Bitcoin Bounces Hard But Cryptocarnage Remains

Content adapted from this Zerohedge.com article : Source

by Tyler Durden

Update 0815ET: Just as we saw at yesterday's US stock market close, dip-buyers just stepped in to Bitcoin in a significant way, lifting the crypto currency over $1000 off the lows and back above $8000...

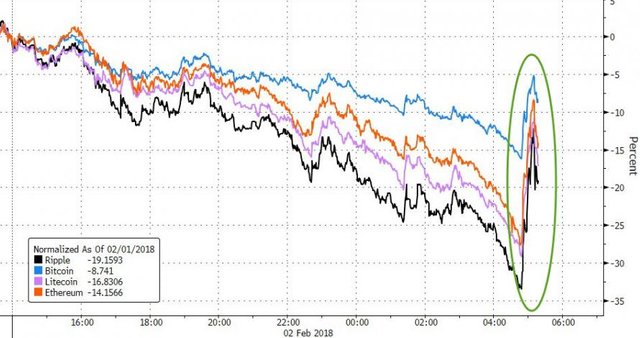

But the carnage remains... for now...

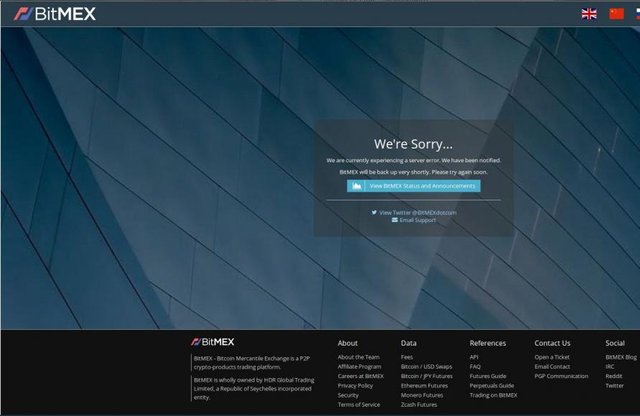

Notably, another exchange - BitMEX is down...

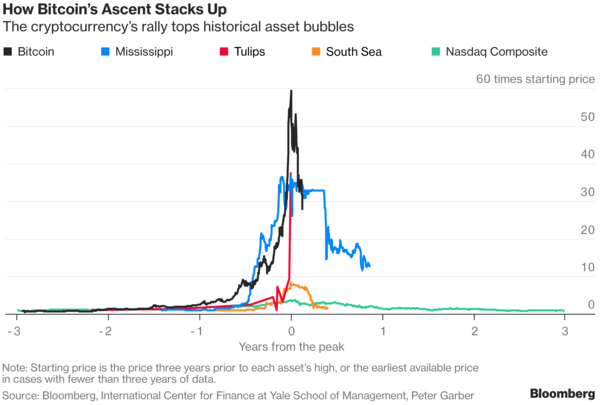

It seemed like just yesterday that every cryptocurrency bloodbath would be promptly bought, often sending the price of bitcoin and its peers to new record highs. Those days appear to be over, at least for now.

So far this year, cryptocurrencies have been beset with bad news: Bitfinex, by some accounts the world's largest exchange, was recently subpoenaed by the CFTC, along with Tether, a separate corporate entity that involves many of the same people from Bitfinex, as questions mount about the authenticity of its tether token. Tethers, which are widely used by crypto traders to quickly move in and out of different crypto pairs, are supposed to be backed by dollars, with one tether = one dollar. But Tether's decision to fire its auditor appears to validate the concerns of the exchange's critics.

Raising fears about another massive, Mt. Gox-like hack, Coincheck, a mid-sized Japanese exchange, reported this month that it suffered "the biggest crypto theft in its history" when hackers made off with $400 million worth of NEM tokens. On Friday, Bloomberg reported that Japan's Financial Services Agency raided Coincheck's offices a week after the hack, hauling out documents and computers as evidence.

The inspection was conducted to ensure security for users, Finance Minister Taro Aso said. On Friday morning, 10 FSA officials entered Coincheck's premises to gain a better understanding of how the exchange is operating in light of the regulator's business improvement order imposed earlier this week, an agency official told reporters in Tokyo. The exchange has until Feb. 13 to produce a report detailing the causes of the incident.

And as if the threat of cybertheft wasn't enough to scare off the marginal buyer, the threat of regulators trying to ban crypto - much like China did - has become a major concern. Regulators in India said explicitly declared yesterday that bitcoin is not legal tender and said it would take "all measures to eliminate their use," foreshadowing a coming crackdown in a market that many hoped would one day grow to one of bitcoin's largest. After a weekslong will-they-won't-they back and forth, South Korea's Ministry of Justice announced revealed that it had abandoned a proposal to ban crypto outright, but instead seek to regulate it, requiring exchanges to obtain details about customer identities.

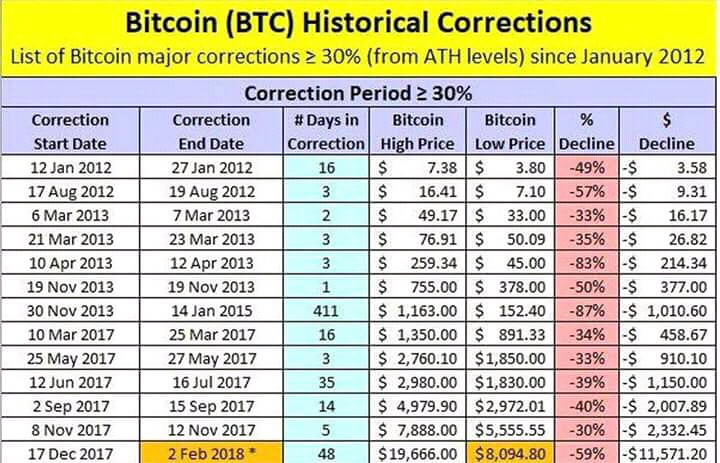

After bitcoin's worst month in years, it dipped below $8,000 Friday morning in the US to levels it hasn't seen since November while Ethereum, Ripple and Litecoin all took double-digit beatings.

Meanwhile, as Bloomberg points out, bitcoin's rough month was even worse in South Korea. As of Friday morning ET, bitcoin has dropped more than 60% from its January high in Korea as South Korea struggles with how to prevent money laundering and tax evasion without throttling the ecosystem.

The selloff has many Korea traders fearing the worst.

"The bubble in cryptocurrencies has burst" in Korea, said Yeol-mae Kim, an analyst at Eugene Investment & Securities Co. in Seoul. Because of the intense demand from retail buyers, bitcoin trades at what's called "the kimchi premium" on SK exchanges. In January, the premium stretched to its widest level on record when bitcoin traded at $22,525 in Korea, $7,500 higher than the composite price at the time.

Great post @zer0hedge.

Regulators cannot ban cryptocurrency. It's like putting a 1 panel fence in the middle of the street: people will simply find a way around this fence just like they will find a way around this "ban". This leads me to question the loyalty of these governments. Do they operate in their own interest, or do they operate in the interest of the people?

Let's look at the news. We've seen issues in South Korea, Japan, India, USA, and other countries. The media has been spreading misinformation for weeks on end. Don't believe me? Look at CNBC. They're literally promoting garbage. They bring on people who have absolutely no idea about cryptocurrency. Because of this, it's contributing to the growing amount of people in this space who think they know something but don't know anything. In order to fully understand this space, you need a tech background and a Finance background.

The Finance background helps you speculate on valuation and economics/tokenomics. The technology helps you understand the why and how.

When the internet was in its infancy, people had similar arguments about it[the internet] when compared to bitcoin and some cryptocurrencies.

We're going to be fine.

I agree with this completely. This is something that I laugh at each time I hear it. How can they? Sure they can try to do it in their country, and in the more tyrannical nations, it might work. But in most other countries, unless all decide to do it, people will have access to them as long as they have access to the internet.

With decentralized exchanges starting to come online, it is going to make it impossible to be able to stop.

I took this opportunity to add a few more to my Bitshares account.

We are most likely getting near a bottom. Weaker hands have been flushed out. There might be another moves down, but I dont think it will be too far (at least I hope not).

Cryptocurrencies are very volatile and I think most are just getting use to that. Most people are accustomed to the stock market where 30% moves in a 24 hour period means something is seriously wrong. In the crypto world, this is normal.

We can also see 20% moves upward in a heartbeat too.

That is the market we are in. With so few traders and such a small market cap, things are going to move in big ways. Find good projects and buy the dips. It really is that simple.

Adding to quality positions will only enhance your returns when the markets turn around.

Look at some of the blockchains and what is going on during this recent collapse...

BTC is starting to implement lightning.

LTC and FB might be nearing a deal.

ETH is solving some of its traffic problems.

STEEM keeps steemin.

Those are just a few off the top of my head...yet the prices are being driven down.

Purely FUD.

I just hope that this crash will kill the shitcoins .

We already saw bitconnect and davor coin get the hammer and allow the coins that actually have utility to grow like vechain , Icx , Eos , Steem , SBD. Because right now, there are tons of shitcoins around.One thing I noticed was that among the alts, the mined coins were holding their value better than the premined/nomine tokens. Imo crash will actually be healthier for crypto in the medium to longer term. The pumps and dumps are spoken of quite openly by people trading. Shit, I see where people are actually using P&D as their investment strategy.

I'm thinking BTC again sells off to $6k and LTC to $80 while futures expire mid February.

Thank you for sharing your intelligent opinion, Sir

But for me there are other factors, it's the correct rectification for you eliminated the past 5 years

In addition to the news of India and the superiority of this China

Bitcoin is sick and does not die. Do not worry about the news of the disabled, the classics in the old financial system

They are fighting for the survival of the old regime

If you sell a share of bitcoin now you will regret it a lot after months you recieve this

Greetings to you a very exclusive exclusive topic.

@zer0hedge

This is a chance for me to have a lot of traders who have recently joined me in trading my Tnnip knowledge

Thank you for sharing your amazing ideas

The support seems to be in place to keep prices above $ 7500 barrier, although commentators point to a near-$ 7,000 decline before a reversal occurs.

Bittcoin's losses have also triggered secondary implications for alternative currencies across the top 100 as followed by "https://coinmarketcap.com", where the vast majority has lost at least 50 percent in the past 24 hours more than bitcoin itself.

Overall, digital currency markets have retreated more than $ 100 billion from their combined market value since yesterday, February 1.

While markets appeared not to be interested in South Korea's "know-your-customer" legislation, which will enter into force this week, comments on Indian Finance Minister's legislation in a budget speech on February 1 were causing the losses to accelerate.

Although local stock exchanges reported that the words of Finance Minister Aaron Gaitley did not include any new information on how legislators would deal with this area, both journalists and mainstream media announced a "ban" on bitcoin in India after the speech.

This has had a significant impact on circulation, although there has been repeated assertion that there is no explicit prohibition planning in the area.

This is why people who are not experts, or who don’t religiously do their homework, should not really trade stocks. People complain about paying brokers’ fees, but they are paying them to do the work of keeping up with all this stuff with an educated eye.

@zer0hedge... it wasn't a fraud back then. The pump from $100 to $1000 was fraudulent (fake money on the Mt. Gox exchange). The pump from $200 to $2000 was legitimate. The pump that happened after that was not, being caused by massive cross-exchange fraud facilitated by Tether. I would not be surprised to see it fall to $2000, and then never recover because BTC has been hijacked and has no fundamental use case any more, with some other, better crypto taking its place and legitimately pumping over the course of years based on real adoption.Tether being fraudulent isn't any different from any other alt-coin being fraudulent and doesn't reflect on the integrity of the bitcoin ledger.Curious how you no longer harp on about Bitcoin transaction fees now that they are on their way down and lightning network is being implemented.Bitcoin will always be the first and most pure cryptocurrency because it was released before people knew it had any value. No other coin can ever claim that for the duration of eternity. You can't change history..thank you for sharing with us..

a very interesting post

a very good post

Just like the highs at 30, 100, 1000, 10000, 20000.

Every time, big retrace.

All the FUDsters come out and chatter about the "end of Bitcoin" and how its going down to another new low, or zero. Then, it fails to materialize, and all of the idiots look at each other and wonder why it happened. Many commenters may have their moments of lucidity, but this isn't one of them.

Please, do go on.

See you at the next all-time high.