Why is carbon pricing so unpopular?

Carbon credits, used in European compliance markets, are one of the world’s best-performing investments as the price increased fivefold over the last two years. Such high prices have raised the interest of speculative hedge funds and other entities which are now operating in the market looking for a return.

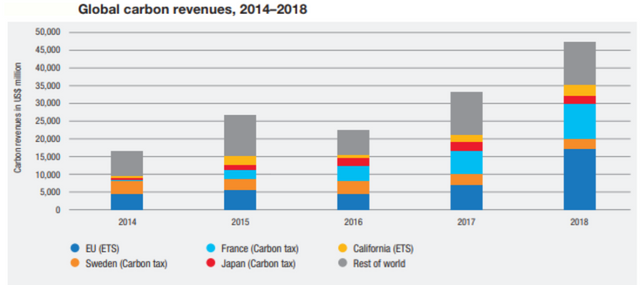

Not only private companies with low emissions compared to the sector average are benefiting from carbon price policies. As mentioned in the last article “Cyber-Attacks on Carbon Markets”, carbon markets raised more than 44 billion USD for governments which demonstrated an increase of more than 70 % since 2015, especially due to the strong price increase (from 6 Euro in the end of 2017 to almost 30 Euros in 2019) in the last two years. The capital raised by governments is determined by the carbon price and sector coverage. It is expected to increase more in the next years as new jurisdictions, especially developing countries, are implementing carbon pricing measures.

The European compliance market is due to its size, the biggest revenue source in the last years followed by the carbon tax in France, the California compliance market and carbon taxes in Sweden and Japan. The next figure shows the development and contribution between 2014 and 2018:

According to the World Bank Group, carbon revenues are used for the following purposes:

-Tax reforms to increase governmental income and boost economic growth alongside with pollution reduction policies

-Encouraging investment in low-carbon technologies and “green projects”

-Subsidies for healthcare

-Carbon leakage to maintain competition

-Debt reduction

However, 42 % of the revenue has been used for environmental projects and 38 % for general budget including debt reduction and 12 % to development-related topics according to statistics of 2017/2018.

Raising capital through carbon markets is great for governments as additional finance fund but they have to be careful about how to use the funds raised and show full transparency. There are several issues:

-Data on carbon revenue is often incomplete

-Lack of transparency

-Corruption or illegal activities as it has happened in the EU ETS in the past

Varies studies revealed that countries with greater public distrust and higher corruption index have weaker climate policies and higher greenhouse gas emissions whereas countries high political trust such as Norway, Sweden, and Switzerland with ambitious carbon price policies. The carbon price in those countries is above 40 USD/tCO2.

History demonstrated that a small number of companies have made windfall profits in the European compliance system due to a little efficient allocation of certificates and a too-high emission cap. Furthermore, the same market has been subject to theft and fraudulent activities which have cost the taxpayer more than 5 billion Euros. These events led to a fall in public confidence regarding carbon markets.

Beyond the fact that carbon markets and hence climate change instruments are made for the private sector to increase governmental income independent of its usage, markets should be accessible for each person and guaranty transparency.

Nowadays, there are several projects which try to make tackle those issues through blockchain technology.

We invite you to find out more at www.deca.eco

Sources:

https://ourworldindata.org/carbon-pricing-popular

http://pubdocs.worldbank.org/en/668851474296920877/CPLC-Use-of-Revenues-Executive-Brief- 09–2016.pdf

https://mpra.ub.uni-muenchen.de/80943/1/MPRA_paper_80943.pdf

https://www.wsj.com/articles/once-unpopular-carbon-credits-emerge-as-one-of-the-worlds-best- investments-11565515800

https://www.tandfonline.com/doi/full/10.1080/14683849.2018.1533821