Future Of Blockchain Technology In Insurance Industry

Blockchain And The Future Of The Insurance Industry. Blockchain technology is picking up the complete consideration of the insurance industry. This is an industry that depends upon strength, trust, and transparency and that will give by this technology. Let's start with from Insurance industry to how blockchain plays important role in this field.

What is Insurance?

Insurance is a method for security from money related loss. It is a type of risk management, principally used to support against the danger of an unexpected misfortune.

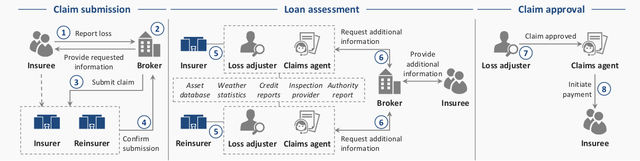

Image Source: World Economic Forum

An Insuree may report a misfortune or may claim to a broker, and with the required data submitted to the Insuring specialists, specifically the Insurer, if applicable, the Reinsurer. The claim accommodation is confirmed by a receipt to the Insuree.

From that point onward, the Claim Agent may ask for extra data for the claim, through an outer source. After these step, if all the mentioned conditions are fulfilled, the claim is affirmed, and the instalment is started via the Insurer's Claim Agent. Insurance is revealed to a variety of fraud schemes. From sharing insurance plan after divorce to disguising medicinal diagnoses. Then how blockchain helps in this field?

Blockchain technology future is viewed as the greatest of an image of the fourth industrial revolution and a potential disruptor for some organizations and businesses including the insurance field. Even the technology is still in its early phase, it has just demonstrated what it can do: streamline printed material, increment information security and spare organizations cost by removing tedious cases forms.

Recap On Blockchain Technology:

The blockchain is an extensive, decentralized advanced record that is dependably up to date and holds a record of the considerable number of exchanges made. Blockchain systems are intended to record anything from physical resources for electronic money and are openly accessible for all the included gatherings to see.

After check process, the block of a transaction is time-stamped and added to the blockchain network in a straight sequential request. The additional block is then connected to previous blocks, making a chain of blocks with data of each transaction made ever in the history of that blockchain.

Key Points Of Blockchain Which Impacts On Insurance Industry :

Improves trust:

There's an emergency of trust in the financial services industry. Despite the fact that the big banks are the main point, the disintegration of trust impacts all businesses. An absence of trust, high expenses, and inefficiency of the insurance business all play a part in the extraordinarily high levels of underinsurance. Blockchain technology encourages building trust of customers since it gives straightforwardness and transparency.Enhance efficiency:

While changing insurance agencies or healthcare, suppliers knows how wasteful the information section process is to get coverage or care started. Moreover, customers have an undeniable dread of losing control over their own information. Blockchain gives an answer for drive efficiency and security that would enable the individual’s information to be controlled by the individual while confirmation is enrolled on the blockchain.Enhanced claimsprocessing through smart contracts:

The insured and the insurer each as of now have issues that blockchain and smart contracts could resolve. Insured people commonly discover insurance contracts long and mystifying, while the insurance agencies are battling a various fraud which is extraordinary. Through blockchain and smart contracts, both of them would profit by overseeing claims in a responsive and transparent way. And it begins with recording and confirming contracts on the blockchain. At the point when a claim is submitted, the blockchain could guarantee that only substantial valid lone cases are paid. But when network finds a set of multiple case claims are submitted from the same accident then blockchain could trigger and check the proper instalment of the claim without human mediation, thus it improves the speed of resolution for claims.Fraud detection and prevention:

A standout amongst the most convincing reasons, insurance agencies ought to research that blockchain is its capability to detect & prevent fake or illegal activity. An expected 5 to 10 percent of all cases are fraud. Blockchain technology's decentralized store and it's historical record which can autonomously check clients, policies, and transactions for authenticity. Each insurance agency needs to make a move today to make sense of how blockchain innovation can affect the way they work together today and later on.

This is the manner by which blockchain technology will help or take a part in an insurance industry in future. In the event of a need to refresh to the concepts or would wish to read the latest news related to Blockchain & Cryptocurrency Technology, please remain associated with us(http://blockchainerz.com).