China's 2nd Biggest Bitcoin Exchange Responds To Report Beijing Is Shutting All Virtual Exchanges

One day after Bitcoin crashed on a massive surge in volume, following a report in China's Caixin website that Chinese authorities plan to shut local Bitcoin exchanges....

... there is still far more confusion than clarity about what is really going on in China: so far there has been no official statement from either the PBOC or China's financial regulator, confirming or denying the report, which spooked millions of Chinese bitcoin (and ethereum and litecoin) holders into dumping their digital currencies. As a reminder, this is the gist of the Caixin report:

The central government’s office overseeing internet financial risks has ordered local authorities to shut down virtual exchanges trading digital currencies with the yuan, a source close to the office told Caixin. The order will affect major Bitcoin platforms such as OKCoin, Huobi and BTC China.

To be sure, it's not like a Chinese government bureaucracy to i) allow such a major leak and ii) not make a validating (or denying) statement over a day later.

The confusion was further exacerbated by the report's seeming contradictions, as in the same report that claimed Chinese Bitcoin exchanges would be halted, also said that the proposed regulation (which has yet to be unveiled) is not meant to be a crackdown on bitcoin itself or actual trading: "the source added that the crackdown targets unauthorized trading at virtual currency exchanges, rather than Bitcoin and the underlying blockchain technology."

So until we wait an official statement from Beijing, which risks the wrath of millions of bitcoin daytraders should it confirming the Caixin trial balloon, moments ago China's second biggest bitcoin exchange, BTC China issued the following statement in response to the Caixin report:

BTCChina Response to News Article On "Banning Bitcoin Exchanges"

We have received a large number of questions from customers following the publication of a news article by Caixin alleging that Chinese regulators would stop bitcoin trading.

Our response is as follows:

BTCChina operates in strict accordance with Chinese regulations. If the Caixin report is accurate, we will continue acting in strict accordance with regulators, and continue protecting the safety of customers' funds.

The Caixin report says that regulators have not said bitcoin itself is illegal, and have not decided to prohibit private, one-on-one bitcoin transactions. If the report is accurate, BTCChina will stop all BTC/CNY trading, and change its business model to become an information service provider for private, one-on-one digital asset trading.

Many people regard digital assets, of which bitcoin is the embodiment, as the necessary result of recent advances in internet technology and the largest scale practical application of blockchain technology. In additional, bitcoin's blockchain may have a far-reaching positive impact on the economy, becoming a foundational layer upon which other revolutionary software projects are based. We believe digital assets will have a far-reaching impact on the global economy.

BTCChina thanks you for your support, and will continue working to provide the best service for all customers.

BTCChina Saturday, September 9th, 2017

What is notable about BTC China's response, aside from its promise to pivot its business model should Caixin's report be accurate, is that it appears that there has yet to be any official confirmation. Could someone be using the highly respected financial outlet as a fake "trial balloon" to push the price of bitcoin lower and load up on the cheap before the PBOC denies the late Friday report? We should know the answer by Monday.

Meanwhile, it is worth noting that while China was once the world’s largest Bitcoin marketplace, accounting for nearly 90% of global trading, this was followed by a series of crackdowns and regulations.

To be sure, Chinese exchange problems with the central bank are nothing new: at the start of this year, the People’s Bank of China launched an investigation into major bitcoin exchanges including Huobi, BTC China and OKCoin, and issued warnings about possible risks on their platforms. In response, Huobi and OKCoin ended zero-fee trading and margin-trading services, which let customers borrow yuan or bitcoin from the exchanges to boost their bets. The exchanges also suspended bitcoin withdrawals, and only reactivated them about three months ago.

These moves ended China’s dominance of the global bitcoin market, as measured by trading volume. As a result, China’s share in bitcoin trading has slid to less than a third of global trading. The three largest exchanges, OKCoin, BTC China and Huobi, account for 60% of Bitcoin trading in the country.

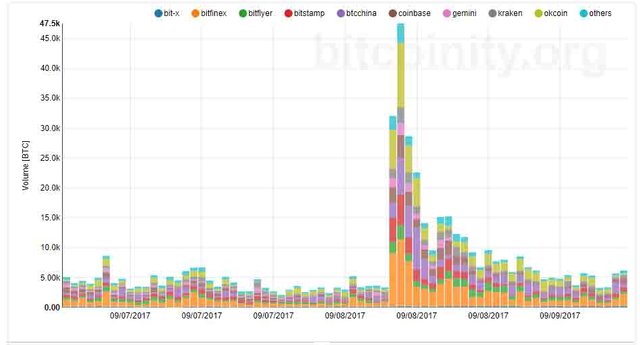

On Friday night, after the Caixin news, Bitcoin value traded at Huobi and BTC China declined nearly 20% to around 23,000 yuan. Bitfinex remains the most active and popular bitcoin exchange in the world.

Source : http://www.zerohedge.com/news/2017-09-09/chinas-2nd-biggest-bitcoin-exchange-responds-report-beijing-shutting-all-virtual-exc

Disclaimer : This is not the real Tyler Durden! I read ZeroHedge every day to find the one or two best articles and reformat them for Steemit. I appreciate the upvotes but consider following the account and resteeming the articles that you think deserve attention instead. Thank you! Head over to ZeroHedge.com for more news about cryptocurrency, politics and the economy.

Let them close the exchanges, that will only push decentralised exchanges further. Governments need to stop trying to centralised crypto and regulate it, Because they never will. This is a war.

Exactly, either the innovation will increase and/or other countries will take the lead of having the biggest volume like South Korea. China is way to heavy in control of a lot of cryptocurrencies by mining or just investing. This whole ban will give every other country the chance to have a bigger impact, which will increase decentralisation .

Well honestly I don't think a majority of people care anymore lol. China use to be the major holder but now only make up about 30% of the entire crypto trading. So if they want to ban etc shame on them.

Well everything crashed because of those rumours and people care about their investment. People lost a lot of money. But yeah, it is good to have a shift in trading volume here. Let they shoot themselfs in their own leg.

Thanks for the article... And I agree, let the natural market figure itself out..

thank for sharing

Ilike it