What is Augur? Step-by-Step Guide to Using Augur

Augur is a protocol that allows users to create their own prediction markets. The Augur protocol rewards users for correctly predicting future events. Prediction markets allow users to buy & sell shares in the outcome of any upcoming event. In simple terms, this means anyone can create their own bet (on anything) and let anyone in the world bet on it.

The Source for this Information is: A Chain of Blocks

How Does Augur Work?

Augur is a free, public, open source software. It is a set of smart contracts that can be deployed using the Ethereum blockchain.

When using the Augur platform, the price of a market share is an estimate of the probability of an event actually occurring. This means that odds are determined by what users are willing to wager. This is different than traditional markets, where the odds are determined by a Casino.

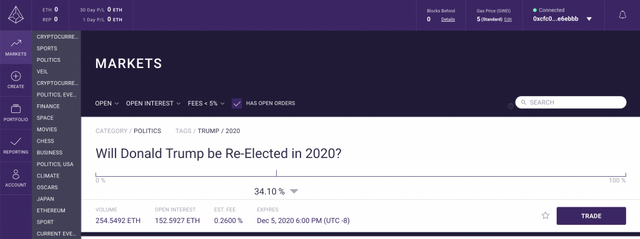

For example, a market could be created to determine if Donald Trump will be re-elected President of the United States in 2020? This market has 2 possible outcomes, Yes & No.

Alex is willing to risk 0.6 ETH for a share of ‘Yes’ and Becky is willing to risk 0.4 ETH for a share of ‘No’. First, the Augur protocol matches these orders together and collects 1 ETH total from Alex and Becky. Then Augur creates a complete set of shares and gives Alex the share of ‘Yes’ and Becky the share of ‘No’. This is how shares are initially created in Augur markets. Once the shares are created, they can be traded freely between users. We’ll dive deeper into the specifics of Trading later on.

Give Me Choices

In addition to Yes & No predictions, the platform also supports Multiple Choice or Numerical Range Markets. Currently, Augur allows up to 8 choices for multiple choice prediction markets. An example of a numerical range market is, “How Many Grammy’s will Taylor Swift win at the 2020 Grammy Awards?” Numerical Range: 0-15 Grammy’s.

Follow the Crowd

Augur prediction markets rely on a scientific principle known as The Wisdom of the Crowd. The wisdom of the crowd principle states that if you ask enough people something, the answer of the group is usually more accurate than any one individual expert within the group. This principle is what has allowed Augur to create such a powerful forecasting tool.

The Centralized Problem

The problem with previous predictions markets is that they have always been centralized. In any prediction market, someone has to report on the result of the event after it occurs. In a centralized market, one person or entity does this. This can be viewed as a single point of failure; as there could be mistakes, lies, or even manipulation and corruption.

Cut out the Middle Man

Augur addresses this concern with its decentralized platform. This allows Augur users to stake their own Reputation Tokens to validate events. Reputation or REP is the native token of the Augur protocol. Augur is designed to reward users that correctly report event outcomes, and penalize users that act maliciously. The platform aims to have thousands of users online at any given time to ensure the safety of the network. We will go further into the reporting process later in this article.

4 Stages of Augur Markets

Augur Markets advance through 4 stages: Creation, Trading, Reporting, and Settlement. Anyone can create a market based on any real-world event (we will cover this in more detail when we actually create a Market). Trading begins immediately after the market is created, all users can trade shares in any market. After the event concludes, the outcome of the event is determined and reported by the designated reporter. After the reported outcome is finalized, traders holding winning shares can close out their positions and collect their payouts. This is known as Settlement.

Put Your Money Where Your Mouth Is…

The best way to understand the first 2 stages, Creation and Trading, is for me to walk you through a real-life example. For this, I will create a Live Augur Market that you can wager on after reading this article.

The Market that I am going to create is: ‘Will My Twitter Account, @achainofblocks have more than 25,000 Followers on September 4th, 2019 at 11:59 PM Pacific Standard Time?’ My current follower count at the time of publishing this article is around 1,420.

Augur Market Maker

I am going to walk you through step-by-step on how to set up an Augur market. Once the market is created, I will show you how you can trade in this market if you’re interested.

Download Augur

The first step to getting started using Augur is to download the Augur client. Downloading the Augur app will give you access to connect to the Main network, the Mainnet is where you can create and trade markets.

To download the Augur app, open a web browser and navigate to Augur.net. You will see 2 purple buttons, and you will click the one on the right, ‘Augur App.’

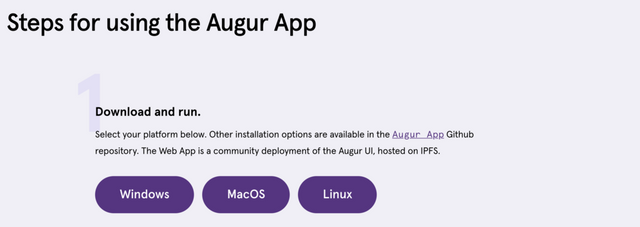

When you click the Augur App button, you will be directed to a screen that shows you 4 Steps for Using the Augur App. Step 1, is to Download the App, it is available for Windows / MacOS / Linux. Click the option that suits your operating system. Depending on the operating system the steps for installation will vary. (This article assumes that you know how to download and install an application on your computer).

Launch Augur

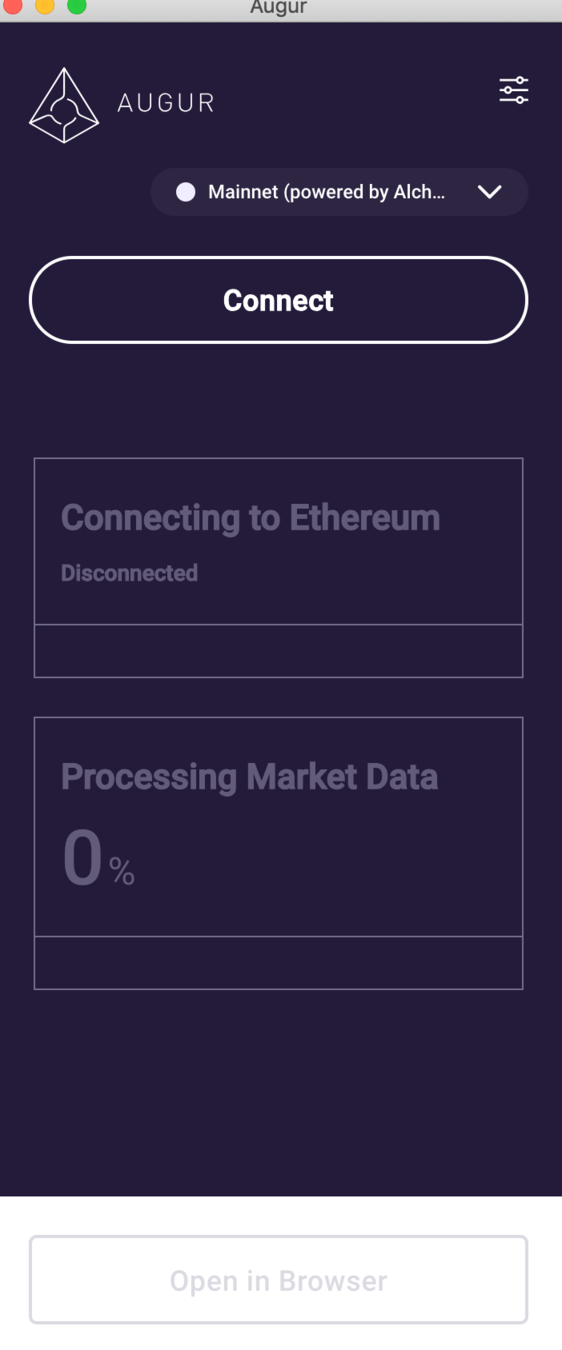

Once you have the appropriate version downloaded and installed on your computer, it’s time to open it. When you open up the app, it will look very similar to the screenshot below.

You will notice at the top there is a dropdown menu to select your network. In the screenshot, I have Mainnet selected (this is the network you will want to use). Below the dropdown, you see there is a button that says Connect. At the bottom, we see Processing Market Data is at 0%. When we connect, the app will start to process the market data, and that number will eventually get to 100%.

Worth the Wait

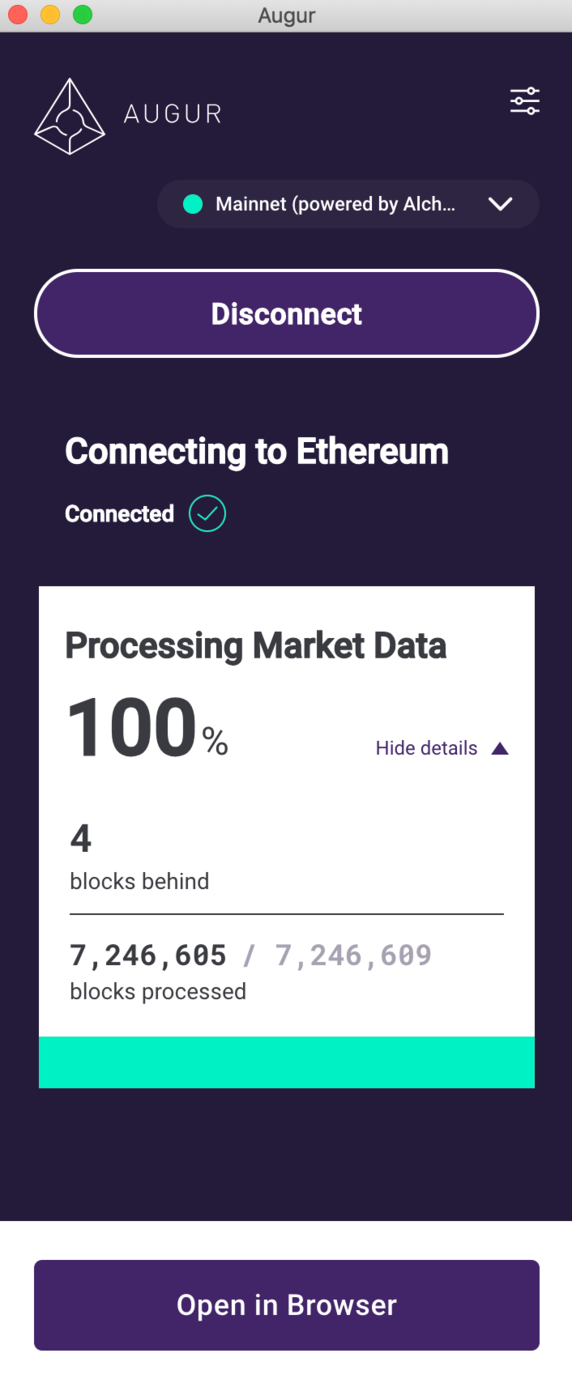

The first time you connect to Augur it will take a significant amount of time for you to get to 100% of Market Data. This is because you need to get caught up on all the previous transactions. Once you complete this process the first time, future connections will be much faster.

When Processing Market Data gets to 100% complete, you will be able to click on the Purple Bar along the bottom of the app ‘Open in Browser.’

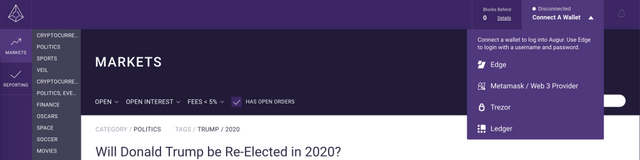

Augur Betting Marketplace

When you click Open in Browser, it will open a Web Browser and direct you to the Main Page of the Augur Prediction Marketplace. When you arrive, initially, you will not be connected. Getting connected is just a matter of connecting a cryptocurrency wallet, this can be done by clicking the ‘Connect A Wallet‘ drop down in the Top Right corner. At this point, you will be only able to view the current markets available on the Augur platform. Of course, if you want to create a bet or bet on something you will need to deposit funds.

For the purpose of this example, I will connect using the Edge wallet option. If you already have an account with Metamask, Trezor, or Ledger, those can be easily integrated as well. To use the Edge wallet, you will create an account with a Username, Password, and Pin. Once completed, you will be able to login to your Edge account and connect to the Augur platform. Once you are logged in with a connected wallet, you will see that you have additional menu options along the Left Sidebar. These options include the ability to add funds to your Account and also Create a New Market.

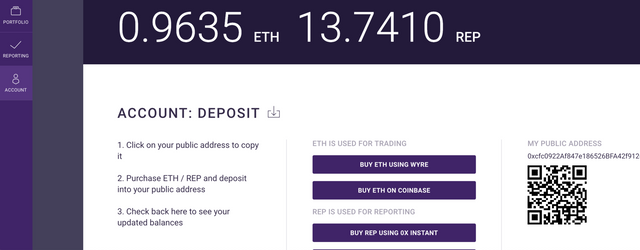

I don’t want to spend too long explaining how to add funds, as this will differ based on the wallet. However, if you are using the Edge wallet option, you select Account from the Left Sidebar. Your account page using the Edge wallet will look like the screenshot below. You will receive 1 public address that can be used to send both ETH and REP. Your participation options are limited until you fund your account.

Ether or Rep?

The Augur protocol supports 2 currencies, Ether and Reputation. Ether (ETH) is used for making predictions in already created markets. ETH is also used to cover the gas cost associated with making a transaction on the Ethereum blockchain. Reputation (REP) tokens are used for reporting on the outcome of markets. If you are only looking to bet, then ETH is all you will need. If you are looking to create your own market, Reputation (REP) is also needed.

You Wanna Bet?

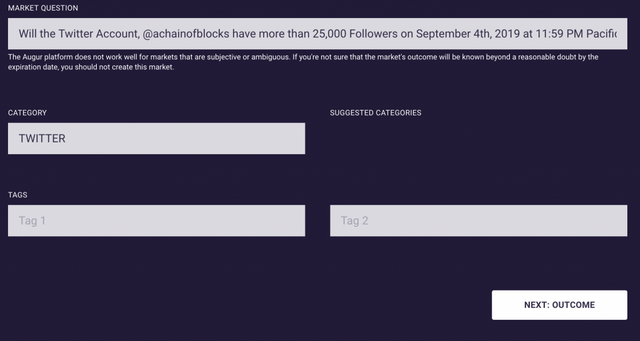

Along the left menu sidebar, you will see an option to Create. Click this + sign, and you will be taken to the 1st screen of market creation. For this example, my market question is, ‘Will the Twitter Account, @achainofblocks have more than 25,000 Followers on September 4th, 2019 at 11:59 PM Pacific Standard Time?’ This question is easily understandable and will provide a clearly discernible answer. Making your question clearly understandable will help ensure a good experience for everyone. Subjective and ambiguous questions will not perform well and may lead to difficulty in resolution, and loss of Reputation.

Once you have decided on your market question, the next field is for Category. This selection will dictate where your market is visible on the platform. For this example, I am selecting the Twitter category. Tags are optional, and in this case, I will choose not put any. Click the Next: Outcome button to continue.

What’s Your Type?

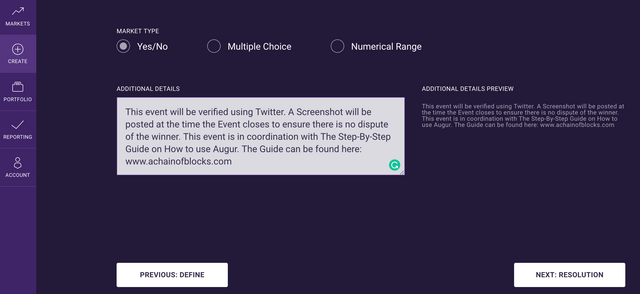

The next screen allows you to select the type of market you wish to create. At the time of this article, there are currently 3 Market Types available. The market types are Yes/No, Multiple Choice (up to 8 choices), and Numerical Range.

Once you select your market type, you’ll see a text box for Additional Information. I highly recommend that you use this space to add specific information on how the event will be resolved. For my Twitter example, I have added Additional Information to state that a screenshot will be posted showing the Follower Count at the time the event expires.

After you have added any additional info, click the button that says Next: Resolution.

Take Me to the Source

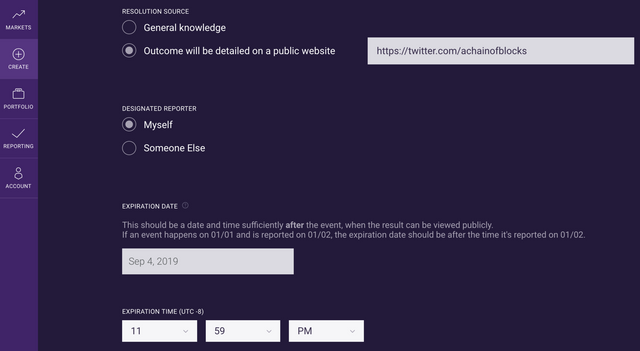

The next step is to establish who will report on the outcome of the event, what the resolution source will be, and the expiration date. There are 2 options for resolution source; General Knowledge & Determined from a Website. In my opinion, General Knowledge is too vague, I would only choose a website as a resolution source. This limits the opportunity for disputing the reported outcome.

The 2nd option on this page is to determine the designated reporter for the event. There are 2 options here as well, Myself or Someone Else. If you choose the Someone Else option, you are required to enter in their Reporter Address. In this example, I will be the designated reporter.

The 3rd and Final option is to determine the expiration date for the Market. Enter the expiration date and time for the event, then click Next: Liquidity.

Add Some Liquidity to the Market

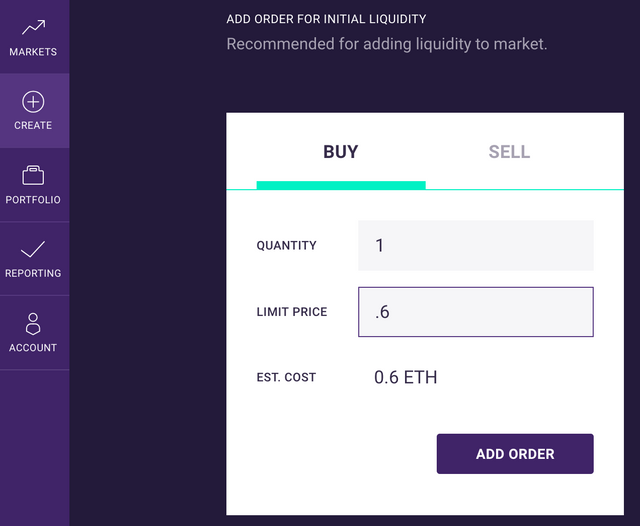

Augur gives the market creator the opportunity to add liquidity to the market. This means that you can place an initial Buy or Sell order in the market you have just created. It is important to note that when trading in a Yes/No market, Buy is the equivalent of Yes and Sell is the equivalent of No. To place an order and add market liquidity, first, you determine how many shares you want to buy? You do not have to buy shares in whole numbers, decimal values are accepted as well.

Once you figure out how many shares you want to buy you need to determine how much you are willing to pay. The price you are willing to pay is also known as your Limit Price. One thing to remember about the Limit Price is that it will always be a decimal, less than 1.

All shares in a Yes/No market are equal to 1 Ether (ETH). This 1 ETH comes from 2 users who have combined their funds totaling 1 ETH to make 1 share in the market. Each of them has given a percentage of the 1 ETH based on their position in the market.

Pushing the Limits

When you place a Buy order, you are betting that the outcome of the event will be Yes. A buy order takes the Number of shares you are buying multiplied by the Limit price to give you an Estimated Order Cost. For example, if you Buy 1 share with a Limit price of 0.6, the Estimated Cost is 0.6 ETH.

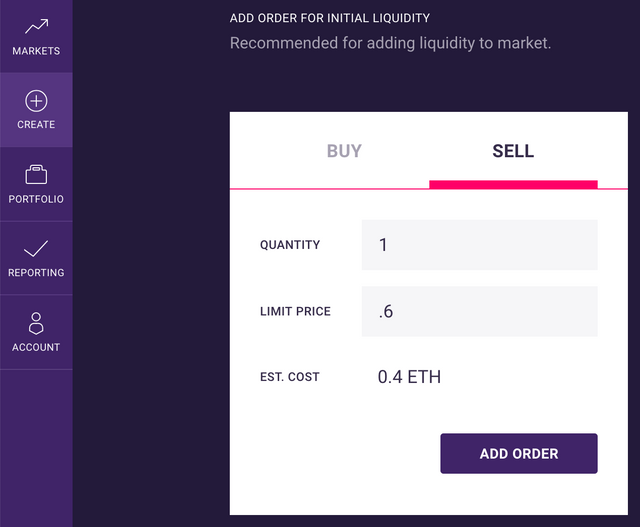

On the other hand, we have Sell orders. A Sell order, as you would imagine, is the opposite of a Buy order. When you place a Sell order, you enter in the same information, Quantity & Limit Price. However, with a Sell order, you are betting on the No side of the market. This means that if you enter a Sell order for 1 share at a limit price of .6 your estimated cost is .4 ETH.

Match Game

The network then tries to match the .6 ETH and the .4 ETH together to create 1 full share in the market at the prices that each user paid.

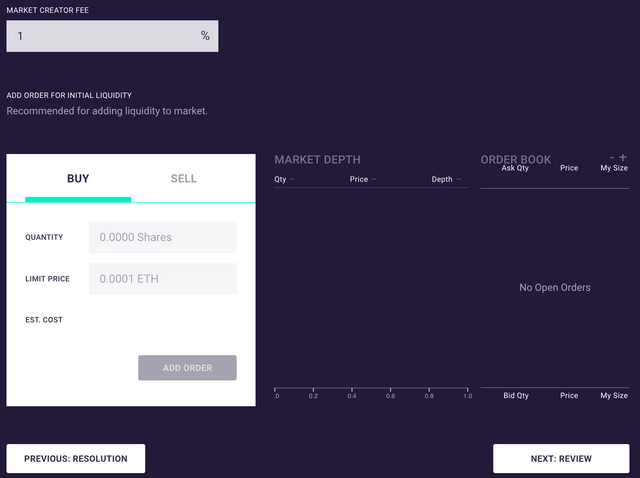

For this example, I am not going to add any liquidity, but it is generally done to increase the initial interest in a market. I may come back and enter a prediction later on.

In addition to adding Liquidity, you have the option to add a Market Creator Fee. The majority of markets I see listed have a Market Creator fee of 1%, which is quite a bargain compared to the centralized alternatives. I am also going to set the Market Creator Fee at 1%. However, any money generated will be given back to Twitter followers and people who leave a comment below. More details on this later. I will now click the button that says, Next: Review.

For Your Review

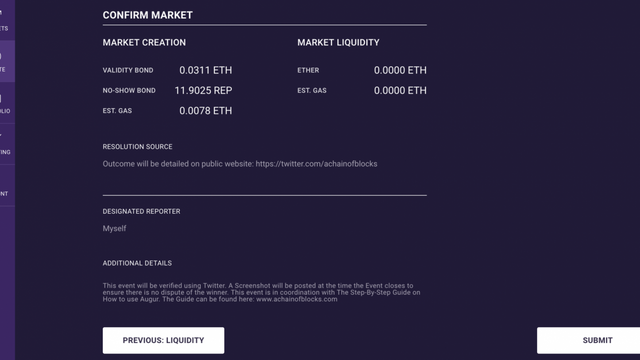

The review screen gives you the opportunity to confirm your market details before submitting.

This screen gives you a lot of important information, make sure you review it thoroughly. Once you submit your market there will not be an option to edit it. The things you want to confirm are Market Question, Category, Expiration Date, Resolution Source, Designated Reporter, and Additional Details. If all of that information looks good, it’s time to review the fees.

Market Fees

There are 3 fees to pay attention to when creating a market. The first one is the Validity Bond. This bond ensures that a Valid market is created. For example, if you create a market that is Multiple Choice and the Winner is not one of your options, this would be an Invalid market. If the market is valid, this fee is returned to the market creator. The Validity Bond for this market is equal to $4.25.

Next, you have the No-Show Bond. Another fee that acts as its name implies. The No-Show Bond ensures that the designated reporter shows up to report on the event. If the designated reporter shows up they will receive this bond back. If they do not show up, the bond is used to attract a new reporter to report on the event. The No Show Bond for this market is almost 12 Reputation tokens. At the time of publishing this article, REP is approximately $12.50 per token.

The last fee is Ether Gas, this a fluctuating fee, and you will not get any of it back. This is the fee to place your transaction on the Ethereum blockchain, it is paid to the Miners. Gas prices vary throughout the day, my gas fee for this market is just over $1.

If everything looks good, you will want to confirm your market by clicking on Submit.

Now Let’s Bet!

Congratulations! We have now successfully created an Augur Prediction Market. Now that we have explored creation and trading, the next step in the process is Reporting.

You Calling Me a Liar?

The system works great when everyone does what they are supposed to do. But what happens if the reporter does not act honestly, or does not report the correct outcome? This is where Reputation comes into play. The designated reporter must put up their own Reputation token as a stake that they will report accurately. When the reporter acts honestly their REP tokens will be returned once the event is finalized.

If the designated reporter is not honest, they risk someone disputing their reported outcome. If a dispute is successful the original reporter could lose their Reputation stake. This provides a built-in financial incentive to report accurately and honestly.

Dispute Resolution

The next question you are likely asking is, how do you settle a dispute? As we learned, the designated reporter has to offer their Reputation as a stake. After the initial outcome (also known as the tentative outcome) is reported, there is a 7-Day period where the outcome can be disputed. If someone feels that a false outcome has been provided, they can stake their own Reputation tokens to dispute. The challenger must offer up twice as much Reputation (REP) in order to dispute. In reality, there is a complex equation for calculating the dispute bond, for general knowledge it is about double the stake of the initial reporter.

I Object to Your Objection

Due to the fact that markets have a clearly defined resolution source, disputes should happen infrequently. However, in the event, of a challenged dispute. The new disputer must stake about double the amount of tokens as the previous disputer in order to challenge. Every time there is a new dispute, it goes through a new 7-day window where anyone can dispute the current tentative outcome.

Agree to Disagree

Seemingly, this back and forth disputing could happen indefinitely. However, if the dispute stakes exceed 2.5% of all the Reputation tokens in circulation, then a Fork State occurs. The fork state is designed as a complete ‘Last Resort.’ If a fork state occurs, the entire Augur Platform will freeze, and not only will this market go offline, all markets will shut down until the fork is resolved. The total market cap of Augur at the time of publishing this article is around $140 Million, 2.5% of this amount is around $3.5 Million. That is a lot of money to risk to dispute something that should be obvious.

Augur Fork State

In past articles, we have explained what a hard fork is. If you need a refresher, check out this Hard Fork Explanation. With Augur, they offer up the concept of a Fork State, but what is a fork state?

If a fork state occurs on the Augur platform, the chain splits based on the number of options available in the market. If this happens, the network goes into a 60-day freeze. Using my Twitter market as an example. The market has two options (Yes or No), this means that the chain would split into 2. Members of the community would support the chain that they felt represented the correct outcome. Whichever chain receives the majority support from the community becomes the winner. This becomes the official chain, also deciding the outcome of the event.

Pay This Man His Money…

Once the outcome of the event is made final, we move into the 4th and final phase, Settlement. In the settlement stage, market positions are closed, this can happen in 2 ways. The first option is that someone can sell their shares in a specific market at any time to another user.

The second option is more common once a market is closed, and that is, a shareholder can settle their shares with Augur. When you use Augur for settlement, it is basically the process of the system transferring the money staked to losing bets over to the winners.

Value Your Reputation

The Reputation token, REP, is intrinsically valuable because it is needed to create Augur markets. As you saw when I created a market, REP was required to cover specific fees. You may be wondering why can’t we just use Ether instead of REP? The reason for the Reputation token is what we just discussed regarding the fork state. Forks on the Augur platform are needed to ensure that reporters will report honestly. However, a fork cannot be initiated using an external currency like Ethereum. Basically, you can’t fork the Ethereum blockchain to settle an Augur dispute. Therefore, the Reputation token is a necessary part of the Augur protocol.

Creation of the Augur Protocol

Augur was founded in 2014 by Jack Peterson and Joey Krug. They had a brief ICO that lasted from August 17th to October 1st, 2015 (the average token price during the ICO was around $0.60). The platform officially launched in July 2018. At the time this article was published, the most current version of Augur is, Version 1.10.3.

All Bets Are In…

The more that I use Augur, the more I like it. It’s important to keep in mind that the live platform is less than a year old. The design of the interface is very intuitive and makes it extremely easy to navigate. Adapting to the betting style takes a little time, especially if you are accustomed to standard prediction markets. Once you start using the platform, I think you will agree that the betting structure is fair and makes a lot of sense.

I hope you enjoyed this Step-by-Step Augur guide. If you plan to Bet YES, please also Follow Me on Twitter.

I will be sure to update this article after September 4th with the results. Please leave a comment below if you participate in this market. Anyone who leaves a comment AND Follows me on Twitter will be eligible for the ETH Market Creator Fee Giveaway, happening on September 28th, 2019.

Today’s Top 5 Coin Prices – March 6th, 2019

Bitcoin: $3,877

Ethereum: $137

XRP: $0.32

EOS: $3.72

Litecoin: $55.19

Bitcoin Dominance: 51.6%

Reputation (REP): $12.52 // REP Market Cap: $137,792,310

References:

https://en.wikipedia.org/wiki/Augur_(software)

https://icobench.com/ico/augur

Congratulations @chainofblocks! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!