Bitcoin to hit $5,000 and Ethereum $500

It has been an interesting year to watch cryptocurrencies. On June 11th when the entire crypto market was valued at $112B, I wrote we have seen "quite the run in cryptos the last few months and may need to take another breather before the next leg up". Since that time the market did take a breather and declined 46% to a low of ~$60B and has since rallied over 95% almost doubling to $117B. I was fortunate to have some cash sitting on the sidelines and added to my positions in ETH and BTC on the dip. These markets are and will remain very volatile and are not for the faint of heart. There are many traders out there playing the market from day to day, but I have taken the buy and hold approach (HODL) and recommend it as I think we will be seeing much higher prices in the future.

Many day traders are investing in what some call "shit coins" based on technicals and movements in the market from day to day. Many of these hundreds of alt-coins have little to no value and in my opinion will be worthless in the long run. I choose to follow and own cryptocurrencies with solid use cases and development teams. One major thing going for Bitcoin and Ethereum is first mover advantage as well as multiple network effects of being first in the space.

Network Effects for Bitcoin (BTC)

Effect #1: Merchants adopt BTC because many customers hold it due to being first in the market

Effect #2: More customers adopt BTC due to easy availability and because many merchants accept it

Effect #3: Developers join BTC team because BTC has the most customers and merchants

Effect #4: Customers/Merchants/Developers adopting BTC create demand for the currency, causing BTC price to rise, making mining rewards more valuable, drawing miners and their computational power to BTC making the blockchain more secure and attractive

Effect #5: Growth of BTC ecosystem draws financial investors which in turn creates demand for derivatives which push the price up further and draw more miners

Effect #6: The larger the BTC market gets the more liquidity on exchanges which reduces spreads to get in and out of BTC into native currencies making adoption more cost-effective for customers, merchants, developers, and investors

These are many reasons why I think Bitcoin will continue to be a force in the crypto space even if it may not be the winner from a market cap stand point in the long-term or the best technology. I still believe Ethereum will surpass Bitcoin in the near future due to its superior technology and there may be others that surpass bitcoin in the future as well. I stated in my previous article that due to the scaling debate I did not think communities within bitcoin would come to an agreement and that BTC would fork and ETH would pass BTC's market cap in August. This was the case for the fork, however bitcoins price was unfazed and has since just hit a fresh all time high of over $3,400 per BTC. I believe this is very bullish for BTC and expect it to continue its trend higher. I have decided to keep my Bitcoin Cash (BCH) for the time being to see how things settle. With that said I still expect ETH to surpass BTC and think ETH will rally through year end with many announcements to come such as Metropolis and more exciting use cases. Ethereum routinely has greater daily transaction amounts, greater daily volume, higher mining reward, and currently has 22,516 nodes versus Bitcoin's 8,895.

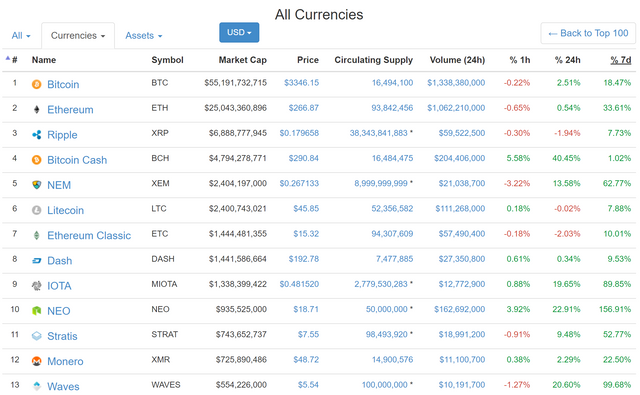

Below I have listed cryptos that I am currently watching and some that I hold. I purchased my first bitcoin in 2013 and have picked some up as low as $315 and started buying ether in January of this year as low as $11.05 for returns of 979% and 2,343% respectively. With all the uncertainty in the market and the declining value of the dollar and other currencies around the globe, I believe cryptos continue their trek higher and soon eclipse a total market cap of $200B. I expect to see BTC breaking through $5,000 and ETH through $500 this year and we will likely see many of the coins below at higher levels in the months ahead.

Bitcoin (BTC) - $3,346

Bitcoin Cash (BCH) - $290

Ethereum (ETH) - $266

Litecoin (LTC) - $45.85

NEM (XEM) - $0.26

Dash (DASH) - $192

IOTA (MIOTA) - $0.48

NEO (ANS) - $18.71

Monero (XMR) - $48.72

EOS (EOS) - $1.77

Veritaseum (VERI) - $147.50

PIVX (PIVX) - $1.91

CloakCoin (CLOAK) - $4.70

Waves (WAVES) - $5.54

Qtum (QTUM) - $11.96

Disclaimer: You should perform your own research and make your own investment decisions, this is not investment advice. I own or may plan to own many of the cryptocurrencies mentioned above.

Happy HODLing!!!

Dont you think steem is interesting to have buy?

I believe Steemit is a great platform and will continue to grow, if Steemit succeeds the currency will continue to rise, but I believe there are better investments out there at this time.