MakerDAO (MKR) Cryptocurrency Project Review ( Get a loan by keep ETH as collateral)

.png)

MakerDao is a project that allows users to take a loan in exchange for stable coins “Dai” by collateralizing their cryptocurrencies, mainly Ethereum.

This process is basically called a collateralized debt position.

MakerDao aims to be transparent and sustainable by giving financial solutions to the people involved in the cryptocurrency or you can say blockchain space.

MakerDao has three important features that help in achieving their goals and visions.

Decentralized Stable Coin “Dai”

Providing Collateral Loans

Community Governance

So we will be discussing all these features, as we move forward with the review, so let’s begin.

Decentralized Stable Coin “Dai”

Maker has its own decentralized stable coin termed as “Dai” which is always equivalent to the USD.

Maker claims that dai is much more decentralized compared to other stable coins like Tether or TUSD.

Dai is the first decentralized stable coin on the Ethereum blockchain.

Anyone can purchase dai without having the risk of its volatility and easily rely on the coin.

Each Dai is backed by the collaterals, so users can stay least worried about its value fluctuations.

Dai also has three main features including:

Security

In terms of security, each Dai coin is backed by another asset value, and also the collateral portfolio is very much diverse, which basically allows multiple assets to determine the value of Dai coins

Transparency

With being transparent, anyone can view the locked collateral that is backing each Dai, including its safety profile.

Makerscan shows all the collateral data in just one place.

Resiliency

In the unlikely case of a black swan event, the system will employ Emergency Shutdown, a last resort to guarantee a stable price.

Introduction To Dai

Providing collateral loans

Providing collateral loan is the main objective of MakerDAO.

Features of collateral loans:

Borrow on users terms

Gain additional liquidity from assets so that users can lend themselves a secure and stable form of money.

If the Dai coins increase more than 1 USD, users are incentivized to generate more Dai coins by dropping the price until it returns to the value of 1 USD, similarly, if the Dai coins decrease lesser than 1 USD, users are incentivized to destroy the coins, by giving a discount to payback the loans.

Increase exposure

By opening a collateralized debt position (CDP), individuals can increase their exposure to an underlying asset and effectively trade on margin.

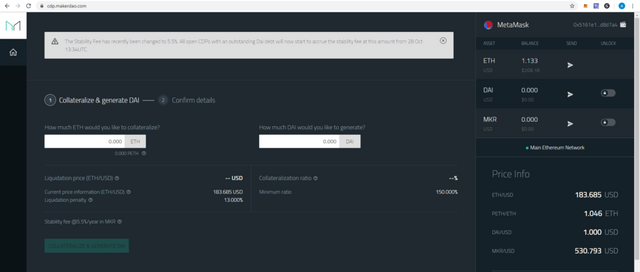

Steps involved in opening a collateralized debt position (CDP)

Anyone owning ETH can open a collateralized debt position (CDP) on the MakerDAO Dapp

The next step is is to sign in with any 1 of the 4 trusted Ethereum supported wallets that are Metamask, Ledger Nano S, Trezor, and Coinbase Wallet.

Once logged in, there will be an “Open CDP” button just in the middle of the dapp.

After clicking on “Open CDP”, there will be two tabs displayed.

The first tab on the left side is the amount of ETH tab, where the user has to enter the amount of ETH he wishes to set as collateral.

The second tab on the right side is the amount of Dai coins the user wishes to be lent.

MakerDao Dapp Interface

The user has to keep in mind about the liquidity risk while entering the amount of dai to be lent, which is really very important to be understood because it helps in preventing the user from major losses.

The next step is to click on the “collateralize and generate Dai” button below, after that you need to confirm the transaction in your respective wallet, the transaction will be processed and since the Dai coins are the ERC20 tokens the user will automatically receive them straight to their Ethereum wallet.

The user can then do whatever he wishes with the dai coins.

Introduction to CDP

Community Governance

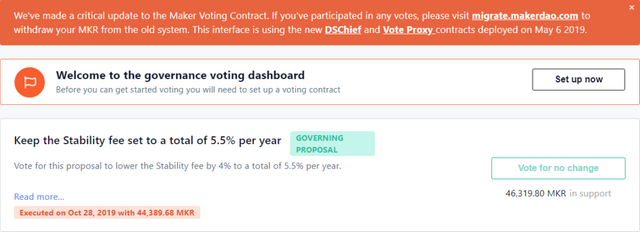

The community governance is a voting system where the MKR token holders can vote for further decision making and electing active proposals they like to wish.

The voters can find the proposals they wish to in the MakerDAO Voting System

Here is an image of the current proposal running on to reduce the stability fee of Dai by 4% to a total of 5.5% per year

So if the voters wish to support this, then they can vote by clicking the vote for charge or vote for no change buttons respectively.

If the voters already have MKR it will use it to vote, if not it will automatically convert the voters ETH present in his wallet into MKR since it is also an ERC20 token.

Voting for proposals is very important as it helps the MakarDAO team in taking the right decision

Congratulations @blockchaintrends! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!