China's bitcoin trading volume rises despite ban

The daily trading volume of the Chinese bitcoin exchange market has nearly doubled that of the US bitcoin exchange market, surging above 45,000 bitcoins. For a brief period of time, the Chinese exchange market overtook the US in terms of market share to become the largest bitcoin market in the world, for the first time since November of 2016.

Although bitcoin is being traded at around $4,000 in China, nearly $200 lower than the US market, Chinese exchanges have demonstrated low trading rates for the bitcoin-to-Chinese yuan pair throughout 2017. Immediately after the imposition of strict regulations and policies on bitcoin trading platforms in 2016, investors stopped trading bitcoin at a premium rate within the Chinese exchange market.

One important indicator of the Chinese bitcoin market’s recovery which investors must acknowledge is the rapidly growing trading volume of the Chinese exchange and over-the-counter markets. Under normal circumstances, a massive sell-off should have occurred when reports from Caixin and the Wall Street Journal were released about the plans of the People’s Bank of China, the central bank of the country, to suspend or ban bitcoin trading platforms.

The Wall Street Journal is a massively influential mainstream media publication in the global finance sector. But, Caixin is a state-owned media company in China, which has insider sources within the government and in the Chinese central bank. When the initial report of Caixin was released, the Chinese bitcoin market crashed, bringing the price of bitcoin down to the $4,000 region. Many analysts expected the release of WSJ’s report to slow down the momentum of bitcoin even further. But, in contrary, bitcoin has recovered to over $4,200 today, with the Chinese bitcoin exchange market demonstrating high trading volumes and US investors moving bitcoin price upwards.

More to that, within a single day, bitcoin price in the Chinese exchange market rose by 9.3 percent, while other markets such as the US, Japan and South Korea remained stagnant. Momentum is rebuilding in China, despite the ongoing bitcoin exchange ban talks and the PBoC’s supposed introduction of plans to suspend bitcoin exchanges indefinitely.

Huobi, OKCoin and BTCC, the three leading bitcoin exchanges in China, have all stated that they do not believe the ban will be approved and are not even sure if it is the actual plan of PBoC. The three companies reassured their clients that they have not received any directives from PBoC and that they are willing to comply with any requests from the Chinese government and its financial regulators.

The optimistic and confident approach from leading Chinese exchanges in regard to the rumours emerged due to the report of Caixin has started to trigger new upward momentum for the Chinese bitcoin exchange market.

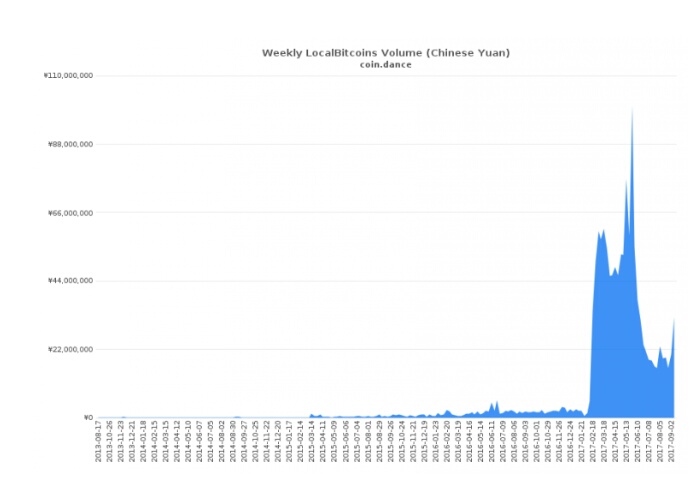

More to that, the Chinese bitcoin industry and market have regained trust over bitcoin and its legal status in China. According to bitcoin market data provider Coin Dance, demand toward bitcoin in over-the-counter and peer-to-peer bitcoin markets such as LocalBitcoins has actually increased over the past two weeks.

It is still unsure whether the report of Caixin on the ban on bitcoin exchanges is accurate and if the Chinese government is considering imposing a temporary suspension on its local trading platforms. However, the Chinese market has shown that it does not necessarily perceive the suspension as a threat.