Lightning Network FLAWED: A Logical Analysis

First things first, this is my first Steemit post!

I've been observing the cryptosphere for the last couple years without really voicing my opinions, because - lets face it - it can be rather technical and confusing. But figured I'd give it a shot...

The recent crypto-EXPLOSION has brought a lot of new (and rather uneducated) investors into the space. Winning the hearts and minds of those investors is crucial in determining which projects will succeed, and which ones wont.

As Bitcoin prepares to have its second (MAJOR) fork in one year, it seems pretty evident to me that one side has a clear advantage over the other in terms of its ability to communicate to these newcomers. There's a lot of people who view Lightning Networks as the crypto-savior. The chosen path to bring about mass adoption of Bitcoin. However, I wanted to try my best to make logical critiques on the Lightning Network, with my admittedly-limited intelligence on the subject.

So I write this post to the community...

Segway/Segwit

To begin this discussion, I would like to talk about Segway (yes, not Segwit). The two wheeled, self-balancing transportation device that was supposed to change the world. The Segway was forecasted to sell 10,000 units a week - but three years into its launch, it had only sold 30,000 units total. Today, the Segway is all but forgotten and only used in niche markets.

The Segway was a false positive. A sure hit that turned into a miss. It had all of the "brightest" business minds and investors behind it, such as Steve Jobs. Although Jobs was critical of its design, he once said "the machine [will be] as big as the personal computer."

How were these great minds be so off?

The Segway simply did not make market-sense. It was supposed to replace cars in cities, but the price point was too high for your average city-dweller. City infrastructure was built around cars and pedestrians. A Segway makes no sense on a road - where the rider would be extremely vulnerable to injury. And it wasn't even allowed on most sidewalks. Even if it was, it still made no sense. Walking in a city like Manhattan is a "shit-show" (to use the scientific term). Pedestrians need to be nimble and flight of feet to avoid those dreaded slow-walkers. Riding a Segway on a sidewalk would be a recipe for disaster - and you'd pretty much be asking for midtown tough-guy to push you off one.

Bitcoin Scaling

The discussion above is relevant because I'm seeing parallels between the Segway and Bitcoin. More specifically, the "Lightning Network."

Everyone knows for Bitcoin (or any other cryptocurrency) to hold its value, it needs value proposition (i.e. provide a useful service). Currently, Bitcoin is too slow and expensive to a viable method of payment for everyday use. However, as a cryptocurrency, it still possesses the most important feature: decentralization.

Most 'cryptos' are intended to be a form of 'currency' (hence, cryptocurrency). As such, we need to keep in mind the most common use cases for currencies, such as buying a cup of coffee or paying a friend. For Bitcoin to succeed, the benefits of using it to buy a cup of coffee need to outweigh those of using status-quo payments, like cash or credit.

Nobody argues the fact that - at this point in time - Bitcoin's benefits do not outweigh cash or credit. It's slow and, more importantly, too expensive. Although we all love decentralization - nobody wants to wait a minimum of 10 minutes to receive 2 confirmations and pay multi-dollar fees just to buy a $1 cup of coffee. That's why solutions to this problem have been debated for the last several years. Solutions can be boiled down to two primary solutions: (1) bigger blocks, and (2) off-chain scaling.

Framing The Debate

The way in which we frame an issue largely determines how that issue will be understood and acted upon. If this most recent election has taught us anything, it should be that anchoring the public to a sentiment or an ideal is necessary for success. For Trump, it was 'Crooked Hillary' and 'Drain the Swamp.' The public debate between HRC and Trump was never about substance. Trump's campaign successfully framed the debate as corruption vs. idealism.

On its face - increasing the block size seems like the logical solution. It's been done before, so why arbitrarily limit it at 1MB? Satoshi Nakamoto - Bitcoin's creator - stated that blocks should grow as big as they need to be; and implied that blocks should increase as they approach max capacity.

However, (like Trump) those opposing bigger blocks have successfully framed the debate away from substance and towards more sinister overtones: power and greed. I believe the reason why the small-block camp was more successful in framing the debate to their liking is because they have a larger presence in the community, such as YouTube personalities (e.g. World Crypto Network).

The argument from the small-block camp is more-or-less as follows:

- Big blocks increase the cost of running a full-node.

- Big blocks will lead to a centralization in mining.

- There is no reason for Bitcoin to compete as a viable currency, at least, for the time being.

- Currently, Bitcoin should only be promoted as only a store-of-value.

- Blockstream and Core have "the best developers" who are working on alternative scaling solutions.

- This solution will lead to instant, low fee transactions.

- Only then, will Bitcoin compete as a means of payment.

In sum: If we scale now, Bitcoin risks technical issues and centralization. That's what the greedy miners want. Let's wait until the best developers in the world develop... THE LIGHTNING NETWORK!

Problematic Implications Of the Lightning Network

The basic premise of the Lightning Network is to create a network of trustless payment channels - when channels close, the ending balance is recorded on the bitcoin mainnet. However, let's explore the issues of implementing this type of network.

User Friendlieness

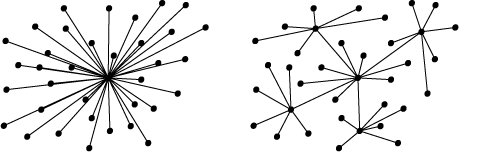

The first problem is that the Lightning Network may not be particularly user friendly for a user. As the above image ironically depicts, nothing about the process seems intuitive or easy to understand.

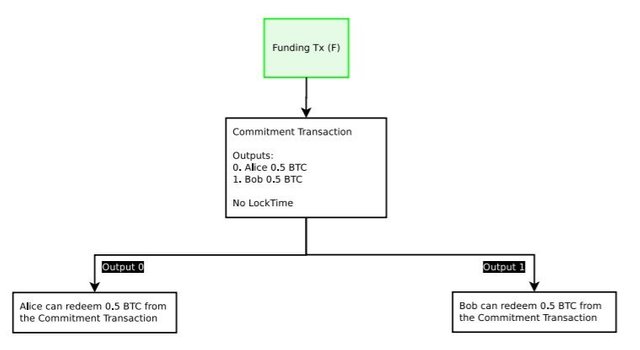

From the whitepaper, in order to use the LN, a common-user needs to: (1) create the parent (Funding Transaction), (2) create the children (Commitment Transactions and all spends from the commitment transactions), (3) Sign the children, (4) Exchange the signatures for the children, (5) Sign the parent, (6) Exchange the signatures for the parent, (7) Broadcast the parent on the blockchain. It's a little confusing, but as the following image depicts, essentially, you fund the network with a transaction on the Bitcoin Mainnet and commitment transactions re-shift the original balances. To sign the funding transaction, they need to exchange their parent signatures and broadcast them back on the mainnet.

As innovative as this idea is, we have to ask: How will this look on, say, a smartphone? What explicit steps will the user have to take to accomplish this? How intuitive will this be for a common consumer (e.g. your grandma)? If it cannot be readily understood and adopted, it may all be for naught. An overly complex user-engagement will lead users to remaining on the mainnet, bogging down the network, keeping fees high, and transactions backlogged.

Economics Lead to Centralization

As described above - in order to use the lightning network, and then use your BTC again on the mainnet, it requires a Funding Transaction, and a Broadcast (or closing) Transaction. Each transaction requires a fee. Unless mainnet fees are greatly reduced, users will not be blindly opening up channels with one another. Further, there really is no incentive to do so.

If I wanted to purchase a pumpkin-spice latte from my local coffee shop, I might open up a payment channel with them, as I visit them often. Opening a channel with a funding transaction could potentially make economic sense if I frequently visit the coffee shop and make multiple purchases within a given period of time, say a month. However, I would still have to consider that the amount funded in the Funding Transaction will not be available to me on the BTC mainnet.

But what if that coffee shop isn't local? What if I want to purchase my basic pumpkin spice latte passing by some obscure town, like Middletown, New Jersey. Lightning would make NO sense. I wouldn't want to pay twice the fees, and wait twice the time, for the sake of using lightning.

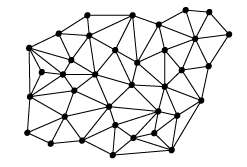

Ah! But wait a minute Mr. Fuzzi. You forget the point of the lightning network! You don't necessarily need to have an open channel with everyone, if there's a route on the network to that merchant. THIS, Mr. Fuzzi, is what the Lightning Network will look like:

A well-distributed Lightning Network will require substantial cooperation from the network users. It's akin to saying "Segways will definitely be the main method of transportation in cities once everyone agrees to buy them, stop driving cars, and shift the city's infrastructure to accommodate them." Possible, but unlikely. However, for argument's sake, let's take the above diagram as true and say there's a good distribution on the Lightning Network.

It is important to keep in mind that fees on the Lightning Network will be an open market. A third party will be able to set their fee structure to connect end-users who wish to transact with one another. Also of note, that third party needs to possess the necessary capital to process the transaction. If Alice and Bob do not have an open channel, and Alice wants to send Bob .5 BTC, they'll both need to be connected to a third party (or a series of 3rd parties). Say if Charles (the third party) only possesses .4 BTC in his respective payment channels with the other users, the transaction will not be able to go through that route. The longer the route, the more likely that a third party does not possess the requisite amount of BTC, thereby making it a useless connection.

However, what if a well-funded, third party exists. What if Alice, Bob, Charles, Danny, Eddy, Francis, and Gina are all connected to that third party? Not only will each route always possess the necessary capital, it will also be the shortest route. There will be no economic incentive for each user to open up new channels with each other. So, in practice, Lightning is more likely to look like this:

And, from my understanding, there's nothing preventing such large third parties from taking form. All the economic incentives of Lightning point to this exact scenario.

Further, such hubs will are likely to always be the shortest route, therefore, they can raise fees because longer routes will result in incrementally larger fees. The lightning network will be a hub and spoke network of bi-directional payment channels. Channels are connections between two nodes on the network, and a single transaction may travel through several channels. Nodes will charge you to use their channels, so you end up paying fees to multiple nodes.

If a route has three intermediary nodes, each intermediary requires a fee. If each fee is .5 satoshis (totalling 1.5 satoshis), the large hub can just set their fees at 1.4999 satoshis to compete. Also, they can provide further incentive to create the above-described scenario, such as covering mainnet Funding Transaction fees for all users.

Who Benefits?

Well this is pretty obvious. Whoever runs and operates the centralized hubs. I'm no rocket-scientist, but my intuition leads me to believe that Blockstream and/or Core will operate at-least some of these hubs.

For the reasons stated above, it is my opinion that the end-effect of the Lightning Network is nothing more than shifting fees away from miners and the mainnet, and - in effect - centralizing the network, creating Visa and Mastercard-like companies which operate Lightning hubs. Further, it is still not fully understood how 'trustless' these companies will be.

Further, there are some legal questions to consider. It's rather difficult to decipher to what extent this entire process will be license-free, as Blockstream possesses certain patents on the creation of sidechains.

Alt-Coin Solutions?

Many claim that nothing will replace Bitcoin. It's the first and the biggest. Everybody knows that the early bird gets the worm. But not everyone remembers that the early worm, gets eaten. Is Bitcoin the bird or the worm?

Fortunately, other projects have alternative solutions to scaling.

Obviously, there's Bitcoin Cash. BCH was this years first contentious fork. The ideology of Bitcoin Cash is simple, maintain Satoshi's vision and increase the block size. BCH has an 8MB block size, which greatly reduced fees - even when blocks surpassed 1MB. At this time, the average BCH fee for the last month was .17 cents.

Aslo, there's DASH (Disclaimer: I do hold more DASH than BTC). DASH employs a hybrid-system of Proof-of-Work (whereby transactions are mined by miners) and Proof-of-Service (similar to Proof-of-Stake, where Masternodes 'stake' 1000 DASH but also provide network services). Masternodes can instantly verify transactions on a masterblock. Not every use-case requires an instant verification, but this optional service makes DASH a viable option today to buy that pumpkin spice latte. DASH also has an optional privacy feature, albeit, rather limited to other privacy cryptocurrencies.

As far as blocks are concerned, DASH's D-A-O has agreed to incrementally test and increase the block-size from 2MB blocks through 400MB blocks. It's also funding research for dedicated hardware for miners and nodes to process increased volume.

At this time, the average DASH fee for the last month was .16 cents.

Another coin, IOTA (currenlty hold zero iota), isn't really a cryptocurrency in the sense that it doesn't run on a blockchain, but rather, a 'tangle' protocol.

I have limited understanding of its cons, but theoretically, IOTA has no fees and no limit to the amount of transactions per second which can be verified.

I'm hard pressed to find an advantage for LTC over BTC, let alone other alts, other than a reduced block time. Seems to me that LTC is moving in a very similar direction to BTC.

Conclusion

I think we can all agree on the following points:

- We would like mass adoption of cryptocurrencies

- Cryptocurrencies should remain as decentralized as possible

- The benefits of using Cryptocurrencies need to outweigh those of status-quo methods of payments.

This article DOES NOT state that there are NO FLAWS with big-blocks. However, I wanted to share my counterpoints to Lightning Network being the most viable method of scaling. Like the Segway, I don't believe its investors have fully fleshed out what effects implementing this network will have. It makes no economic sense for nodes to connect when they interact sparingly, therefore, there is little to no incentive for nodes to create a well distributed network. More importantly, there is a great economic incentive to use highly-centralized, well-capitalized hubs.

I'm truly concerned that one-side of the debate has wrongfully framed the debate and have cast themselves as possessing the moral high-ground, when - in fact - there are real economic motivators to implementing the Lightning Network. Fighting against and preventing even modest increases in the block size ensures that the plan comes to fruition.

To be fair, quite much of the complexity will probably be handled seamlessly by the software. I expect smart wallets to automatically establish and overfund a channel whenever paying to a lightning recipient, and distribute funds over lightning and mainnet using some "sane defaults". There will probably also be services available for converting lightning-funds to mainnet-funds instantly.

That said ... one of the points I like to make is that lightning isn't so different from an alt-coin. I don't see any reason why lightning should get more popular than any other altcoin. It's pretty much the same chicken-and-egg problem.

Does LTC LN work in the same way with the centralized hub? That is interesting DASH is experimenting with larger block sizes. Innovation should happen with alt-coins first. With alt-coins as the proving grounds bitcoin can establish itself as a trusted currency. 'Grandma' isn't going to trust bitcoin if she can't understand why there are 3 forks of it.

Re the grandma, in the end, there will be only one fork that is "bitcoin".

We're extremely fortunate that Roger Ver got control of Bitcoin.com and is making it clear which Bitcoin is the real Bitcoin.

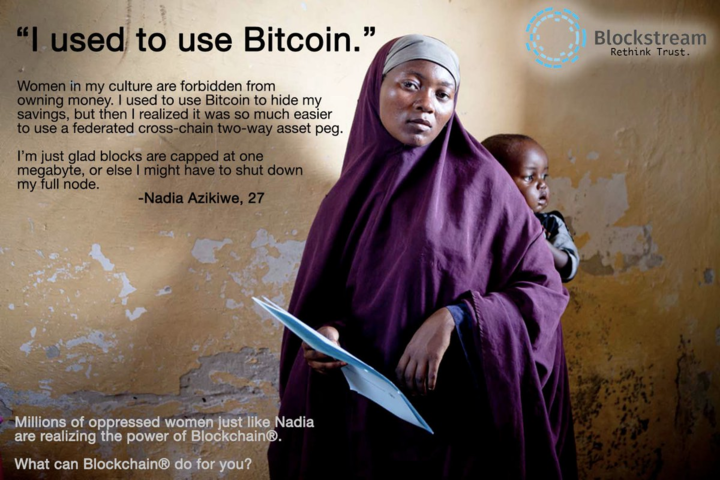

Nice article. Are those blockstream advertisements for serious? I find them both hilarious.

PS - Don't mind the haters. Lots of people are very emotionally invested in this debate and of all my decades witnessing IT people debate things with religious fervor...I've never seen the vitriol of the big/small block debate before.

I just have to say, this is a great article ! Obviously we all have are points of view, but this sums up most of them. Good job :)

Thank you, i appreciate it

Congratulations @fuzzi-logic! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @fuzzi-logic! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @fuzzi-logic! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPhttps://steemit.com/bitcoin/@d4amenace/quick-install-of-full-bitcoin-mainnet-eclair-lightning-network-node-on-pc-and-smartphone

Congratulations @fuzzi-logic! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Firstly you are a moron. Secondly you don't have r/btc moderation to protect you from me here. Third your argument is devoid of economic theory. Fourth it holds a tacit assumption:

That is not a founded economic argument and I wager you don't even realize what i mean by that.

Here is the logical counter argument, and no you didn't list it in your small blocker points, because you are unaware that it exists. You are unaware of the truth because r/btc mods have censored it.

Thank you for letting the posters there see this:

https://medium.com/@rextar4444/bitcoins-most-valuable-usecase-7f5c6e95be22

Bitcoin as a coffee money serves no valuable purpose and EVERY ACTIVE DEVELOPER AND EXPERT has said you will break it if you get your big blocker way.

Lastly, I have shown the most valueable usecase for the world is for bitcoin to arise as a high value settlement system. My argument is founded, tied to ACCEPTED economic theory.

You sir, are a moron. An idiot.

No need to resort to personal insults. You could very well promote your point of view without the opening and ending paragraphs.

They are facts not insults.

My point of view to use founded science not rhetoric.

Yea, no.

Not every active developer supports this - that's a mad statement.

Clearly, you can't form arguments on your own - and are just regurgitating Core/BS arguments.

And because you obviously get offended easily - and are quick to anger and insults, I'll keep this rather short....

YOU'RE ADVOCATING FOR THE SAME THING! JUST A DIFFERENT MANNER.

You're not arguing that people shouldn't use BTC to buy coffee - you're arguing for people to use virtual bitcoin IOUs, in the form of a 'child transaction' on the LN to buy coffee, and then settle it on the BTC mainnet.

My article just points out the problems with such networks.

What you linked is a means and methods to achieve buying a cup of coffee. Claiming using the mainnet - alone - to buy coffee will 'break' bitcoin.

We all agree we want to buy coffee with BTC - we're just arguing over how to achieve that. How do you not see that?

So my statement stands - For Bitcoin to succeed - it needs to outperform status-quo methods of payments.

You have zero understanding of economics and you have a loudmouthed opinion. You have no education on the manner.

You are the very definition of a moron.

On the 'matter' - genius