What's happening in Bitcoin?

Fundamental Analysis

So much has been going on around bitcoin this week against thoughts that the outbreak of the Coronavirus in Hubei province would negatively affect the price. That has played a part, but it is nothing as heavy as we expected at a time when the death tolls form the deadly airborne virus hits 722; a record high in the history of airborne diseases in the region. As bitcoin keeps gaining traction, promoting cryptocurrency in China has become very difficult. Coindesk's reporter David Pan reported a live situation in which Jason Wo, CEO and Founder of non-custodial crypto lending platform, Definer, had to cancel meetings because residents refused to leave their homes for fear of contracting the dreaded virus.

Bitcoin also reached a new milestone a couple of days ago ahead its halving in may when the total number of transaction processed on the network surpassed a billion. Reports credit this reemerging trend to the current bitcoin price which is nearing the $10,000 mark. After the halving, which is due in May, miners will start to earn half of their present rewards for mining BTC. So after the halving, miners will get 6.25 BTC per successful block mined instead of the current 12.50 BTC. There are still strong predictions in favor of a wild bullish run that might see the price of bitcoin going above its all-time December 2017 high of $22,000. We shall talk more on that shortly.

A couple of days back, Twitter's CEO Jack Dorsey added the bitcoin emoji to his official twitter handle. That doesn't come as a surprise because he didn't stop there. Forbes reporter Billy Bambrough in a recent article revealed an insider plan by Twitter CEO to bring 1.2 billion people into bitcoin given his statement about the potentials for digital currency in Africa. Also, in what seemed like the weakest side of an argument there are predictions that bitcoin will gain wide adoption if presidential candidate, Andrew Yang, emerges as president of the United States in the forthcoming election. Interim president of the United States, Donald Trump has also released his token, the Trump Token giving his approval of trades in cryptocurrencies. By doing this, Trump may be sending signals or affirmation to popular media parodies describing hims as erratic. The good thing though is that President Trump's step has a positive impact on bitcoin since SEC advertised to sell about $200 million worth of confiscated bitcoin a couple of days ago.

Technical Analysis

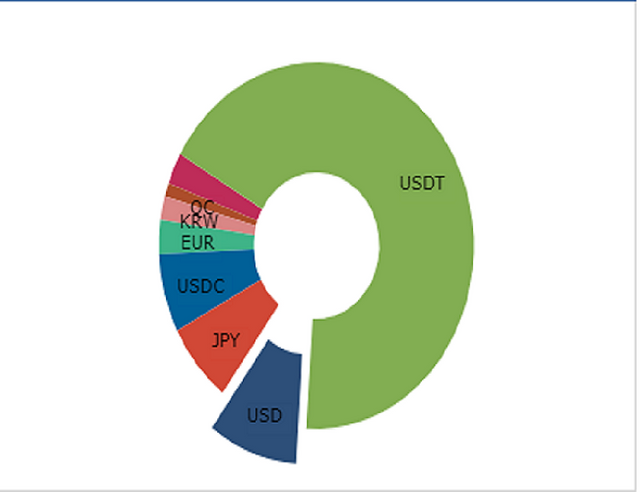

Monthly Volume

So far, the USDT/BTC pair is leading by volume with about 67.67% of the monthly exchange. It is followed by the USd/BTC pair, which only supports our earlier suggestion that there are increasing cryptocurrency transactions in the richest nation on the Planet. The BTC/JPY pair is next with 7.11% of the monthly market volume. The Japanese have been ardent supporters of cryptocurrency since it was founded, treating the digital gold as some sort of fiat currency and acceptable legal tender. Amazon Japan currently accepts payments in bitcoin, thumbs up to the Asian Tigers.

Weekly Candlestick Chart

Overall, the bitcoin market is still on a bullish trend with a key support level of $9,122 on the weekly chart, and a resistance of $9,823. The appearance of the hammer on this chart goes a long way to tell us that the up trend might continue. In fact, bitcoin might break the $10,000 dollar mark anytime soon. You can see the upward reversal in the weekly chart below.

Monthly Candlestick Chart

The key support level here is $9,808 and the bullish rally seems to be stronger than ever, hitting higher floors, and higher ceilings. The monthly support level is a deep of $7,743, which is almost insignificant given the current trend on the BTC charts, but long term traders may want to watch out for this to set clear exit points in the coming 30 days.

Moving Average Convergence Divergence (MACD)

Looking at the weekly MACD technical indicator, this might be the right time for doubters to enter the market. There is a strong by signal in the candle stick chart below indicated by the crossing of the Above signal. See blue arrow in the chart below for details.

200/50 Day Moving Averages

A bit longer, but these are some of the best indicators and what we see on the chart tells us more about which decision to make. The length of time though, might make this more helpful for long term and monthly traders than it would be for daily swing traders. Here, the 50 MA is above the 200 MA, again confirming the up trend. A look at the candle stick cart below offers more insight into what is going on right now.

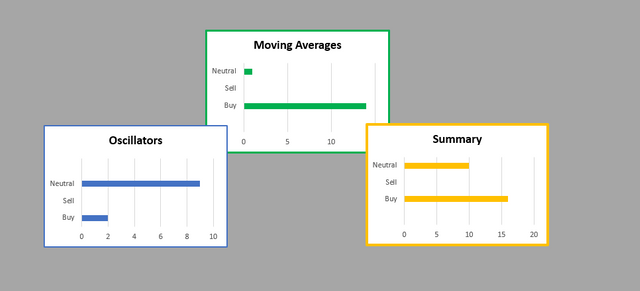

Other Calculations

There are a range of calculations used by technical analysts to determine the price of financial assets like cryptocurrency. The table below the list based on the 28 of these calculations. The table may offer the strongest insight on what to do at the moment. The data was collected from the most reliable sources, and each bar was formed by decision from the most informed and experienced traders. Scroll down to see the list and subsequent table.List of calculations

- Relative Strength Index (14)

- Stochastic %K (14, 3, 3)

- Commodity Channel Index (20)

- Average Directional Index (14)

- Awesome Oscillator

- Momentum (10)

- MACD Level (12, 26)

- Stochastic RSI Fast (3, 3, 14, 14)

- Williams Percent Range (14)

- Bull Bear Power

- Ultimate Oscillator

- Exponential Moving Average (5)

- Simple Moving Average (5)

- Exponential Moving Average (10)

- Simple Moving Average (10)

- Exponential Moving Average (20)

- Simple Moving Average (20)

- Exponential Moving Average (30)

- Simple Moving Average (30)

- Exponential Moving Average (50)

- Simple Moving Average (50)

- Exponential Moving Average (100)

- Simple Moving Average (100)

- Exponential Moving Average (200)

- Simple Moving Average (200)

- Ichimoku Cloud Base Line (9, 26, 52, 26)

- Volume Weighted Moving Average (20)

- Hull Moving Average (9)

Conclusion

Bitcoin, is the leading cryptocurrency with a total market volume of $2.62 billion. We do not know Satoshi Nakamoto at the moment, but can at least console that loss, with the little we can tell about the future of the digital gold. The bitcoin bullish rally may continue until May. Top analysts from Wall Street are still hopeful that bitcoin could hit $50,000.

What are your thoughts about bitcoin? Read this article, and share what you think in the description below.

Charts, and some graphical images used in this article are provided by Trading view.com, Cryptocompare.com, and Binance.com. All images have been edited in part, but the rightful providers are highly acknowledged by the author.