A Look At Who Owns Bitcoin, And Why

Content adapted from this Zerohedge.com article : Source

by Tyler Durden

Bitcoin's tepid performance since the beginning of the year - it has largely consolidated around $10,000, down 50% from its all-time peak - has left cryptocurrency evangelists with egg on their face.

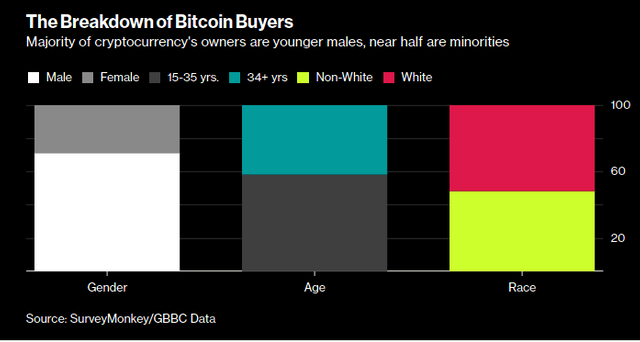

But who exactly owns bitcoin? While nearly 60% of Americans say they've heard of it, only 5% of people own bitcoin, according to Bloomberg.

At least that's what a joint study by SurveyMonkey and Global Blockchain Business Council determined... And within that group, demographics are fairly consistent. An overwhelming 71% of them are male. The majority - 58% - are young, between the ages of 18 and 34 years old.

And unlike the broader US population, nearly half of them are minorities.

When asked why they bought the crypto asset, investors answered that a combination of a lack of trust and an opportunity for return are at play. About one-third of Bitcoin owners said it was a means to avoid government regulation - 24% also said they trust Bitcoin more than the US government in a separate question - and about two in 10 saw it as a hedge against crashes in traditional assets. More than 60% also said that buying the digital coin was seen as a growth investment.

Studies like this show how small the whole market still is. We are just at the very beginning and still far away from Bitcoin being at the peak of a bubble. Whenever 50% of people own Bitcoin, then one can start to worry ;)

It makes sense that many young people own Bitcoin. In an age where you can find so much dirt about governments on the internet, it only makes SENSE that young people would immediately jump towards alternative opportunities.

You're investing in something that NO government can control. I said CONTROL. Let's be frank for a second: young people do not like control. Why not invest in cryptocurrencies?

Performance wise, we've seen what crypto can do. Sure BTC is down 50% from it's ATH, but bears never mentioned that we're STILL up over 1000% in the past YEAR. What stock has out performed that? What real-estate portfolio has out performed that?

Most people have preliminary information about Bitcoin

Through a global payment system, such as their counterparts in paper currencies, such as dollars, euros and sterling. It is distinguished from any currency in the world that it relies on encryption and does not have a serial number. It is not controlled by governments and central banks. It is handled directly via users and through the Internet. The story of Bitcoin started when a Japanese named Satoshi Nakamoto This name is said to be the umbrella of a group of people or companies hiding under the creation of the digital currency, believing that the time has come to keep pace with the technical progress that is dependent on the Internet, not just technology, in all walks of life. The digital currency was created on the ground in 2007, while August 2008 was the year of the real launch, after the launch of a site called Bitcoin.org to be the official domain, and the launch of the first version of the currency, which was actually in early 2009.

The exchange rate of the first issue of bitcoin was $ 1309 per btc. The Bitcoin Stock Exchange was launched in February 2010, which witnessed the first real trading of the currency, according to the stock market legislation, but the market forces pushed to reduce the price of the traded form to close to $ 25, accompanied by the jargon of some traders, as the exchange rate for the purchase of a pizza of large pieces, while the size of the market traded by 10 thousand composition, while aiming Nakamoto founder of the currency to the issuance of 21 million bitcoin only.

Thank you for the valuable information

I loved this very much. @zer0hedge

People all over the world are investing here but some countries government ban cryptocurrency in their country.

I also don't think it's impossible to say that it's a combination of a ton of different factors. Trust, regulation, hedging against economic downturns, and pure speculation are all great reasons and not necessarily mutually exclusive either.

I also think so bro.

You're right, it is a combination of different aspects. For me, the price attracted me, and the technology got me to stay. I've never been this hungry for knowledge in my entire life. I'm so thankful for Bitcoin. Without Bitcoin, many of us would have never heard of steem and steemit!

you can say that again!!!

Thanks for the info! About what I had expected..

It makes sense that the ostracized are the ones buying it. Bitcoin offered opportunities to those who were shunned before. Wall Street requires money and most people do not have that. Initially, the outcasts and anarchists could get involved for little money. Now those people are millionaires.

Over time, we will see more of this as crypto spreads. On here, I bet a lot of the holders of STEEM are not in the traditional model of Wall Street. There are a lot of women on here plus many from third world nations.

This is what is starting to make STEEM one of the best communities on the net.

An end of allll ends to poverty baby !! I remember your post about this awhile back

The digital currency "bitcoin" is still operating in many countries of the world, after it registered a rise in trading last year, and recorded with it a continuous increase in price, spread and growth in the number of users, which has caught the attention of international stock exchanges, and many investors , Financial trading houses, the media, social networking sites and news agencies.

The future is "bitcoin", especially since many international banks are still looking at it cautiously, and many experts are afraid to deal with them, and alert to wait before approaching the arena of trading in these "mysterious funds", warning that the sudden rise, threatening to fall sudden.

But digital bores will force themselves

Thank you for the valuable participation. @zer0hedge

Yeah bitcoin price just increased recordly last year.

OpenSSL is also open source but it got the Heartbleed vulnerability discovered among the other CVEs they are constantly fixing.

"Thermo-rectal cryptoanalysis" how we call it in Russia - a few bad guys put a soldering iron into someone's anus and ask questions. Helps to get various passwords and keys very quickly. I heard that number of similar crimes around crypto-miners/holders increases, therefore please be careful in your non-digital life boy . @zer0hedge

Without a monopoly on currency, the fiat world order is dead. When Bitcoin entered and became more of a threat as a currency rather than an asset, the banking system needed a way to discredit the threat to their system. They figured it out: inject price instability. I read a piece about Stripe no longer accepting Btc because the price fluctuations wreak havoc on profitability, among other things. The banking system wins again. They don't care if there's another asset to be traded called Bitcoin. They only care that there is no alternative currency called Bitcoin.

Same thing with the recent announcement that solar panels are being slapped with a tariff. Of all the products upon which to assess the fee, they choose one that is blossoming into a genuine alternative to petroleum. There shall be no alternatives to the petro-dollar. It's not a bullet to the heart of the solar industry, but it is a good knife-wound. It removes the incentive for most people to make the switch to home-generated energy

Yeah I agree that without a monopoly on currency, the fiat world order is dead.

"I have not seen any product up to now with such a steep graph, but Bitcoin is following the steepest path I've ever seen in my career," Roach said, noting that Bitcoin is the hardest moving financial product he has seen up to now.

Bitcoin, which has gained more than 11 kattan since the beginning of the year, ran to the limit of 12 thousand dollars. The crypto currency, which has been experiencing very hard ups and downs in the recent period, continues its record series against all warnings.