Ethereum Price Technical Analysis – ETH Nosedives, Can It Recover?

Ethereum price registered heavy losses and even closed below the $12.00 handle against the USD. Can the price recover moving ahead?

SPONSORED ARTICLE: Tech Analysis articles are sponsored by SimpleFx - “Keep it simple!”,

SimpleFX is a robust online trading provider, offering trading with Forex CFDs on Bitcoins, Litecoins, indices, precious metals and energy. Offers and trading conditions simple and transparent.

Key Highlights

Ethereum price dived sharply against the US Dollar, and one of the main reasons could be Ethereum classic price surge.

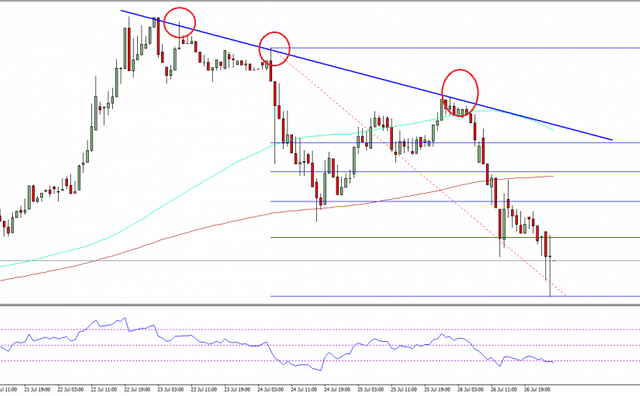

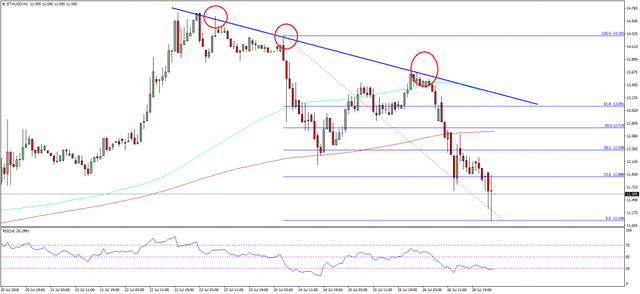

Yesterday’s highlighted bearish trend line on the hourly chart (data feed via Kraken) of ETH/USD acted as a perfect barrier in pushing the price down.

There was a heavy bearish pressure noted on ETH/USD, which could stay here for some time.

Ethereum price registered heavy losses and even closed below the $12.00 handle against the USD. Can the price recover moving ahead?

Ethereum Price Weakness

Ethereum price ETH was under a lot of bearish pressure during the past couple of sessions against the US Dollar. It broke a few important support levels including $12.80 to post heavy losses. The ETH/USD pair even closed below the 100 and 200 hourly simple moving average, which is a strong sign of weakness.

Yesterday, I highlighted a bearish trend line on the hourly chart (data feed via Kraken) of ETH/USD. It acted as a perfect resistance to push the pair down. The price traded as low as $11.15 where somehow it found bids and started to recover. An initial resistance on the upside is around the 23.6% Fib retracement level of the last drop from the $14.29 high to $11.15 low.

However, the most important resistance is now below the trend line in the form of the 200 hourly SMA, as it also coincides with the 50% Fib retracement level of the last drop from the $14.29 high to $11.15 low. Overall, I think buyers should wait until the price recover. In the short term, one may even consider selling with a stop above the trend line resistance.

Hourly MACD – The MACD is strongly placed in the bearish zone, calling for further weakness in the short term.

Hourly RSI – The RSI is around the oversold readings, which may result in a minor correction.

Major Support Level – $11.20

Major Resistance Level – $12.40

Very good blog. Good to see I'm not the only one who thinks like this. The current total market cap of all cryptos might seem high but blockchain is here to stay and will involve all our lives. I do see a bright future for everyone that's hold's their coins with a long term vision. I found this amazing platform: https://www.coincheckup.com They seem to give this complete indepth analysis of all cryptocoins. Sorted by team, product, company, advisors, previous investors, etc. For example: https://www.coincheckup.com/coins/Ethereum#analysis To see the: Ethereum Detailed analysis