Bitcoin Vs Fiat Currency: Which Fails First?

Content adapted from this Zerohedge.com article : Source

Authored by Charles Hugh Smith via OfTwoMinds blog,

What if bitcoin is a reflection of trust in the future value of fiat currencies?

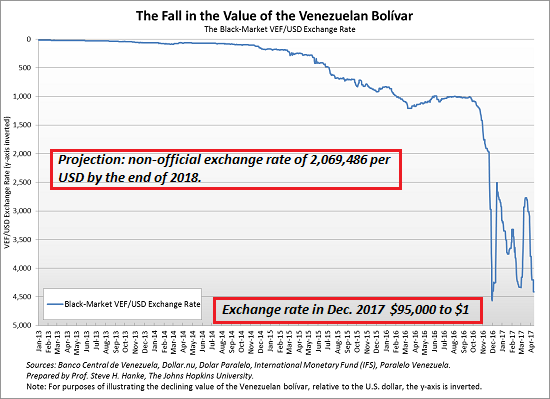

I am struck by the mainstream confidence that bitcoin is a fraud/fad that will soon collapse, while central bank fiat currencies are presumed to be rock-solid and without risk. Those with supreme confidence in fiat currencies might want to look at a chart of Venezuela's fiat currency, which has declined from 10 to the US dollar in 2012 to 5,000 to the USD earlier this year to a current value in December 2017 of between 90,000 and 100,000 to $1:

Exchange Rate in Venezuela: _ _

_On 1 December, the bolivar traded in the parallel market at 103,024 VED per USD, a stunning 59.9% depreciation from the same day last month. _

_Analysts participating in the LatinFocus Consensus Forecast expect the parallel dollar to remain under severe pressure next year. They project a non-official exchange rate of 2,069,486 VEF per USD by the end of 2018. In 2019, the panel sees the non-official exchange rate trading at 2,725,000 VEF per USD. _

If this is your idea of rock solid, I'll take my chances with bitcoin, which currently buys more than 1 billion bolivars. Of course "it can't happen here," which is precisely what the good people of Venezuela thought a decade ago.

Gordon Long and I discuss Fiat Currency Failure (The Results of Financialization - Part IV) in a new 31-minute video. The bottom line is that fiat currencies are debt-based claims on future profits, energy production and wages, claims that are expanding far faster than the real economy and the productivity of the real economy.

In effect, fiat currencies and debt are like inverted pyramids resting on a small base of actual collateral.

If you look at the foundations of fiat currencies, you find loose sand, not bedrock. Massive mountains of phantom wealth have been created by central-bank inflated bubbles, bubbles based not on actual expansion of net income earned from producing goods and services, but on financialization, the pyramiding of debt and leverage on a small base of real assets.

"Free money" that accrues interest isn't free. Eventually the interest eats debtors alive, regardless of the debtor's size or supposed wealth.

Creating "free money" in unlimited quantities impoverishes everyone who holds the currency. In the initial boost phase, the issuance of "nearly free money" to borrowers, qualified or not, generates the illusion of prosperity. But once the boost phase ends, reality sets in and marginal borrowers default, inflation moves from assets (good inflation) to real-world essentials (bad inflation), and creating more "free money" ceases to be the solution and becomes the problem.

Yes, cryptocurrencies are risky--but so are fiat currencies. Illusory "wealth" evaporates, and expanding credit-based "risk-free money" at rates that exceed the rate of expansion of the real economy reduces the purchasing power of all those holding the currency. Eventually trust in the currency, and in the authorities who control its issuance, erodes, and a self-reinforcing feedback loop turns the rock-solid currency into sand.

What if bitcoin is a reflection of trust in the future value of fiat currencies? Those dismissing bitcoin as a fad might be missing the point: trust in the authorities who control the expansion of fiat currencies might be eroding fast in a certain segment of the populace.

And more importantly, they might be right, and everyone who placed their trust in the authorities who control the expansion of fiat currencies ends up holding a handful of sand.

I'm offering my new book Money and Work Unchained at a 10% discount ($8.95 for the Kindle ebook and $18 for the print edition) through December, after which the price goes up to retail ($9.95 and $20). Read the first section for free in PDF format.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

I am currently in South Africa and I would say the probablilty of the ZAR collapsing is very high. C

urrency vs fiat might be a more difficult question in the first world, its an easy question here.... Bitcoin for the win!

We know what's going on, the fiat currency goes into history.

The dollar and all other currencies have no coverage in gold and real value. Money is printed as needed and the main characters (super-banks) determine the value based on their needs. Inflation is emerging with new money printing, etc. 40% Bitcoin is owned by 1000 People (

you wrote that yesterday @zer0hedge ), they keep money and control future development. But they are not the only factor in the value of Bitcoin, everyone begins to believe in him as if he is a small God.

The goal is to replace paper called money,

This requires people to believe in the growth of Bitcoin and other electronic currencies. Now there are over 30 million users, decentralization, money owned by the people - the goal is total control behind which powerful people are. Banks will collapse, it's an illusion, it will only replace its role, instead of money it will have Bitcoin, I hope that it will insert both Steem and SBD - that's great for us.

Now is the great time to invest in bitcoin, its value will go to the star. At one point, I'm thinking of selling 50% and buying real things (buildings, land, etc.). I believe more in Bitcoin than in paper money - it goes to the landfill of history.

There is no good sample or basis for comparison. Fiat money was introduced 1000 AD and dominated / dominates totally 20th century. I really believe that 21st century belongs to blockchain technology but fiat money can also use blockchain becomeing digital fiat money. So it will be interesting to see how things change.

What a time to be alive, huh :)

What is money? basically

So, waiting for future evolutions, this bitcoin can't be considered an efficient money. It is simply the first of a new asset-class and a laboratory for the developement of blockchain. But no, at the moment it isn't the new world free money

Dollar for example exist only because people so far trust this worthless paper. Why? Well $1 dollar bill have writen "in good we trust". Then signature by treasure secretary...Meanwhile they printing it like crazy. Also US can not pay his debt. Bitcoin on the other hand is evolution of money.

If Bitcoin loses the race to be mainstream adoptable, it will go the same way as the fiat currencies since it won't establish anything more than insignificant utility value. A store of value is built upon widespread use as a currency and by maintaining purchasing power over an extended period. Proclaiming Bitcoin to be a store of value right now is nonsense, borderline delusional behavior to justify entry into an extremely overpriced market, drawn by the promise of easy profit.

Which fiat currency performes best so far against Bitcoin? Swiss Frank? Czech koruna?

Trust is the reason why people do business. If we can't trust money as the medium of exchange for the value it represents, then we need to come up with a better way of solving inflation-based global economics. The surge of global interest in bitcoin is just at its nascent stage. Looking forward to see how things are going to unfold on the macro scale.

i think bicoin is the frist dear @zer0hedge thanx you so much for your helpful #news . & upvote & resteem Done .

i watch this contant dear. nice sharing @zer0hedge . @resteemed this post