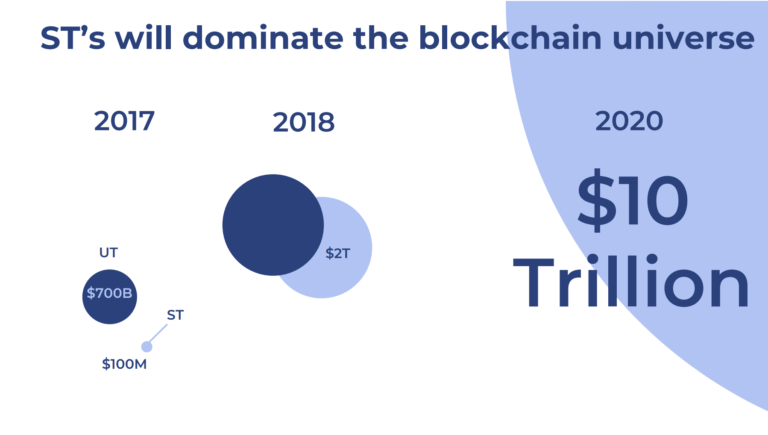

Security Tokens Will Dominate the Crypto/Blockchain Universe by 2020

Global banking is currently a $134 trillion industry. The promise of blockchain as a trustless, disintermediated technology is to disrupt:

*Payments: By eliminating the need to rely on intermediaries to approve transactions between consumers, blockchain technology could facilitate faster payments at lower fees than banks.

*Clearance and Settlement Systems: Blockchain technology and distributed ledgers can reduce operational costs and bring us closer to real-time transactions between financial institutions.

*Fundraising: By providing companies with immediate access to liquidity through initial coin offerings (ICOs) a new, cryptoeconomic model of funding that removes to capital from traditional financial services.

*Securities: By tokenizing traditional securities such as stocks, bonds, and alternative assets, the blockchain is upending the structure of capital markets.

*Loans and Credit: By removing the need for gatekeepers in the loan and credit industry, the blockchain can make it more secure to borrow money and provide lower interest rates.

2017 has truly been the year of Initial Coin Offerings with the investment volume of ICOs even surpassing venture capital funding. This happened even with these crowdfunding initiatives occuring in unregulated (or at least poorly regulated) territory. It is important for both investors and companies to be aware of the regulatory and legal landscape so that they can avoid future civil and criminal liabilities. That is why we put together the most critical things you need to know about token regulations.

- What is a token?

Tokens can come in various different forms and functions and are therefore hard to define. Some represent a user’s reputation within a system (augur), a deposit in US dollars (tether), the quantity of files that are saved in it (filecoin) or the balance in some internal currency system (bitcoin)

Thus, a token can fulfil either one, or several of the following functions:

A currency, used as a payment system between participants

A digital asset (a digital right like land ownership)

A means for accounting (number of API-calls, volume of torrent uploads)

A share (stake) in a company

A reward for contributors (i.e. Steemit)

Payment for using a system/product/service

- Lack of regulation

In the world of cryptocurrency, one of the most pressing questions facing investors and executives is how regulatory authorities will treat various digital assets. Because there are different economic realities of tokens, it’s often hard to classify these coming from a legal perspective. There are people who argue that cryptocurrency tokens are an entirely new asset class which deserve their own laws outside of the existing ones, but this is not reality (at least not as of now).

“Government’s view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.” President Ronald Regan, 1986

Governments around the world are still struggling to solve the taxation issue and we’re still months (or years) away from clear regulatory structures in the space of cryptocurrencies. This lack of regulation must not be mistaken as a safe, unregulated utopia as there’s still a lot of legal fallbacks being triggered which can be more or less suitable for this industry. And thus, cryptocurrencies often overlap with traditional classifications.

- Token classes

There are two distinctive classes of tokens:

I) Utility tokens

They serve as a (future) access to a product or service and can be best compared to a gift card or software license.

Utility tokens, also called user tokens or app coins, represent future access to a company’s product or service. The defining characteristic of utility tokens is that they are not designed as investments; if properly structured, this feature exempts utility tokens them from federal laws governing securities.

By creating utility tokens, a startup can sell “digital coupons” for the service it is developing, much as electronics retailers accept pre-orders for video games that might not be released for several months. Filecoin, for instance, raised $257 million by selling tokens that will provide users with access to its decentralized cloud storage platform.

Because the term “ICO” is a derivative of “initial public offering” (ICO), utility token creators usually refer to these crowdsales as token generation events (TGEs) or token distribution events (TGEs) to avoid the appearance that they are engaging in a securities offering.

II) Security tokens

These tokens constitute an investment contract, where the main use-case, and the reason for the contributors to buy the tokens, is the anticipation of future profits in form of dividends, revenue share or (most commonly) price appreciation.

If a crypto token derives its value from an external, tradable asset, it is classified as a security token and becomes subject to federal securities regulations. Failure to abide by these regulations could result in costly penalties and could threaten to derail a project. However, if a startup meets all its regulatory obligations, the security token classification creates the potential for a wide variety of applications, the most promising of which is the ability to issue tokens that represent shares of company stock.

Some token offerings are also structured as a donation (i.e. Tezos), whereby those who contribute bitcoin or ether in exchange for tokens are deemed to have charitably contributed to a foundation or non-profit entity. But it is unlikely that this structure is going to be a best-practice solution in the future as it doesn’t provide any legal protection on the investor’s side.

Many industry observers believe that mainstream companies will one day issue shares through ICOs, either in place of or in addition to traditional public offerings.

- Security or utility token?

The SEC has its flexible test to determine when something qualifies as a security called the Howey Test (which was already established 1946). In a cryptocurrency environment, the Howey Test roughly boils down to two questions which both need to answered with “yes” for the token to qualify as a security. (Keep in mind, in reality it’s actually more nuanced distinction than described below.)

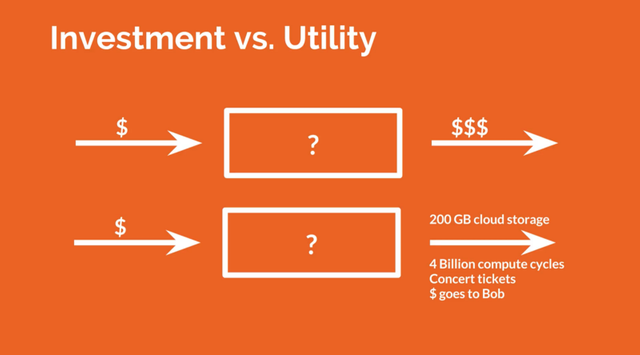

I) Is the token being sold as an investment?

One needs to identify whether the token is desirable because buyers anticipate future profits or price appreciation or if the token is being bought because it provides some sort of use-value to the buyer. Therefore we need to look at the token as a black box, where money goes into them and out comes either more money or some sort of product/service.

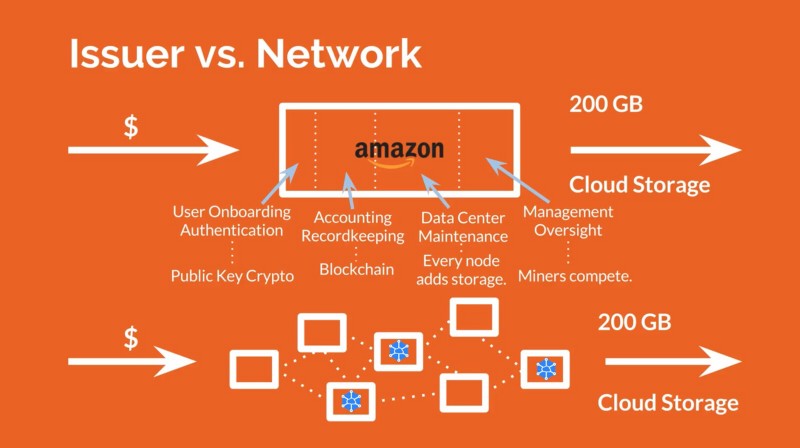

II) Is there a person upon whom investors rely?

We need to check whether a network of people/entities creates the value of the token or if it’s a single entity or small group of entities. The latter can be compared with Amazon which is mostly responsible as a single entity / company for the product “cloud storage” to work. In contrast there exists decentralized cloud storage (i.e. our client Storj), which relies on many different parties to store files, check access permissions, etc.

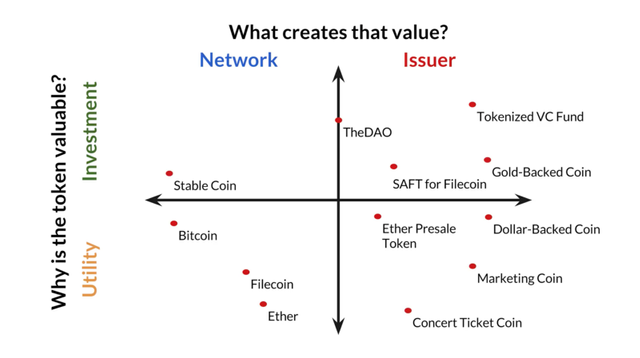

According to the two questions above, all tokens can be plotted on a graph, whereas tokens in the upper-right quadrant or close to it, have high chances qualifying as an security. It’s important to note that tokens can change their position on the graph over time. Especially when tokens are being sold prior to having a product / utility in place but develop this use-value at a later point. This actually applies to most pre-product ICO’s that are currently being launched, which might aim to achieve being a utility token but are in fact an investment contract during the time of issuance.

- Substance over form

The truth may be that most token buyers are holding tokens as an investment, not because they intend to use them personally. While there are utility tokens that are successfully structured to have no investment characteristics, they are actually quite rare.

This is because the SEC goes by the philosophy of “substance over form”, so the commission looks at tokens according to the way they are actually used rather than the way they were intended to be used. This might lead to many projects being classified as securities even though they initially setup their tokens as a utility, just because the economic reality is that the contributors invest primarily because of anticipation of profits.

If a token has a significant utility in the operation of the application, it may be less likely to be considered a security (since this characteristic may help the token to fail the Howey test, as discussed above). But, the reality is that utility tokens can indeed be considered a security under the definitions set forth in Section 2(a)(1) of the Securities Act of 1933 (1933 Act) and Section 3(a)(1) of the Securities Exchange Act of 1934 (1934 Act). If this wouldn’t be the case, every investment contract could just escape securities law jurisdiction simply by building in a trivial utility to the token. Imagine a tokenized share of stock, except the token also enables you to redeem it for a cat GIF.

Until the SEC delivers thorough guidance through, no one can say for certain that utility tokens are not securities.

- Benefits of a security token structure

Issuing security tokens under regulatory frameworks such as Regulation D, Regulation S, Regulation A+, and Regulation Crowdfunding is significantly cheaper and faster than conducting an initial public offering structured as utility tokens, and it can significantly reduce legal risk.

As the SEC ramps up investigations and enforcement actions, organizations that issue tokens in a compliant manner will have certainty that they will not suffer significant business interruptions from SEC enforcement actions and private litigation arising from unregistered securities offerings.

Securities laws have been developed and continuously refined for decades. Security tokens would inherit a wealth of legal precedents that would illuminate token buyer rights, protections and expectations. Additionally, they would clarify duties and obligations of the issuer.

If an organization acknowledges that its token is a security, then it can acknowledge it as an investment. The organization could provide token buyers with benefits like dividends, profit shares and voting rights which it would normally avoid if it wanted to avoid the security label. Its security token could still feature significant “utility” attributes; it could still be used in native transactions in an organization’s service or product.

Moreover, the organization can be more transparent with buyers about token economics and how they intend to increase token value.

- Shortcomings of a security token structure

Many of the organizations conducting an Initial Coin Offering (ICO) have been desperately trying to avoid having their tokens classified as securities. Mainly because a classification as a security automatically comes with many regulations and limitation on who can invest in these tokens and how they can be exchanged.

Secondary trading and liquidity is greatly reduced for these kinds of tokens, as securities cannot be traded freely and are subject to many restrictions. This can limit or even destroy the network effects and the use of the tokens to build a widely adopted platform or protocol.

- Trading of security tokens

The online retailer Overstock recently announced that tZERO, a joint venture with The Argon Group, will hold an ICO to fund the development of the first licensed security token trading platform. The tZERO tokens will be issued in accordance with SEC regulations, and Overstock CEO Patrick Byrne has stated that token holders will be entitled to quarterly dividends derived from the profits of the tZERO platform.

Key takeaways

There are two main legal structures for tokens: security tokens and utility tokens.

Even though the Howey Test is a good approximation to evaluate whether something qualifies as a security, there’s still a lot of uncertainty on how the SEC will apply the test in regards to cryptocurrencies.

Just because a token has a use-value doesn’t automatically prevent it from qualifying as a security token.

Structuring a token as a security leads to legal clarity and protection for both the company and the ICO contributors. But (as of now) they’re still subject to strict regulations and limitations.

Secondary trading of security tokens will be facilitated through the launch of licensed security token trading platforms. This will greatly improve liquidity for security token investors.

Because of the regulations of SEC, crypto exchanges are having a hard time to adopt the Security Tokens so that's why SEC is planning to make a new exchange. Here it is.

https://blog.kucoin.com/security-token-offering-what-you-need-to-know/