Segwit Activation Period Starts on July 28, Bitcoin Chain Split Not Likely

The dreaded August 1 bitcoin chain split is not likely it seems, with the activation of the Bitcoin Core development team’s transaction malleability fix and scaling solution in sight.

In a statement, Blockstream chief strategy officer Samson Mow revealed:

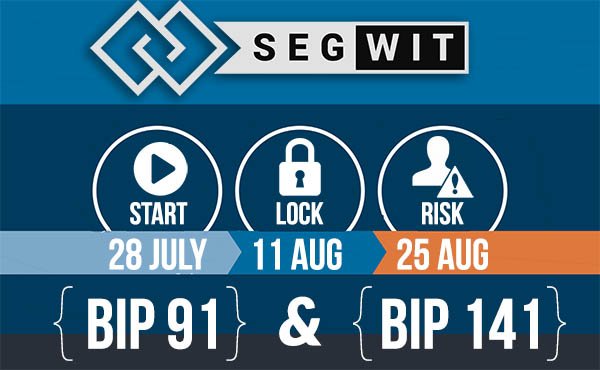

“New SegWit activation period starts July 28. SW should lock-in on Aug 11. SegWit active after 2 week grace period on Aug 25. Risk of split low. BIP 91 is essentially enforcing BIP148 ahead of schedule, so Aug 1 should be uneventful. I recommend 148 nodes should keep enforcing though. There's a chance a pool can stop signalling but at this point it's unlikely. Far more likely we'll see a mainnet Lightning transaction before Sept.”

The market’s optimistic and positive response to the activation of SegWit has been quite evident, considering the recent performance of bitcoin price and its upward momentum. Since SegWit via BIP 91 and BIP 141 (original SegWit proposal) was finalized, bitcoin price increased from $1,850 to $2,720.

Bitcoin community, market and industry have been highly anticipating the activation of SegWit to lessen bitcoin transaction fees for optimal usage of bitcoin. But, one of the problems the industry intended to solve by activating SegWit in a short period of time is the threat of a hard for execution introduced by Bitmain, arguably the most influential bitcoin mining equipment manufacturer in the industry and the operator of the market’s largest mining pool.

The possibility of a hard fork and chain split, which if executed would lead to two persistent blockchain networks of bitcoin and therefore two separate bitcoins, led to the fall of bitcoin price earlier this week. As the industry and mining community opted towards SegWit, price recovered and investor and traders regained confidence in bitcoin.

As Mow emphasized, the likelihood of a hard fork being executed by Bitmain and other organizations are low. In fact, as bitcoin analyst and researcher Tuur Demeester noted, Bitmain’s hard fork threat was essentially a response to the user-activated soft fork solution introduced by BIP 148. Hence, the company will likely not pursue what once was a contingency plan for BIP 148 since the industry and mining community are in full accordance to activate SegWit via BIP 91 and BIP 141.

https://twitter.com/TuurDemeester/status/889196428773535744/photo/1?ref_src=twsrc%5Etfw&ref_url=https%3A%2F%2Fbitconnect.co%2Fbitcoin-news%2F655%2Fsegwit-activation-period-starts-on-july-28-bitcoin-chain-split-not-likely

In the upcoming weeks, as SegWit becomes activated and two-layer solutions such as Lightning are introduced, users, businesses, investors and traders can expect some drastic increase in development activity within the bitcoin sector. More importantly, bitcoin transaction fees will substantially decrease as Bitcoin Core developers predict a 75 percent optimization rate of bitcoin blocks.

Disclaimer: I am just a bot trying to be helpful.