ICO Market Prediction: Does history repeat itself?

INTRODUCTION

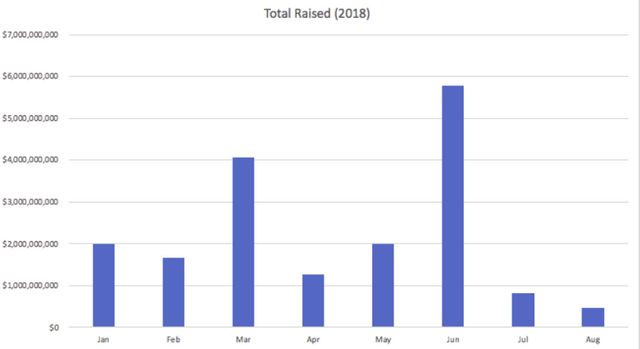

The ICO market is seeing an unforeseen decline in demand in the last 2 months, and the reasoning behind this has been discussed at length. Coinschedule[1] reports that the total amount raised by ICOs has been the lowest in the month of July this year. Parallely, falling ETH and BTC prices, and increasing volatility of the prices have led to a massive frustration among upcoming ICO projects and new crypto investors. Market manipulation by crypto whales, scandals by exchanges such as Bithumb and Upbit, and regulatory concerns across the globe are some of the reasons[2] that have led to this frustration. Unavailability of a common valuation[3] methodology is often sighted as a reason for high volatility of ETH and BTC, since then prices are more driven by sentiment than fundamentals.

https://www.coinschedule.com/stats.html

HYPOTHESIS

The obvious question that comes to crypto-enthusiasts’ mind is “Where are we going from here? How long will this trend last?” In this highly unpredictable scenario one can but only hypothesise. The hypothesis I propose is that market is going to resurge in the forthcoming months, and the associated market prediction is based on the following factors:

Historical Events

Institutional Investors

The Dunning-Kruger Effect

EXPLANATION

- Historical Events

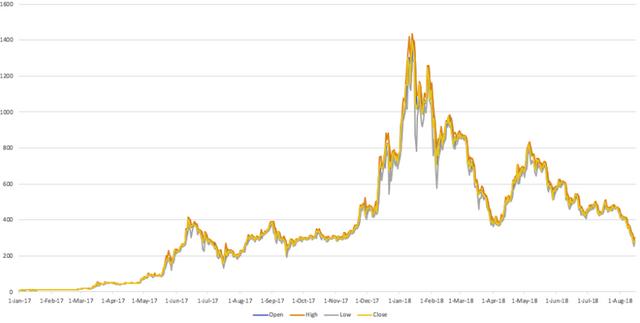

At times like these it is often prudent to observe history and collate reasonings for past events. It is clear that we are dealing with a crypto-market re-correction phase, and we have seen quite a few patches of re-corrections this year. The current ETH price has closed towards the annual historic minima, given that around 15 August last year the ETH was around 289 USD, and a year hence, the price is around 282 USD. One inference that can be drawn from this trend is a completion of one (or the first) cycle of investment fueled by the euphoria surrounding ETH and ICO projects (most of which were based on the Ethereum platform). The rationale behind such an inference is a notion that the experimentation phase of early crypto investors is over and the investment cycle that follows hence will be more driven by fundamentals and project quality than frenzy and Fear of Missing Out.

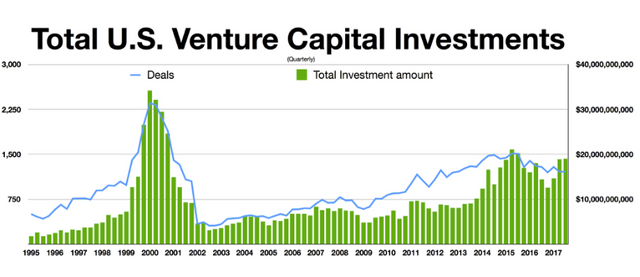

A parallel and obvious comparison can be done to the dot-com-bubble. Considering the fallout of the dot-com-bubble of 1995–2000 we saw a change in behavior among VCs and investment banks. The dot-com-bubble started off with VCs investing in any company with a “.com” as its website suffix, ended with a burst, and was followed by VCs being very diligent in their assessments and investing in only legit high-tech start-ups, backed by real technological innovation or novel use-cases. Similarly, it is believed crypto VCs and investors will now be more wary of the ICO projects’ underlying value proposition than ever before. There’s going to be a widening and clear distinction between high-end projects and fraud ICOs and what this can translate to is a resurgence of optimism for ICO ecosystem as a whole and a subsequent upward pressure on ETH prices due to increase in demand and positive market perception.

Dot-com bubble | Wikiwand

The dot-com bubble was a historic economic bubble and period of excessive speculation that occurred roughly from 1995…

www.wikiwand.com

- Institutional Investors

Another noteworthy aspect of current on-goings in crypto space is the increasing involvement of institutional investors such as JP Morgan[4], whose CEO, Jamie Dimon, had changed his outlook[5] towards blockchain technology in the beginning of this year. There’s an article[6] by Forbes explaining clearly why there will be massive involvement of big institutional players in the crypto space. For example, Liechtenstein’s Union Bank has recently started its own stable coin called UBSC[7]. Regulators across the globe (especially the United States and South Korea[8]) are becoming aware of the pervasiveness of cryptocurrencies and tokens. The market for crypto-derivatives and crypto-ETFs is also showing traction. In addition to this, major financial institutions like Börse Stuttgart[9] and Intercontinental Exchange are starting to offer custody solutions. Among many experts this is seen as potentially the biggest game changer in enabling investments by professionals and institutional investors.

- The Dunning-Kruger Effect

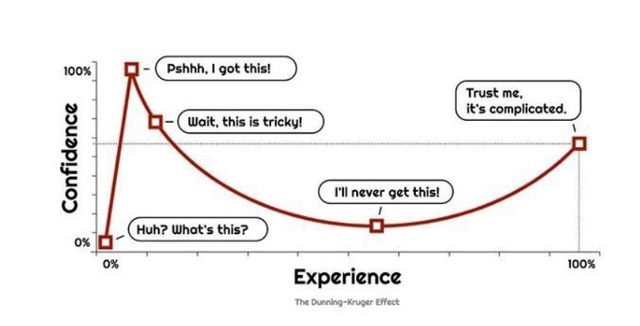

The Dunning-Kruger effect is premised on the interdependency of the level of knowledge (in this case: experience) with the amount of confidence portrayed (in this case: market perception or ETH price). Although the Dunning-Kruger effect is often used “on-post” to explain bubble phenomena, it is harmless to use it in the current context.

If we consider the graph below, we can find ourselves in the local minima of post realization phase. Psychologically, major chunk of early entrants in any disruptive idea or system will be more attracted by the surrounding noise than the core ideology or technology. What this means is that by now investors have gained enough experience with ICOs to be able to distinguish the good from the bad ones, and with this comes more certainty and confidence in a selected few projects. I believe the next few months will most likely see a slow and stable growth in both ICO investments and price of major cryptocurrencies. This can explain why there would be a bigger push for a more mature market, and this is where HELIX Orange comes in.

HELIX Orange is a blockchain driven ICO platform which brings the best ICO projects and KYC/AML cleared investors together. We support such a development in the market in months to come since we believe we are bringing trust back to the market.

https://www.wikiwand.com/en/Dunning%E2%80%93Kruger_effect

CONCLUSION

It is prudent to perceive the current bearish trend positively for the longer scheme of things and for the overall widespread adoption of blockchain technology. ICOs are definitely here to stay, but only the qualified ones will eventually succeed. In short, yes, history will most likely repeat itself. As far as geographical demand trends are concerned, the following are some of the recent events which substantiate to these claims.

The emergence of STOs[10] will democratize investments and will only improve upon the underlying blockchain technology. This will have a highly positive impact in the market in days to come, although these are early days for STOs.

Countries with weakening local currencies might force regional investors to move towards crypto. Possible examples can be Turkey, Brazil, Argentina

Regulators in Asian countries are starting to loosen up their stance on crypto regulations, one instance being that of South Korea[8]

COUNTER-CONCLUSION

The above arguments can be affected by an inherent latency and inertia exhibited by market participants. The case may arise that the drivers of current prices are factors such as political decisions or even outright market manipulation. In such a scenario the current bearish trend might continue in an unpredictable manner. From a fundamental view, the economic value provided by digital assets they might still be completely overrated and correction is by far not over yet. Investors who have suffered massive losses over the last months will not want to return to put their money in crypto and accordingly demand can diminish. Wealth in crypto is even more densely distributed than in fiat which might keep institutional investors away from entering the market.

About: The author, Ansik Mahapatra, is a member of HELIX Orange and is a part of the analytics and marketing team. HELIX Orange is a blockchain driven Digital Identity and ICO platform poised to bring the best ICO projects and accredited investors together.

HELIX Orange is conducting its own ICO Main Sale starting from 13th September. To know more about HELIX Orange, visit: https://ico.helix-orange.com/.

Disclaimer: The contents of this article are merely the opinions of the author, and not investment, legal or tax advice. This publication has the sole purpose of addressing specific topics. The publication makes no claim to completeness.

Appendix:

[1]https://www.coinschedule.com/stats.html

[2]https://www.techllog.com/2018/05/reason-behind-the-cryptocurrency-market-is-crashing-consistently/

[3]https://hackernoon.com/will-crypto-crash-again-f5205ff483cf

[5]https://www.cnbc.com/2018/01/09/jamie-dimon-says-he-regrets-calling-bitcoin-a-fraud.html

[8]https://bitcoinist.com/south-korea-moving-towards-cryptocurrency-acceptance/

[9]https://www.marketsmedia.com/boerse-stuttgart-looks-to-digital-assets/

[10]https://venturebeat.com/2018/08/04/the-era-of-security-tokens-has-begun/