5 trends in the blockchain ecosystem

Since the launch of the startup tracker at the end of may we (Outlier Ventures) collected data on 967 startups. To make the tracker as useful as possible to users, we learned from them, what information they lack. As it turned out, our clients would like to know more about the distribution of crypto-currency business world. We offer you to see some noteworthy facts and trends.

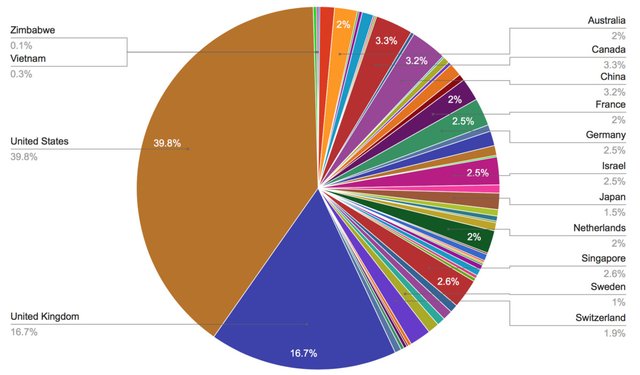

The UK became the global blockchain-hub, second only to the US

As might be expected, the blockchain-the market is dominated by the United States: there was or are developing 38.9% of blockchain-related startups. Second place after the USA occupied Britain with 16.7% of start-UPS. Will be interesting to see how the cryptocurrency industry impact of Brexit; according to early reports, investors may see the weakening of the pound as an opportunity and not a reason to panic. It is worth noting that Berlin already is making active efforts to attract technical talents. Germany divides the leaderboard blockchain-industry 6-th place with Israel: they account for 2.5%. Third place goes to Canada with 3.3%, the fourth — China 3.2%, and the fifth — Singapore 2.6%.

Sympathy for Bitcoin is particularly strong in the United States

If you dig a little deeper, it turns out that every country has its unique structure of the start-up scene. In the United States especially big investment in Bitcoin, which appears to be due to the early access to technology — even before the emergence of alternative blockchains and methods of their use. The fact that the companies and products created in connection with Bitcoin, it is difficult to reorient the culture and resources for the study of alternative possibilities. Partly for this reason, the most interesting Ethereum startups are based in Europe, mainly in UK and Germany.London — the center of the blockchain-industry

In contrast to the United States, FINTECH companies in the UK are showing much greater interest in blockchain technology. Among the 115 companies that have come to our report, you can find startups for clearing and reconciling payments, insurance, securities trading and not only. High regulatory barrier in the financial industry means that the special value acquires knowledge of its nuances. For this reason, a start-up from the periphery of the financial world (for example, Bulgaria) have little chance to revolutionize the industry. We predict that the blockchain-companies from the UK will retain their role as catalysts for change in financial technology and insurance.Clustering of startups dedicated to methods of application of the block chain is weak

If you leave London and financial services, there is no indication that startups are grouped in specific countries to solve specific problems. Supply chain, logistics and similar areas are doing around the world, such as Israel, Singapore, Italy and USA. Blockchain startups developing IOT solutions can be found in Kenya, Germany, the UK and the USA. German startups are doing almost everything from data analysis and financial services to certification, notary services and social networks. The lack of clustering of start-UPS across regions can be explained by the fact that the market has not yet formed. Perhaps the clusters are still there, but it is possible and that the physical clustering will remain a relic of the old industrial world, which is right before our eyes is changing thanks to the Internet, reducing almost to zero the marginal costs of communication and distribution.

The end of clustering?

Clustering is the result of the fact that companies from the same industry move closer to each other to benefit from economies of scale. Nearby companies can benefit through access to a shared pool of talent, experience, suppliers, and customers. Technology clusters are usually formed around universities: Silicon valley gets a lot of advantages because is close to Stanford. However, courses on the blockchain, distributed systems and cryptography while relatively rare at universities, and many talented developers came to the blockchain-the industry of online hacker communities, which are initially distributed around the world due to close connection with the development of the Internet. Global communication network, the exchange of experiences on GitHub, the service providers are based in the cloud and distributed across the Internet, and customers can be anywhere in the world. For these and other reasons clustering no longer provides such great economies of scale, as it was before.

Will there be clusters over time?

The lack of clustering may indicate that the market is very young. Perhaps in the next few years we will see the emergence of clusters. Berlin may be the hub of technology development decentralization, tel Aviv — security Singapore — supply chain, and London insurance. The Internet makes it easy to spread knowledge on a global scale, but there is one area in which the boundaries are still important: it is finances. Despite the enormous potential of block chain technology, currently the financial industry is very heavily regulated, and it requires a national license. This means that the blockchain startups that need financing have to be close to venture capitalists and angel investors. That is why a blockchain startups created in Silicon valley, new York, London, Berlin and Singapore. Thus, the clustering still makes some sense because the transformation of Finance and venture capital has just started.

- It seems that the location of the company doesn't matter anymore

By studying the data, we found more global trend: respectively the distributed nature of the blockchain and the team working on the blockchain startups, distributed across the world. Second place in the list “locations” is the item “headquarters is missing” proportion of startups is 28%. Figure out where are the leading developers of a project, it's easy, but it doesn't matter: companies creating products based on decentralized technologies themselves are decentralized and distributed across the world. For example, many employees of startups are in London, Warsaw, Madrid and Thailand.

What is important is whether the choice of the state for the blockchain startups?

50 years ago, the company has registered, paid taxes, hired employees and developed all business processes in one country, but globalization has radically changed the approach to business. Perhaps the blockchain startups can be considered the first swallows of the postinternet era, with (in the limit) zero cost for communication and distribution. Thanks to the Internet, employees and customers of such companies can be located anywhere in the world. A blockchain startups raise funds and pay developers in bitcoin and ether; thus their interaction with the state financial environment is minimized.

Is there now any point in talking about where “are” the company? In any case, for most startups in the blockchain the community the correct answer is “Internet”. This is particularly interesting in light of recent events: while everyone is much discussion of Brexit and a new format of interaction of great Britain with the European Union, the blockchain startups the care of the national States became almost indifferent.

Cool Share

Steemon