Decline of Blockchain hype and rise of a common sense

My dear friends who are deeply involved in blockchain tech — I want to disappoint you. Almost for 2.5 years I’ve been involved into cryptocurrency industry, and saw Bitcoin, Blockchain, Ethereum hypes. I’ve been visiting dozens of conferences and events, talking to hundreds of people. And here is my conclusion. But please treat it as a personal view, as I can be wrong.

Blockchain trend is going down. We will see cooling interest towards it already in 2016. The same applies to smart-contract hype, ok, it has just started so maybe early 2017. A lot of Bitcoin/Blockchain startups that have enormous valuation will fail soon. The reason is simple — nobody needs blockchain. But… why am I telling you this — the least person you would expect to hear it from?

Neither a bank nor a financial institution has implemented blockchain technology yet. Even if they say they are working on it, it is done in a pilot version and works for something like test scenarios. Big money is not ready to move onto it. There are a few reasons for that:

- it is highly risky & expensive to change core IT infrastructures (banks still use mainframes!)

- security paradigm is different and we are not ready to assess it — blockchain implies that users keep their keys by themselves (and you don’t need to protect the perimeter around core databases as you used to do)

- blockchain is associated with cryptocurrency and decentralization (and again, shifting the trust model), and it really becomes a political question

Party is not over

Why are people so excited then? There is a problem of perception which stems from the fact that people mean different things when they say the word “blockchain”.

- particular Bitcoin blockchain

- blockchain as a technology (I would rather say it is an approach)

- private blockchain as an implementation of an approach

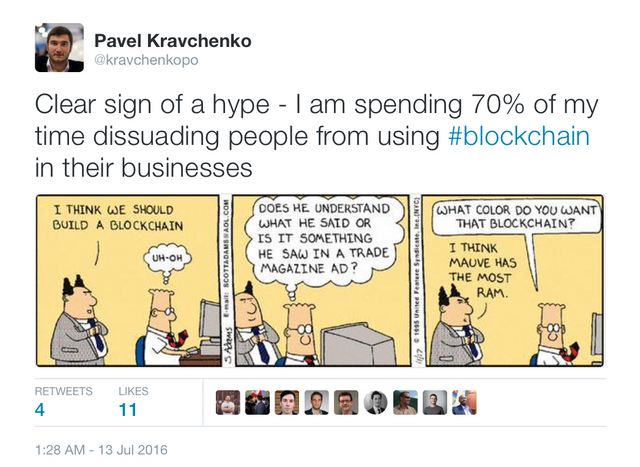

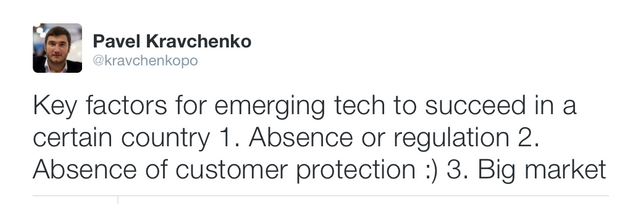

If you mix these things you will probably think something like that:“blockchain can guarantee that certain information can be trusted”“blockchain will validate our transactions”“blockchain can help us to get rid of our servers”etcNot far from the reality. Imagine you are a banker and you read this:

Then a very reputable well-funded organization comes and tells that they will build blockchain for you… Obviously after a year and $100k+ spent on building a pilot, you realize that blockchain can do… whatever your business logic, legal framework, IT department can do and NO more.But at the beginning nobody understands what they are talking about — technologists don’t care about legal framework, business processes and integration, business people don’t care what technologists mean under “blockchain”.

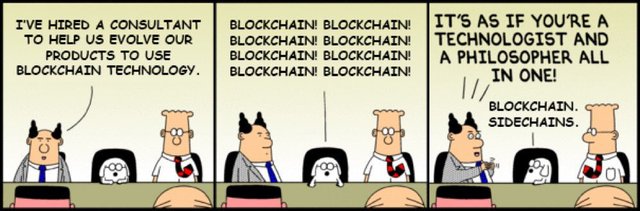

But why Big Four is actively promoting it to their clients? I would say the reason is extremely simple — implementation of blockchain into core business is hard, meaning the contracts will be huge :)

I think I don’t need to explain why I put this picture here

Regarding Bitcoin/blockchain startups, the situation is that 90% of them just burn cash and it is unclear when profits will appear. Many of them pivoted over last year from Bitcoin exchange/payment/storage/whatever strategy into blockchain consultancy for banks. Market is also full of startups that realized that if they add word “blockchain” in their pitch their valuation goes up 3x-5x :) Well, I think it is a good investment.Cryptocurrency community also introduces a mess. Bitcoin initiated so many research studies that are really exciting but so far could be applied only in refined environment. For me it seems that community discusses level 51 of complexity while financial people stuck at level 1. We DO need to move forward with ideas and technology but we shouldn’t pretend as if industry is ready for it. Otherwise it is like promoting and investing in everything that looks like helicopter right after Da Vinci described it in the 15th century.

Money $$$

A lot of very bright people are currently thinking about how to monetize technology that 1) is supposed to be fully free 2) removes intermediaries.

My opinion is — there should exist a fully open financial web — a set of protocols and tools to establish connections and send payments. There is no such a process as “sending” money — it is just changing numbers in some databases in a way that involves parties agreement. Very much looks like traditional internet with its HTTP requests, routing, name resolving etc. My opinion is that thinking about monetization only in context of fees for service requests is like believing that the only monetization way for internet is charging for data in MB/s.

Smart contracts in a dumb environment

I want to address the interest towards smart contracts separately. Smart contract is smart only when it is able to take custody over real assets. So the biggest obstacle to their usage is the absence of truly digital assets that can be managed using cryptographic keys.The other thing — just ask a financial guy who is excited about smart contracts — who will be validating these contracts and who is legally responsible for taking the custody over the assets? As a matter of curiosity, just check what their lawyer thinks about all of that.

So what? Are we closing the shop?

Obviously not. Since I am running Distributed Lab (and it is probably the second biggest independent blockchain company in the world, profitable, with 25 team members and we keep hiring :) ) I believe in the most prominent future. It just takes time. So, now comes the strategy >>>

Strategy

- Prove that blockchain works with real use-cases that touch traditional finance. People need time to realize it is a reliable thing :)

- Digitize assets via building government registries, core banking systems, stock exchange software etc.

- Build cross relationships that require the same APIs (essentially make it happen for code to manage private keys and execute transactions between institutions) — you’ve got financial intranet!

- Scale infrastructure — build financial internet — that’s where real value comes from.

Meanwhile, deal with internet security, private and public key management (luckily we can use some techniques and hardware from existing PKIs), but don’t touch regulation! Don’t try to change business relationships between institutions you want to modernize. Please don’t tell them all these stories about trustless execution of contracts, DAOs and similar stuff. They don’t get you, and even if they pretend they do — they will be wrong. At the end you will just spend a lot of money brainstorming and talking to lawyers.

Selling point

What you can tell them is about total cost of ownership (TCO) — including features that they would be building if it wasn’t very hard using traditional technology (something like secure escrow, collective management of an account, secure reconciliation, key split and recovery etc).Benefits include:

- potential reduction of costs per transaction as a result of cutting of the middleman

- release of funds that were needed to insure risks during long settelement

- optimized reconciliation process

- well-tested opensource code

On the other side of the scale:

- costs of learning, integration and education

- new risks and different threat model

- costs that come with negotiation of new standards

As you may guess, blockchain technology is helpful when you don’t have old legacy systems and you are building something from scratch.

How Distributed Lab is addressing the problem?

Ok, we are building several projects that fit the vision of building financial web. These are the aspects of “blockchain development” that we do:

- Digitizing assets

- Making history secure and transparent

- Making accounting software cheap

- Decentralizing decision making

Most of crazy ideas we work on will be implemented in Ukraine in a first place. Why here?

Blockchain based core banking system, transparent insurance company that works with fiat, cross border payment & FX network, decentralized auction (already works! — http://www.eauction.idf.solutions), transparent traditional exchange — this all come soon!

Welcome Pavel! I loved your post on meedium, now I can upvote it! Cheers from Berlin!

Great post. Looking forward to seeing how digitized assets plays out in the future.

While I see some advantages, it's likely we'll have to go through some kind of bubble before things settle down.

I totally agree with you - regulations are slow down the industry. Any attempts to connect a huge number of laws just waste of time.

straight talk from Pavel, a guy who has been at the forefront of crypto for a while now - looking forward to reading more!

Congratulations @kravchenkopo! You have received a personal award!

Click on the badge to view your Board of Honor.

Congratulations @kravchenkopo! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!