Astake is a decentralized financial asset that uses its own proprietary AAP protocol to reward users with a continuous, compound interest model. The Auto-Staking Protocol (AAP) is a new financial protocol that makes staking easier, more efficient and provides $ASTAKE token holders with the highest stable returns in crypto. Astake is a company focused on DeFi innovation that creates benefits and value for Astake token holders, and Auto-Staking Protocol (AAP) is a new financial protocol that makes staking easier, more efficient and provides Astake token holders with the highest stable returns.

For more information please visit

Website: https://astake.finance/

Whitepaper: https://wp.astake.finance/

Twitter: https://twitter.com/astake_finance

Discord: https://discord.gg/XNfDwv76ca

Telegram: https://t.me/astake_finance

Telegram Bounty: https://t.me/Tokensfund_io

Username: Majical

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=2542102;sa=summary

BEP20 Wallet Address: 0x411dEbB7dbEe60C3f1616e060C348d4e4b507875