Dan Morehead's talk on blockchains, 9 Nov 2016 at Epicenter Stockholm

Two days ago I listened to a talk by the investing legend Dan Morehead on blockchains and their future at Epicenter in Stockholm. I also made a recording with Dans presentation and answers to questions from the audience. Sorry for the shaky quality (mobile internet), but hope you find it worthwhile!

Below is the summary of Dan's talk.

The silliest today is not to hold 1% of your net worth in BTC

Bitcoin is the missing money transfer protocol

Dan started by introducing the timeline of money, where we went from stone money on Yap island 3000 BCE, through the precious metal coins and gold-pinned currency, through fiat currency to the next era of money - cryptocurrency with Bitcoin at its forefront. The transfer of money over internet can be thought of as the last puzzle piece in the big internet protocol puzzle. Analogous to VoIP, this protocol can be called MoIP (Money over Internet).

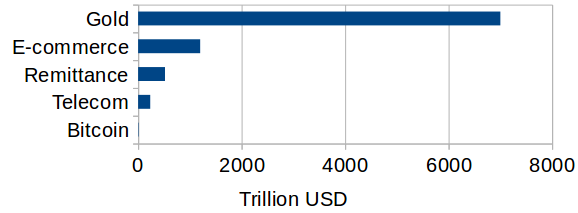

Bitcoin has the potential to disrupt trillion-worth markets

Figure: The market cap of Bitcoin, USD 10 trillion (10^12), is still very small compared to other markets, but has the potential to grow and disrupt them.

The tech is still young so there is potential to work on it and invest in it. Because a lot has and is being invested, especially by big financial institutions over the recent years, we will see lots of new applications the coming years. For instance, payment systems that replace credit cards will come in 5-10 years.

Dan's investment firm Pantera

Dan's company Pantera invests in many blockchain startups, some of which are:

- Abra - "Abra is a digital wallet that lives on your smartphone"

- Align Commerce - "Rethink WireTransfers"

- Brave browser. The current revenue model of the internet is outdated according to Dan - it's either subscription or ads. The Brave browser cuts the bigger part of a pageload time by not downloading annoying ads, and so works much faster. Instead, its revenue model is based on micropayments: you are either paid in BTC for watching ads or you pay BTC for not watching ads. I'm using it already :-)

- coins.sh (hm, address doesn't work)

- Bitpagos - "Financial services in Latin America".

- Bitpesa - "Do business across Africa with easy FX and B2B Payments"

- Korbit - "A secure and comprehensive service to use, accept, and buy bitcoin"

Future use of blockchains include identity and authenticity applications

- Identity, like BankID in Sweden

- Trade finance: tracking shipped products and conditionally making part payments, like when the product reached some place along the supply chain.

- Elections - easy to track votes without risk for fraud. But probably long before we see this because countries that do need this systems have governments that will oppose this solution, and countries that don't need the system that much probably have stable elections anyway.

- Luxury goods authentication. You are at a restaurant drinking wine - you scan an RFID tag on the wine bottle with your mobile phone and get instant verification.

- Music royalties tracking, as opposed to "Hollywood accounting", meaning you don't really know what happens.

Here is the event I went to for reference.