Why didn't Warren Buffett invest in any cryptocurrency like Bitcoin..?

To the surprise of nobody, Warren Buffett isn’t interested in Bitcoin at all. He just recently told CNBC that…

…in terms of cryptocurrencies I can say almost with certainty that they will come to a bad ending.

In his view, cryptocurrencies are a bubble that are purely driven by speculation. Not surprisingly, his top advisor Charlie Munger recommended to “stay way from Bitcoin like the plague”.

But why is Buffett so adamant about criticizing crypto currencies?

A closer look at Buffett’s investment strategy reveals that Bitcoin and Buffett were never posed to be a love affair. Buffett’s investment strategy circulates around the concept of intrinsic value.

Buffett defines intrinsic value as follows:

Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during its remaining life.[1]

To give you an example: Buffett bought about $ 1 billion in Coca Cola stock in 1988. Coca Cola has lots of intrinsic value: People all around the world consume Coca Cola, thereby creating a steady stream of profits for the company. These profits make Coca Cola a valuable company.

Now, what Buffett looks for are companies whose market cap is significantly lower than their intrinsic value. In other words, Buffett looks for companies that are significantly undervalued, just like Coca Cola in 1988.

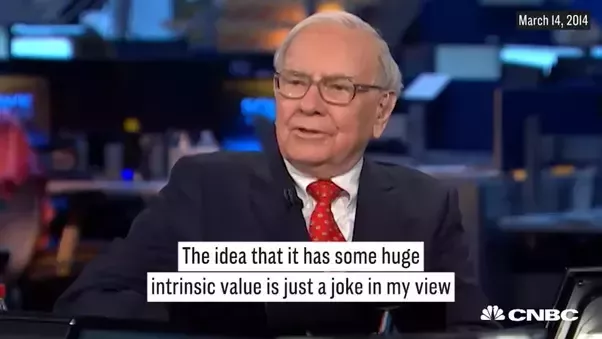

Now let’s check again what Buffett says about Bitcoin:

The idea that [Bitcoin] has some huge intrinsic value is just a joke in my view

And Buffett is right. Currently, the price of Bitcoin is mostly driven by speculation, and not by an underlying profit stream that justifies the price.

Basically, Bitcoin is the opposite of what Buffett is looking for: Buffett prefers investments with high intrinsic value and a low price. Bitcoin has hardly any intrinsic value (by Buffett’s definition) and a high price. No wonder that Buffett recommends:

Stay away!

Does this mean that Bitcoin investments are doomed? I don’t think so. Even though Buffett is insanely successful, his investment strategy is not the only one that works. Buffett’s investments are generally rather conservative; with large positions in mature businesses. Investing in promising, yet un-validated business models is outside of Buffett’s strategy - yet other investors have been very successful with this approach. It might be the same with cryptocurrencies - even Buffett admits that he “doesn’t know anything about it”.

So, with all respect to Buffett - he and Bitcoin were just never meant to be. That shouldn’t necessarily discourage you from investing - as mentioned, there are other investment strategies that work just as well (or even better).

PS: Buffett’s $1 billion investment in Coca Cola is now worth $ 19 billion. That’s just as much as Satoshi Nakamoto’s stake in Bitcoin if the Bitcoin price increases to $19,400 again

This post received a 0.021 SBD (0.27%) upvote from @upvotewhale thanks to @supriyo! For more information, check out my profile!

Hmm...aren't all investments on the stock market, commodities, property, cryptos, or anything, a form of speculation? Buffett invests in many traditional stocks, when he invests in something, isn't he speculating that the price goes up or it continues to pay dividends. OK maybe he does some homework first but unless he has insider info that can guarantee his investment WILL go up, he's still making a gamble with his money.

As they always say in professional investment circles: "Past performance is not an guarantee of future results."

And then there's the old chestnut, "Aw bitcoin has no intrinsic value, it's only worth what somebody else will pay you..." Isn't that much the same with stocks and shares, well ok, maybe your shares might have a face value per share on the share certificate which is usually a tiny fraction of the current value of the shares.

At the end of the day, with shares or any investments, you still need somebody who is willing to buy them off you at a higher price in order to profit.

Incidentally, WB has never really been a fan of tech. He didn't do well during the Dot Com boom and it looks like he's going to pass over the Crypto boom too. True all booms will eventually come to an end, people like WB can afford to sit on the sidelines and watch it go by.

If a lot of people like to buy and bid up cryptos then all power to them I say!!!!