Inching towards recognition: Crypto-currencies are integrating into mainstream financial services.

Fingers crossed

Since Japan chose to legalize Bitcoin as a legal payment method, the use of blockchain-based cryptocurrencies rose in anticipation of a new wave of popularity. The animal spirits were high for a full-scale inclusion of crypto into the financial system.

However, without the support of the currently entrenched financial behemoths, crypto has faced a hard time. Its advantages were mostly ignored, and the drawbacks were inflated to make it the boogeyman of finance. Denounced as a pastime for millennials, it was scantly recognized even as a possible addition to the financial services.

However, the potential of blockchain cryptocurrencies for private-transactions, remittances, online shopping or investment in technological startups remains high. This is slowly being acknowledged, as established financial corporations begin to pay attention and prepare for the future of FinTech (Financial Technology).

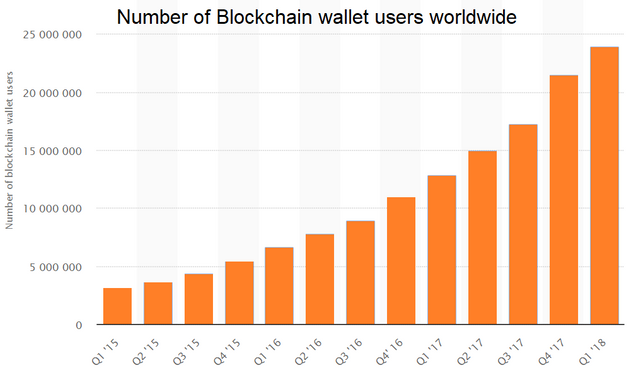

Source: Statista

The New Frontiers

Most recently, on July 17th Mastercard won a patent to link cryptocurrency with fiat accounts from the US Patent and Trademark Office. MasterCard Labs, the company’s research, and development department have previously already filed more than 30 different blockchain or cryptocurrency related patents, but this one is of particular importance.

By linking crypto with its efficient transactions systems, the company would be able to overcome one of the main concerns alarming the crypto-community: The speed of transactions.

Traditionally, a blockchain-based transaction takes 10 minutes or so to be processed. If you’re on the receiving end of that transaction, you don’t care about how secure and anonymous it was until you receive the money. Therefore, merchants, retailers, service providers may be wary of accepting crypto for products, as it doesn't sound particularly appealing to hold a customer in store for that period of time.

To shorten transfer time, MasterCard is making plans for the development of a new type of account. An account that would be able to cut travel time by transferring crypto that is pegged to traditional government-backed currency. Not only should this be more efficient, but also far more secure.

The company is attracted to the use of the new technologies for the purposes of defense against fraud and identity theft that is achieved by storing all the information in a decentralized ledger.

In short, this combination of traditional payment technologies and blockchain currencies may just be the much-needed push towards the inclusion of crypto into the world of finance.

It’s all in the numbers, silly

Of course, whereas the behemoths are catching up, the vision of seamless back and forth transactions between crypto and, say, euros or dollars has already been the bread and butter of some upstarts.

ORCA Alliance, a company to bridge crypto and traditional finance, has recently presented its technological case for the community during a live event streamed online. ORCA completed a transfer from a cryptocurrency exchange straight to user’s bank account in 6 seconds.

D. Radin presenting ORCA’s technical solution

The upstart has managed to accomplish this feat by combining 3 APIs (Application Programming Interfaces): one for crypto-exchange, another for the payment gateway and an API of a financial institution. With this elaborate method and its user-friendly financial management tool, the firm is very well placed to be the solution provider crypto-community desperately needs.

To complete the hash

The previously closed-off Silicon Valley insiders club is inching towards mainstream financial service providers. Upstarts and incumbent alike are putting forward solutions to relieve numbers of issues tormenting cryptocurrency adopters. Don‘t be surprised if their fresh ideas put a novel spin on old financial practices.