It's Official: "Long Bitcoin" Is The Most Crowded Trade On Wall Street

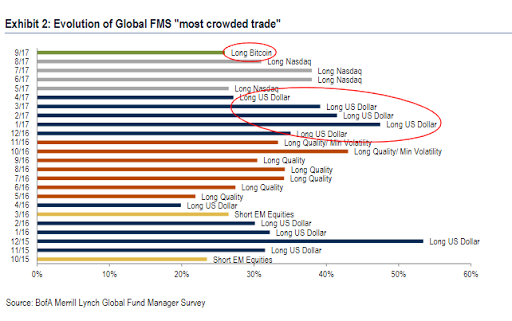

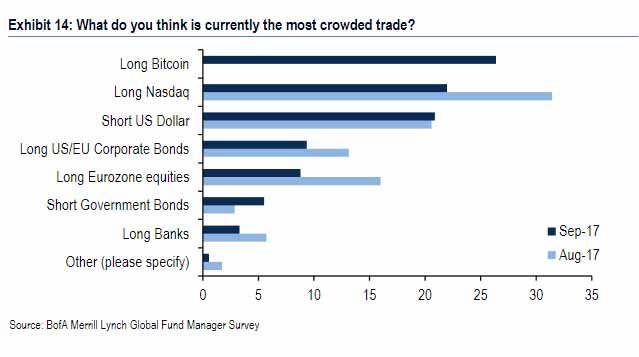

... at least according to BofA's latest, just released monthly Fund Managers Survey, in which 181 participants with $549bn in AUM responded to dozens of questions, among which "what do you think is the most crowded trade." In September, for the first time ever, the top answer, per 26% of respondents, was Bitcoin, (which as BofA handily reminds us was up as much as 344% YTD), #2 was "long Nasdaq" (up 20% YTD) according to 22% of fund managers, while the "Short US Dollars" (-11% YTD) was third at 21%. Note: long US$ was most crowded trade as recently as Mar'17.

Of course, this does not mean that everyone is long bitcoin; it just means that everyone thinks everyone else is long bitcoin...

Another notable change in September: "central bank policy mistake" is no longer the biggest tail risk - that honor now belongs to North Korea by some margin (34% of respondents) , followed by Fed/ECB policy mistake (21%) and Chinese Credit Tightening (15%).

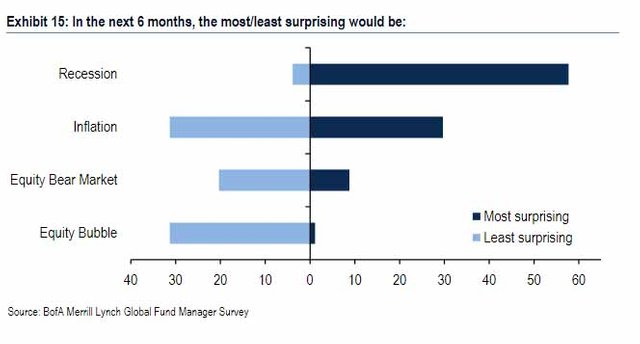

Looking ahead, the smartest people on Wall Street said that over the next 6 months, a recession would be the most surprising event (54% of respondents), while an equity bubble least surprising (net -30%).

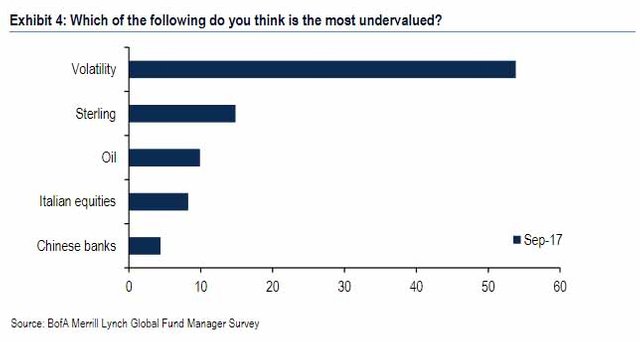

Finally, in terms of most over and undervalued assets, volatility was declared by far the most overvalued (54%), with sterling, oil, Italian equities and Chinese banks in distant 2nd through 5th slots.

Meanwhile, on macro, FMS growth optimism continues to sag (+62% in Jan to +25% today) but profit hopes rose a tad this month (+34%)…greater conviction in EPS than GDP; notable divergence in FMS perceptions of fiscal policy ("easy") vs. flatter yield curve shows US tax reform most obvious catalyst for steeper US curve.

What is also interesting is that "Mean reversion" has become a contrarian theme as investors cut expectation of higher bond yields: rotation back to QE themes of scarce "growth" & "yield" (e.g. EM), away from "value" (Japan, banks) as investors shun mean reversion, slash expectations for "much higher" bond yields (+26% last Nov to 5%); energy ("value") UW largest since Mar'16, utilities ("yield") UW smallest since Aug'16.

To summarize: most on Wall Street are short volatility even as they suspect everyone else of being long bitcoin (explaining the tepid performance by the hedge and mutual fund community), nobody expects a recession although most admit the equity market is a bubble, and most are hopeful that the economy will surprise to the upside even as earnings outperformance is taken for granted.

Good luck trading that.

Source : http://www.zerohedge.com/news/2017-09-12/its-official-long-bitcoin-most-crowded-trade-wall-street

Disclaimer : This is not the real Tyler Durden! I read ZeroHedge every day to find the one or two best articles and reformat them for Steemit. I appreciate the upvotes but consider following the account and resteeming the articles that you think deserve attention instead. Thank you! Head over to ZeroHedge.com for more news about cryptocurrency, politics and the economy.

Thanks for posting this. Very interesting stuff.

It is encouraging that they dont think there will be a recession although that could be the contrarian play...when everyone else is looking up, it goes down. The stock market is holding up in spite of calls the past few months for it to crash. It still could but the bull is holding on.

I find it funny that not everyone is long BTC, just everyone thinks everyone else is long it. At this point, I dont think much Wall Street money is in crypto yet. It is starting to filter in but is nowhere near the norm.

Finally, the money managers do not see BTC as overvalued it seems since it didnt appear on their list. Perhaps it just wasnt in the question.

If everybody in Wall Street were long BTC prices would be 50x what they are now. Bitcoin is a very limited asset. They all think the other people in the room are the suckers hahaha. Saludos Taskmaster!

It's a fact many hedge funds are long Bitcoin. It's a big reason it's up from under $1000 earlier this year

I agree it's not everyone but to say none are otherwise it would be 50x higher is just foolish. It's up 40,000.00 x since 2011

It is overvalued given a better crypto could easily take its market share lead.

Bitcoin at $200K....well that isnt the most outlandish projection delivered in the past couple months.

The more I analyze the potential here, the more I keep coming back to the same point: BTC has a lot of room to run. Store of value versus gold, money versus currency markets, app on a platform like FB and AMZN...total market cap versus other investements....it all leads to tremendous growth.

Unless, of course, it completely collapses which isnt likely.

BTC is utterly overvalued. Blockchain is utterly undervalued. BTC is nothing but a steam engine or better example; Internet Explorer. Hopefully we'd see at least some of that money invested in great products like Dash, NEM, Factom, MaidSafe, Monaco, NEO etc.

Cryptos are there to serve and fulfill the needs of people. It's not something to park your money wishing it to grow. We don't need digital gold. We need digital cash. We need DAO. We need decentralized services. Not something to park money to get rich.

Exazly ! Also bitcoin isn't a safe place to park things in a recession, it hasn't even existed in one yet. I support and hold bitcoin , that said Its crazy how blind so many are assuming it will not be replaced by a better crypto just because it was first. It will likely be the MySpace to a better Cryptos Facebook

Most of the top 100 cryptos are already better than BTC. Bitcoin was the minimum viable product. Check out Dash, NEM, PIVX or even Digibyte. They are all simply better. I only got into blockchain this year and I've never held any BTC for holding purposes. It has utterly weak fundamentals. BTC actually had negative adoption this year (https://www.dashforcenews.com/bitcoin-abc-lead-dev-2017-is-the-first-year-with-negative-bitcoin-merchant-adoption)

I should also mention that I only have contempt towards the BTC devs. Dash is heaven in comparison. Wall Street never bets smart. If they did we wouldn't have had a dot-com bubble or the housing bubble.

https://www.dashforcenews.com/scaling-ticking-time-bomb-blockchain-currencies-must-face/

I guess it all depends on where you live. I can use cash anywhere in my country. I can use my debit card anywhere in my country. I can use a CC anywhere in my country. My savings account gets about a -2% ROI assuming you believe the governments inflation data. The gold market is more manipulated than Caitlyn Jenner. Equities market at all time highs while the US president and Kim Jung crazier than his dad square off all just makes me nervous. Real money hasn't even began to flow into CRYPTO yet but it is coming!

Really insightful and interesting article. I almost spit out my coffee when I saw the chart on inflation and recession. It just goes to show how out of touch Wall Street is with main stream America. While it's not surprising, it's a healthy dose of reality to be reminded of the disconnect between real life and the world the speculators live in.

As for BTC, wherever gains can be made, the speculators will follow. If we don't see a substantial new ATH in BTC before the years up I'll be highly surprised.

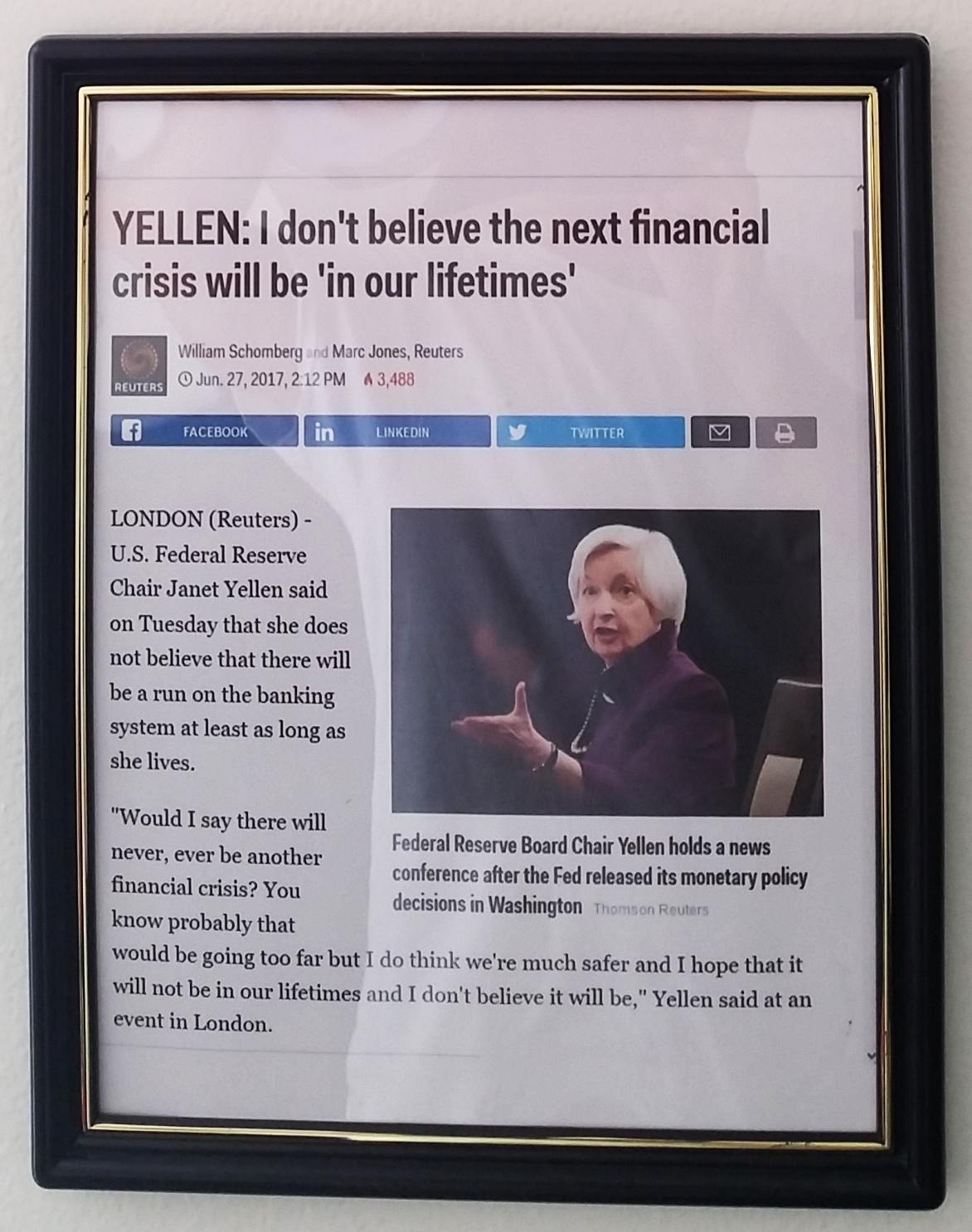

Sure, there won't be a recession, Yanet says so hahah. Markets are kind of predictable, it's always the same "this time is different" and "permanent plateau" just as we are about to hit one. I had this framed as a reminder:

Bitcoin is overvalued

It's just a fact. And I myself support bitcoin I'm not a hater. Do research people

Based on what metric? Seriously i honestly don't think there is a valuation metric that can be applied that take into consideration the fundamental differences in this investment vs any other the world has ever known. Not to be argumentative but i just started researching Bitcoin a few months ago when it hit the mid 2000's and haven't been able to stop calculating the possibilities of this new tech. Granted Bitcoin might not be the game leader 10 years from now. However it will undoubtedly be the safe haven asset in the next few years within the blockchain sphere. For better or worse Bitcoin is blockchain for the next few years and betting against blockchain is like betting against freedom.

That is why the price is so high, most are holding on coins

@zer0hedge Excellent... Motivating and it will make me joyful to check out effort and resolve prevail. Adore it. Upvoted.

Excellent... Motivating and it will make me joyful to check out effort and resolve prevail. Adore it. Upvoted.

@zer0hedge Excellent submit and very insightful. Have learnt a whole lot from it. Resteemed.

Really great completion of submit! Cherished the images and description. Resteemed.

@zer0hedge Amazing job! Followed.

Thank you for your work, I invite you to evaluate my work. Followed.

@zer0hedge This is awesome! Love it.

@zer0hedge Terrific write-up. Certainly This is often truth in each individual state. Upvoted.

Terrific write-up. Certainly This is often truth in each individual state. Upvoted.