Does The Market Even Care If Your Crypto Can Scale? Well, Yes...Eventually.

One of the big reasons I bought in to Steem was I saw the "scaling" train coming down the tracks a long time ago. Most of my criticism on this front has been of Bitcoin, but that's only because that was the obvious flash-point for the biggest and worst problem. Steem had near-instantaneous transactions and no fees. It was the natural extreme opposite from the impending scaling problem in Bitcoin and Ethereum.

On numerous occasions this has gotten me attacked or wrongly flagged as some sort of "shill", and offenders even call Bitcoin Cash a garbage alt...as if we don't all know that the original garbage alt is Ripple! (It hits all the bullet points, centralized for banks, useless [not needed for transactions on network], insta-mined, etc.)

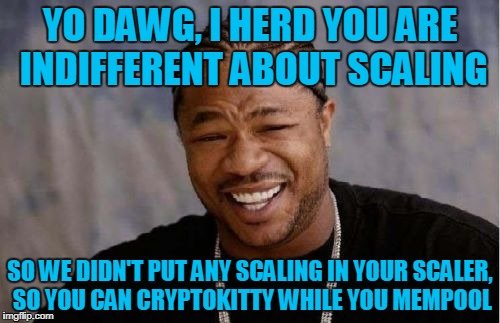

Now, thanks to people trading (mostly ugly) digital cat images on the Ethereum Network, it is not merely the top cryptocurrency but the top two (by market cap) which clearly have no ability to scale in their current form to handle any significant uptick in users.

Incidentally, this is probably why EOS has suddenly shot up from a bottom around .50 to a top around $13. Ditto for Bitcoin Cash from $200-$300 to a top of $5000.

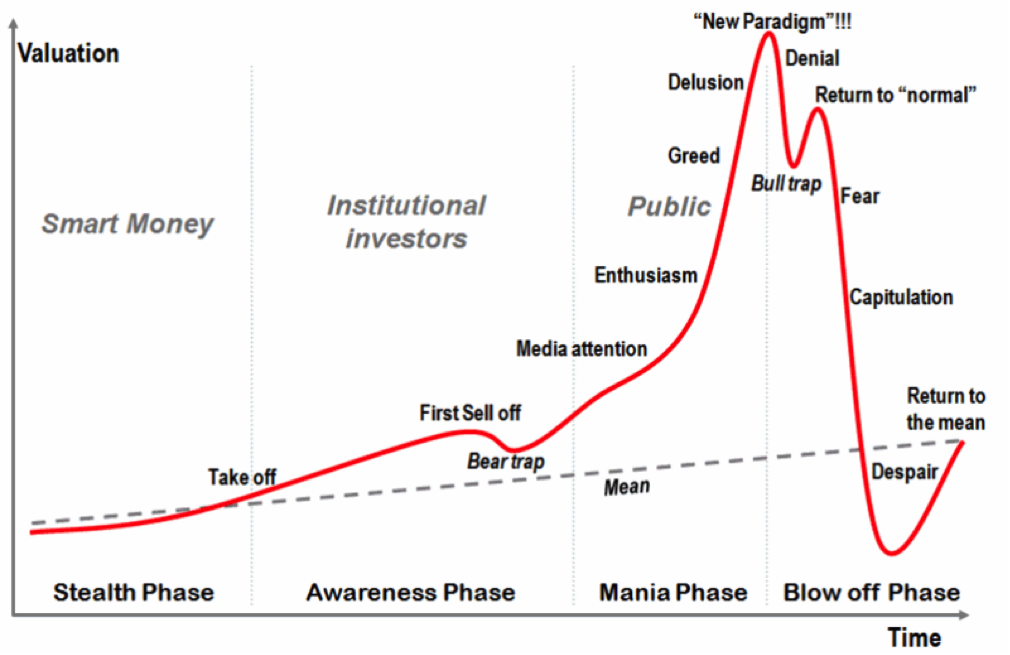

The truth is, the market does care about scaling, but only the early, smart money cares has cared so far. We've already passed the stealth phase, when Bitcoin Cash was $200-$300, and EOS was $0.50-$1. This is why we are seeing wild spikes in both currencies - "small" buyers by institutional standards can easily clear the order book on something like EOS.

I recommended EOS long ago for the same reason I recommended Bitcoin Cash long ago - the market was ignoring the scaling risk. It was not priced in. Bitcoin and Ethereum were well into the "Media Attention" phase, but EOS was still in the stealth phase. Now it has taken off:

Ethereum, or Bitcoin, don't even need to have a severe problem. The mere potential for one makes diversifying into these assets wise as institutional money flows into this sector over 2018, which means both EOS and BCH could be looking up.

(However, if atomic swaps change the scaling game in practice, all bets are off.)

The market can stomach a replacement for Ethereum more easily than one for Bitcoin. It's still in denial about that possibility (not inevitability, possibility) with Bitcoin and not fully pricing it in. If EOS is $100 in a year, we'll be saying the same thing about it, too.

You would be wise not to make the same mistake.

PS - Attention Fork Haters: I'll be discussing how Bitcoin and Bitcoin Cash can productively coexist in a near-future post, so feel free to take that into account before flaming/flagging/spamming me in Discord again. I know you've been hurt by Bitcoin Gold. I get it. I almost wrote an article about BTG being a potentially "hostile PR fork", so I do understand. I haven't done my due diligence on the later forks, but the only one I've seen that appears legitimate is Bitcoin Cash. This is not an endorsement of other or future forks. Sigh.

If you have any additions or errata for this post, please let me know! I will see that they are voted to the top of the comments, and will make the appropriate edits (if possible).

We also have a Radio Station! (click me)

...and a 5000+ active user Discord Chat Server! (click me)

Sources: Imgflip

Copyright: Xzibit, Coinmarketcap, https://www.cryptokitties.co/

I think Bitcoin will be always the king because the level of decentralization and security can never be reached by another coin, so wealth will always be stored in BTC. A combination of atomic swaps, Lightning network and other new innovation will solve the scaling issues for BTC and since BTC has the strongest fundament it will take back market shares from alts. ETH is a different story in my opinion and EOS can idd take over the leading position, because ETH has no properties that can not be implemented in another coin. Bitcoin cash rises are mostly pumps where weak moments for BTC get used, so I expect it only to do well for the short term.

"because the level of decentralization and security can never be reached by another coin"

Everything here is provably false. If you think Lightning Network "decentralizes" anything (lol), you have no idea what it even is.

"ETH has no properties that can not be implemented in another coin"

OK, so it's exactly like Bitcoin, then?

"Bitcoin cash rises are mostly pumps where weak moments for BTC get used"

Do you work for Blockstream on the side?

https://coinmarketcap.com/charts/#dominance-percentage ... at the 19th of December, for the second time in history, the market cap of btc fell to below 50%, and it continues falling.

I have problems understanding this "store of wealth"-usecase ... one would want to find some more stable asset for such a usecase, I believe the only usecase left for BTC is speculation. I call that the "tulip usecase".

"I believe the only usecase left for BTC is speculation. I call that the "tulip usecase"."

Heh, well-played.

In normal markets, your points would be salient. However, in this crazy, Wild West, California Gold Rush market, BTC might be "stable" enough (as in, it hasn't gone to 0 in 8 years) to be the "store of value" - at least for now. It's ultimate nature as highly deflationary certainly helps here, as does its lack of other real uses given the fees and transaction times.

BTC accidentally backed into the role of US$ (global reserve) for it's particular market...

Bitcoin is not decentralized. There are plenty of coins which are more decentralized, and some can even prevent centralization (which otherwise always happen in most coins).

Thank you. At least someone out there is paying attention. The poster you replied to is either highly ignorant, or a shill.

Either way, he is to be ignored.

The real issue is that no crypto currency by itself can handle a solid load they all have this flaw at the moment. While some can handle a lot more it still falls crazy short of what is needed for a truly globalized crypto currency that is used in day to day exchanges

Bitshares and Steem come pretty close tho...

Altho we have not even seen 5% yet of wat they are capable of,

and the tx is already better than eth/btc at that level

By far. Unfortunately, the pesky market seems to discount fundamentals far too often.

I kept wondering when this issue would come to the fore. Better to address it now than wait and have it used as a club to bash cryptocurrency to the general public later.

Indeed. I elucidated a similar view in my article on Bitcoin and Bitcoin Cash co-existing, with a possible use case for Bitcoin as a reserve asset (like gold.)

Some can handle near Visa size and still be decentralized. EOS is not released yet but will handle 1 million transactions per second. Steem can scale now to millions of users. A lot of investors don't realize Dash can handle on chain scaling currently to 10,000 per min. and has the ability to scale to 400mb blocks implementing specialized hardware for its paid nodes. The tech is here to scale to world but Investors have been over looking these problems

"Dash can handle on chain scaling currently to 10,000 per min"

Unfortunately, nobody wants Dash for anything except making their own Masternode.

Steem and EOS both either promise or deliver very hefty transaction loads. The issue with scaling Steem technically, if I understand it (and I may not), is the large amount of transactions are creating a larger and larger blockchain such that server RAM requirements become continually heftier.

very informative information.thanks for sharing

.gif)

I daresay this gif completely misses the point.

lol that's a funny gif x)

I agree, steem and bitshares are still undervalued despite the huge rally we just had. Graphene tech is a leader in the blockchain space. Steem should be ranked much much higher than 34th market cap. It could be the best opportunity in the crypto market!!

I thought the same when I first joined Steem, and clearly it's done well lately.

However, I am regularly disappointed at the market's inability to value these sorts of fundamentals. Bitshares, aside from having a tough interface, should be the exchange gold standard. Steem should be used for many more transactions than it is (account registration requirement aside).

You got a 9.00% upvote from @postpromoter courtesy of @lexiconical!

Interesting. I forgot that you make a lot of points in regards to crypto that really teaches me a few things. Litecoin..in regards to scale-ability and micro-transactions...What's your quick thoughts?

Sorry I'm getting to this so late...

Litecoin scales better than Bitcoin, but probably not enough to takeover. Atomic swaps may help. I think LTC looks good for awhile, yet.

I am a very strong believer in steem! I'm telling everyone I know on this planet about steemit and its potential! It is such a great and helpful community! I'm very proud and honored to be a part of the steemit community! Two thumbs up my Friends! )

We're glad to have another enthusiastic supporter such as yourself.

Good analysis and agree that the ability to scale is important.

Thank you for composing a comment salient to the discussion!

You're welcome and thank you for recognizing it so much after the fact... I hope you have a fantastic day :)

Where the F have you been?

I just posted an APB on you.

"One Adam 12, One Adam 12, be on the lookout for a man with a conscience."

I wrote this on another comment yesterday, but is fits for this post as well.

I recently watched an interview with Bitcoin Jesus. His beginning investment in Bitcoin was recently worth $342M! Believe it or not, he has sold it all out and moved it to Bitcoin Cash. Here is what he said about it:

"Bitcoin transactions are getting slower and unreliable. The costs to transact Bitcoin cash are only a penny as opposed $50 for a $10K BTC transaction. Bitcoin cash is made to scale. In the near future, Bitcoin will continue to do well as money comes into this market. Eventually though the market will choose and it choose something that is low cost to transact with and doesn't have slow transactions. At some point, Bitcoin cash will overtake Bitcoin as the market's choice."

Great post and l love the graph. Haven't seen this one before.

I definitely think Bitcoin Cash has a bright future. Whether it can overtake Bitcoin before an even faster alternative steps in is still up for debate!

Exactly!

That's quite a mouthful.

can you tell me what is the meaning of witness vote

The witnesses for Steemit are the block-producers. A little like miners in other currencies. Their servers secure the block-chain, so voting for trustworthy ones is crucial.

The Steem blockchain requires a set of people to create blocks and uses a consensus mechanism called delegated proof of stake, or DPOS. The community elects 'witnesses' to act as the network's block producers and governance body. There are 20 full-time witnesses, producing a block every 63-second round. A 21st position is shared by backup witnesses, who are scheduled proportionally to the amount of stake-weighted community approval they have. Witnesses are compensated with STEEM Power for each block they create.

Steemit leverages Steem because the founders of Steemit believe Steem’s decentralized text content storage and governance model makes Steem an excellent platform for supporting the long term success of its social network and digital currency tokens.

Well said.

" for supporting the long term success of its social network and digital currency tokens."

I wish they were a little more focused on the former than the latter.

Excellent explanation!

I just hear it but do not understand what is it..

Think of them as the server-hosts that run the block-chain.