10 Statistical Price Predictions for 10 Cryptocurrencies

So, you're sitting at your computer with money to invest.

You have made some good money already in the market, but you want more.

Cryptocurrencies have reached a record $185 billion in market value after the bitcoin surge, with the inevitable $200 billion mark right around the corner.

The price movement of top currencies remains a mystery. But it doesn't have to be.

THE PAIN OF UNCERTAINTY

Cryptocurrencies are volatile, irrational beasts.

Simple methods of forecasting grossly over/underestimate the potential of a volatile currency.

For example, moving averages are used frequently to estimate future prices. Moving averages, however, suffer from many pitfalls that make them poor estimators of volatile markets.

Every great and successful investor has a plan. You will add one more tool to your arsenal today.

A BETTER METHOD FOR ESTIMATING CRYPTO PRICES

In my prior article about estimating the movement of Bitcoin Prices, I spoke of a method that is used frequently in the stock world to estimate prices.

This method is a Monte Carlo simulation using the geometric Brownian motion model.

I won't cover off on the full methodology here, but essentially I am going to:

- Get historical daily prices for 10 top cryptocurrencies

- Calculate daily returns

- Simulate a year

- Simulate a year many times

By the end of the article, you will have the following:

- A one-year simulation of top cryptocurrencies

- Likely price range of each cryptocurrency

- A downloadable model to complete yourself

A note on forecasting, simulations, and recommendations: Monte Carlo simulations are to be used as guidelines and tools, not as gospel. I am not offering financial or investing advice.

BITCOIN

What is Bitcoin?

You know what Bitcoin is, stop it.

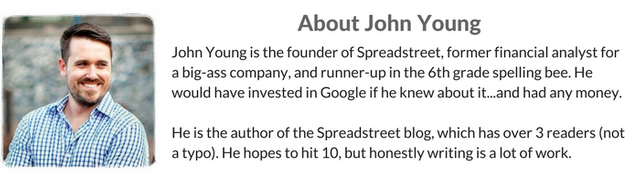

One-Year Simulation

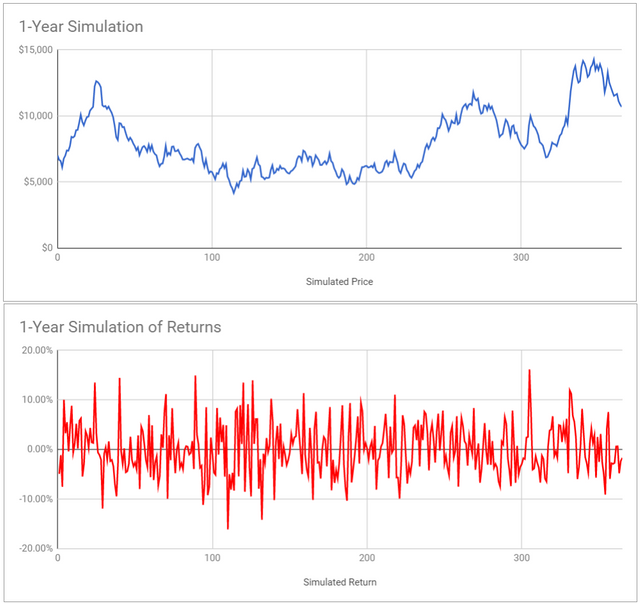

One-Year Simulated 1,000 Times

Verdict

We can be 95% certain that Bitcoin prices will fall between $4,614, and $129,269 with a mean of $41,238.

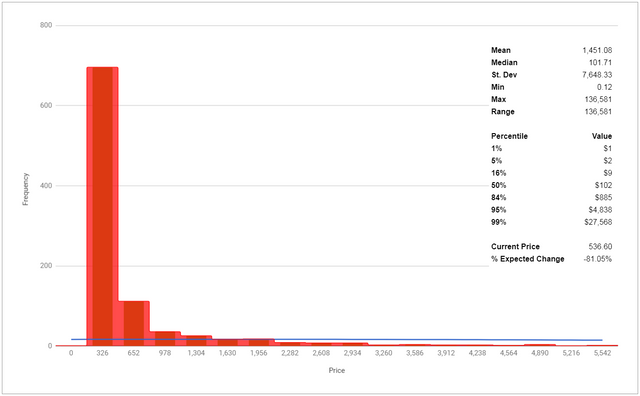

BITCOIN CASH

What is Bitcoin Cash?

From the Bitcoin Cash project website:

“Bitcoin Cash is peer-to-peer electronic cash for the Internet. It is fully decentralized, with no central bank and requires no trusted third parties to operate.”

Really, it was an additional currency that was created after a fork from Bitcoin core.

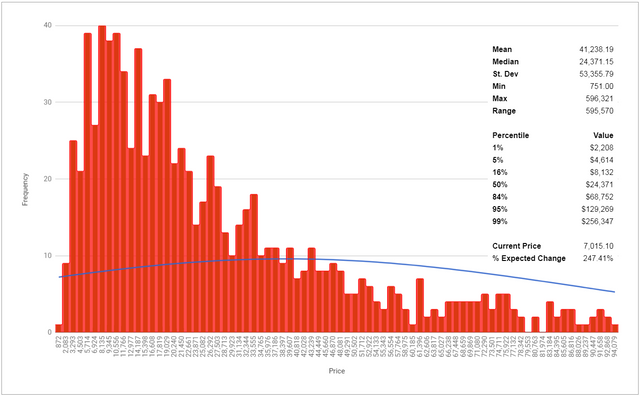

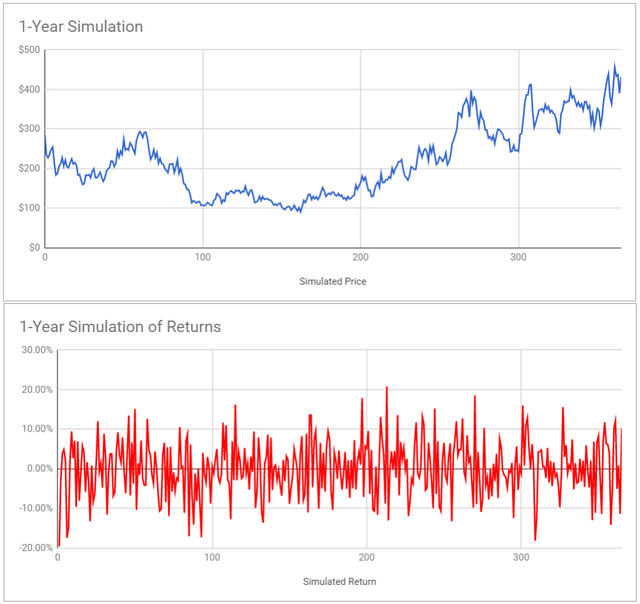

One-Year Simulation

One-Year Simulated 1,000 Times

Verdict

We can be 95% certain that Bitcoin Cash prices will fall between $2, and $4,838 with a mean of $1,451.

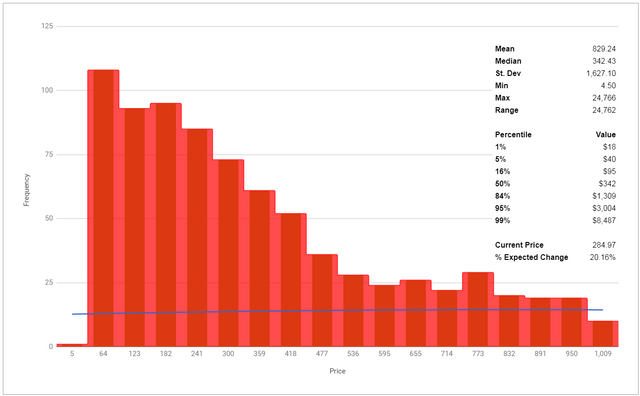

ETHEREUM

What is Ethereum?

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of downtime, censorship, fraud or third party interference.

Ethereum has been busy recently. Multiple steps have been pushed in motion for the upcoming large change - reaching a new consensus method.

From Jordan Daniel at ethnews.com:

Ethereum’s Byzantium hard fork was only one half of a two-part process designed to transition the decentralized application platform to a new method for reaching consensus – proof-of-stake. The next hard fork, called Constantinople, was recently discussed during an Ethereum core developer meeting and could include Vitalik Buterin’s Casper update.

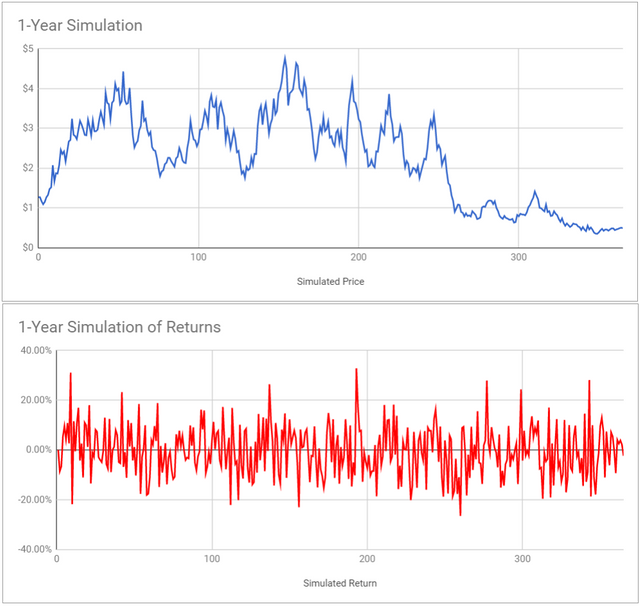

One-Year Simulation

One-Year Simulated 1,000 Times

Verdict

We can be 95% certain that Ethereum prices will fall between $40, and $3,004 with a mean of $829.

EOS

What is EOS?

EOS is a blockchain-based, decentralized operating system, designed to support commercial-scale decentralized applications by providing all of the necessary core functionality, enabling businesses to build blockchain applications in a way similar to web-based applications.

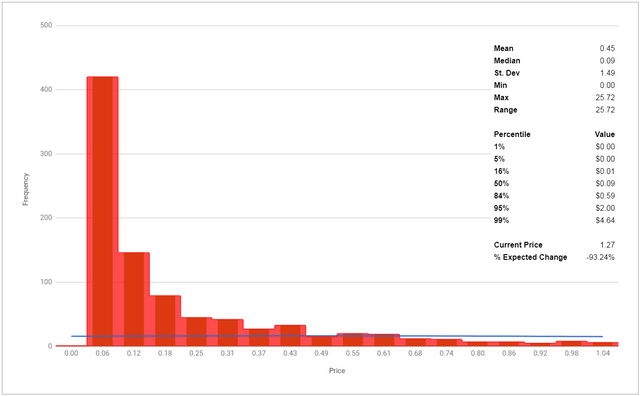

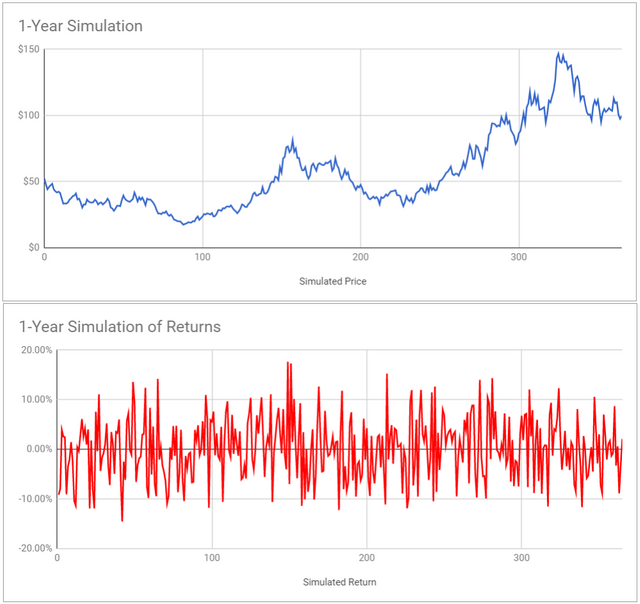

One-Year Simulation

One-Year Simulated 1,000 Times

Verdict

We can be 95% certain that EOS prices will fall between $0.002, and $2 with a mean of $0.45.

LITECOIN

What is Litecoin?

Litecoin's claim to fame is faster transaction processing times. It uses a scrypt-based mining proof-of-work algorithm to target the regular computers and GPUs most people already have.

The ability to target regular computers and GPU's happens to be a huge differentiator from the crowded mining population of Bitcoin.

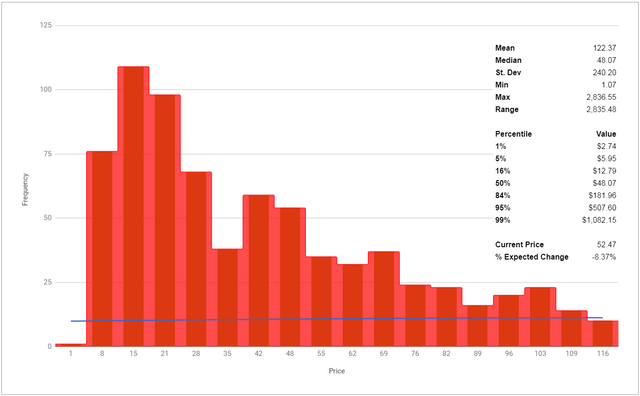

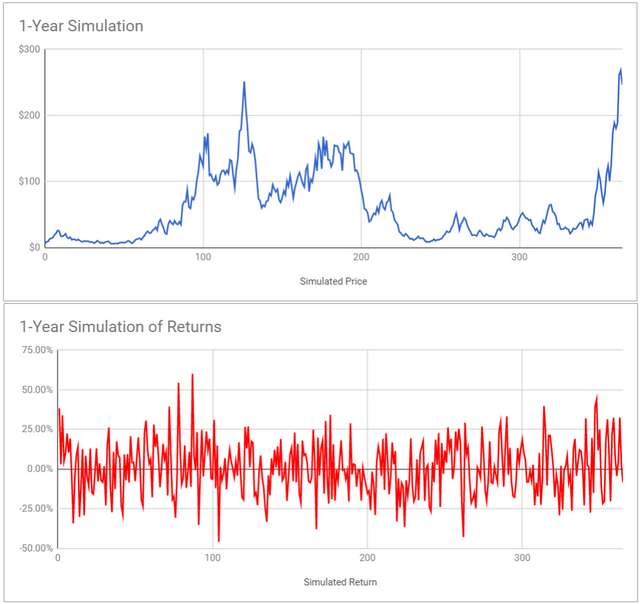

One-Year Simulation

One-Year Simulated 1,000 Times

Verdict

We can be 95% certain that Litecoin prices will fall between $6, and $507 with a mean of $122.

OMISEGO

What is OmiseGO?

OmiseGO is building a couple of things:

- Decentralized exchange

- Liquidity provider mechanism

- Clearinghouse messaging network

- Asset-backed blockchain gateway

OmiseGO is not owned by any single one party. Instead, it is an open distributed network of validators which enforce behavior of all participants.

According to Blocknight:

Also, OmiseGo counts Vitalik Buterin (Ethereum), and Joseph Poon (Lightning Network Co Author) among their advisers. Joseph Poon is actually billed as author of the OmiseGo whitepaper.

Those are some pretty big names.

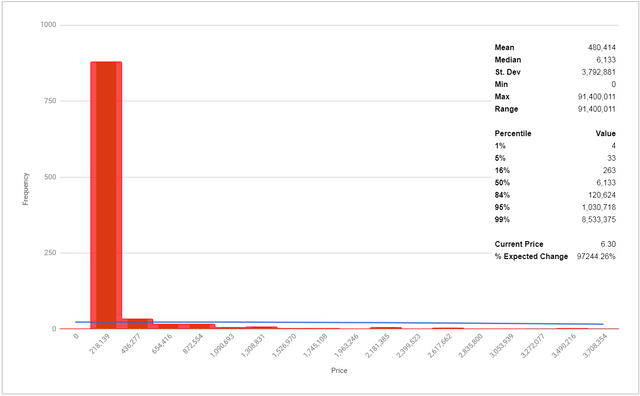

One-Year Simulation

One-Year Simulated 1,000 Times

Verdict

We can be 95% certain that OmiseGO prices will fall between $33, and $1,030,718 with a mean of $480,414. Holy volatility!!

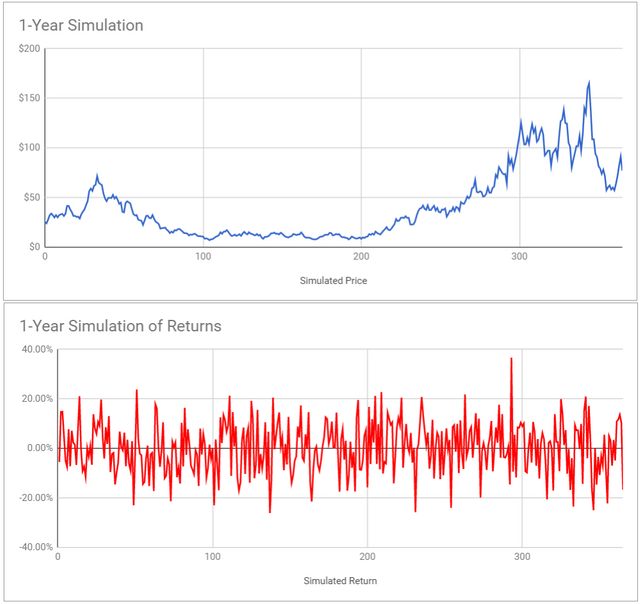

NEO

What is NEO?

NEO (formerly known as AntShares) is a smart asset platform and the first open source public blockchain project in China. Smart assets are the combination of smart blockchain contracts and digital assets.

One-Year Simulation

One-Year Simulated 1,000 Times

Verdict

We can be 95% certain that NEO prices will fall between $2, and $1,314 with a mean of $347.

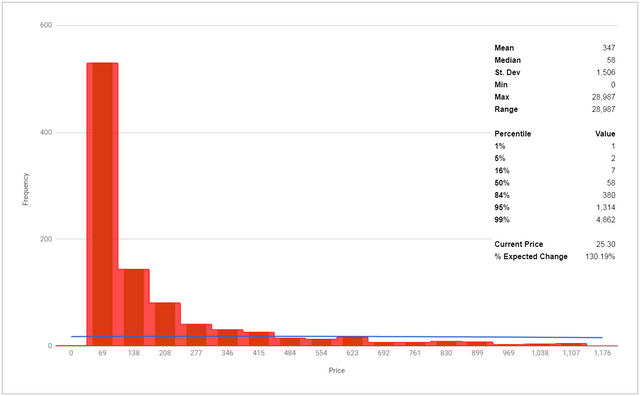

RIPPLE

What is Ripple?

Ripple is a system created for banks to enable immediate payments and lower costs.

The vision of the Ripple creators is to allow a bank transfer in a few seconds (instead of the horribly annoying 2-3 business days).

Of note, is that Ripple is a U.S. based company. From the xrphodor blog:

Ripple is a US-based company.

Why is this an important point to consider? A US-based company like Ripple is subject to some very stringent laws regarding securities trading and money transmission. These include requirements that define how Ripple might interact with crypto markets and both institutional and retail crypto traders.

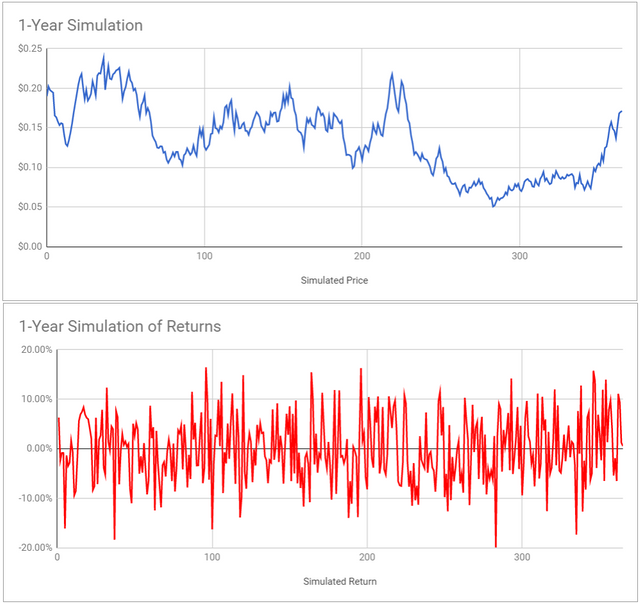

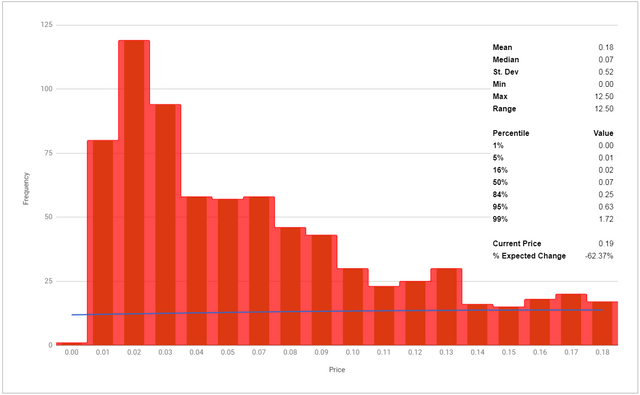

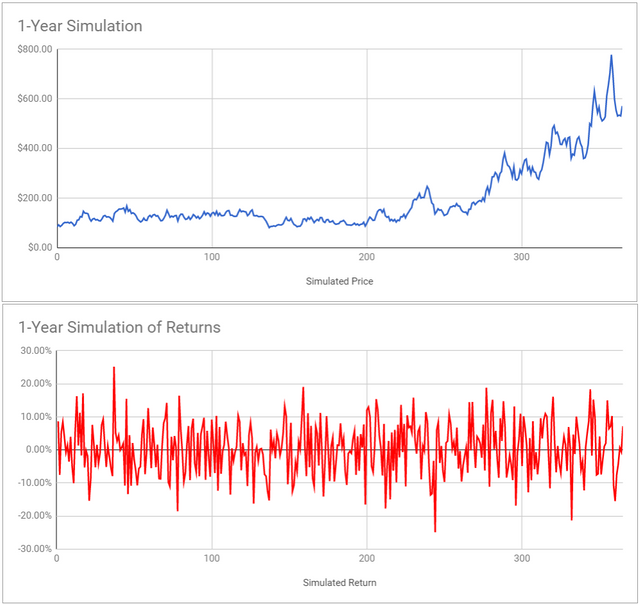

One-Year Simulation

One-Year Simulated 1,000 Times

Verdict

We can be 95% certain that Ripple prices will fall between $0.01, and $0.63 with a mean of $0.18.

MONERO

What is Monero?

Monero attempts to solve privacy and fungibility issues that persist in Bitcoin.

Part of the algorithm for Monero automatically mixes transactions with previous transactions and does this by implementing ring signatures.

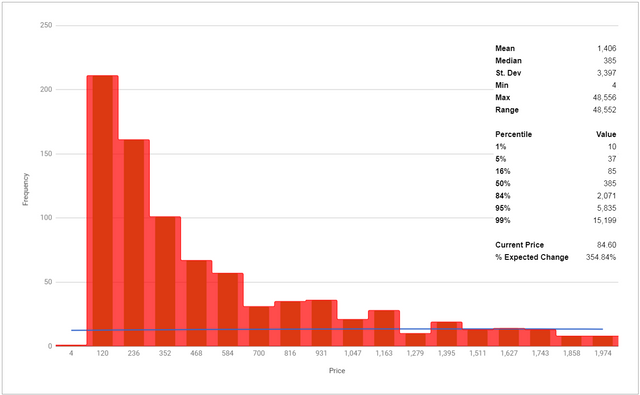

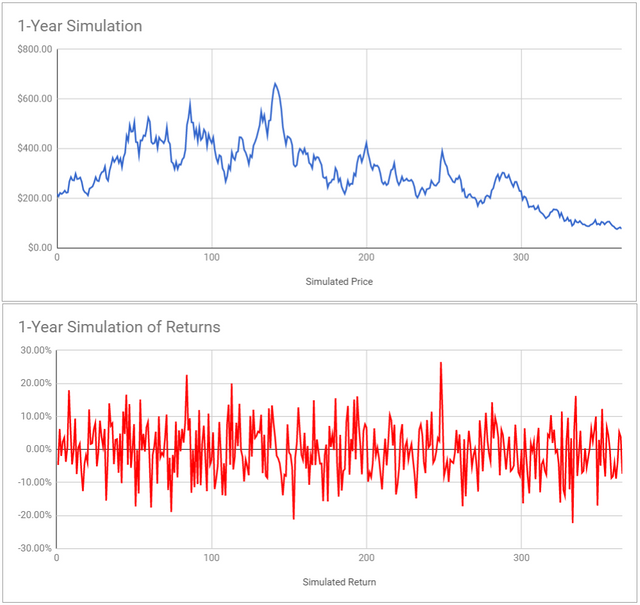

One-Year Simulation

One-Year Simulated 1,000 Times

Verdict

We can be 95% certain that Monero prices will fall between $37, and $5,835 with a mean of $1,400.

Zcash

What is Zcash?

From the Blockchainhub infographic:

Zcash is a permissionless cryptocurrency that can fully protect the privacy of transactions using zero-knowledge cryptography.

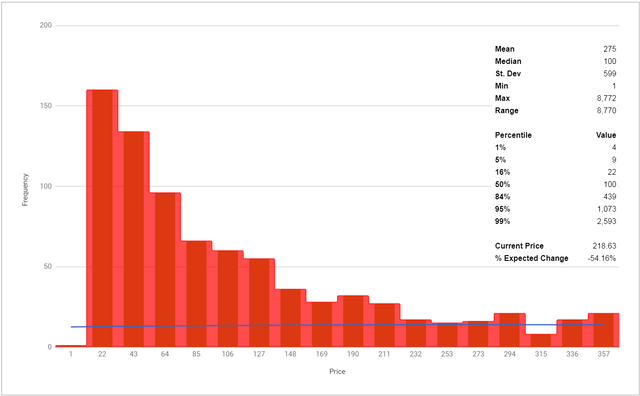

One-Year Simulation

One-Year Simulated 1,000 Times

Verdict

We can be 95% certain that Zcash prices will fall between $9, and $1,073 with a mean of $275.

CONCLUSION

Whether you are investing in Bitcoin, Ethereum, or SpankCoin, it is imperative to have a plan. Most notably, a worst-case scenario.

The Monte Carlo simulation is a fantastic way to get a range of prices for a cryptocurrency. And after reading this, you can see how the final values change drastically depending on what you are looking at.

I urge you to download the sheet and try your own hand at simulating different coins. The sheet is setup to pull in every single coin from CoinMarketCap.

Cheers, and happy hunting!

RELATED POSTS

Bitcoin Madness: How to Simulate Bitcoin Prices in Google Sheets

High-Flyers and Shitcoins: What I Learned from Analyzing CoinMarketCap Data in Google Sheets

7 Smart Ethereum Price Prediction Methods for HODL’ers