BTC in the Accumulation Phase: A short overview

As we approach the next pivotal moment in Bitcoin's life cycle—the 2024 halving—there's increasing evidence that we've entered an accumulation phase. This phase is characterized by savvy investors amassing BTC in anticipation of reduced supply and potential price hikes. This article aims to shed light on the current accumulation trends and what they signify for the future of Bitcoin.

What Is the Accumulation Phase?

The accumulation phase is a term used in market analysis to describe a period when informed investors begin to buy or "accumulate" an asset. This typically occurs before a major price rally and is often driven by fundamentals rather than hype.

Identifying an accumulation phase can be challenging, but there are markers such as increased trading volumes, stable yet gradually ascending prices, and heightened activity from institutional investors. Especially the most recent Bitcoin ETF applications paint a good picture about institutional interest.

Historical Context of BTC Halving

Bitcoin has undergone three halvings since its inception in 2009, each leading to a tightening of supply and often a subsequent increase in price. The patterns around these events provide some predictability for what might occur in 2024. The halving event cuts the block reward for miners in half, effectively reducing the new supply of Bitcoin entering the market. This built-in scarcity model serves as a counterbalance to inflationary pressures, making Bitcoin an attractive asset for long-term holding.

Current Accumulation Trends

As we inch closer to the 2024 BTC halving, current market trends indicate a steady accumulation of Bitcoin.

On-Chain Data Supporting Accumulation

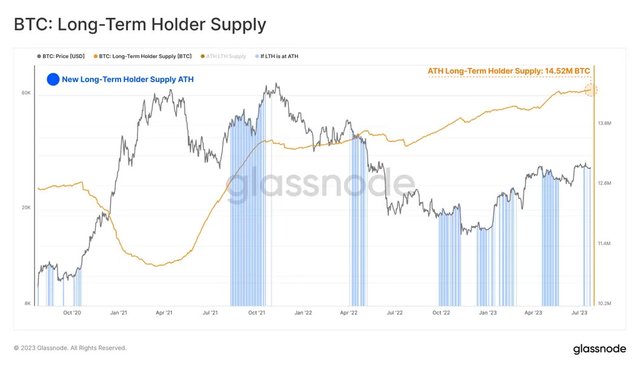

Metrics such as a decrease in exchange balances and a rise in Bitcoin "HODL waves" demonstrate that more BTC is being held rather than sold, signaling an accumulation phase. Futhermore long term holders control 75% of the circulating supply, which is a good indicator too.

Institutional Investment Indicators

Major institutional players are increasingly adding Bitcoin to their portfolios, another sign of an accumulation phase. Long-term investment strategies from these institutions hint at a bullish outlook for BTC.

Why Accumulate Before the Halving?

The anticipation of the 2024 BTC halving is a key factor driving current accumulation trends. But why is this event so significant for investors? Let's delve into the details.

Supply and Demand Dynamics

The upcoming halving will reduce the new supply of BTC, creating a scarcity that could drive up demand and, subsequently, price. Accumulating before this event can offer a more favorable entry point.

Long-Term Investment Potential

Bitcoin's historical resilience and increasing adoption as a store of value make it a compelling long-term investment. Accumulating now may lead to appreciable returns post-halving.

Conclusion

As we approach the 2024 BTC halving, signs point to an ongoing accumulation phase. From historical patterns to current on-chain metrics, the data suggests that informed investors are amassing Bitcoin. The anticipation of reduced supply and increased demand post-halving makes this a strategic move. For those considering an investment in Bitcoin, understanding these dynamics can offer valuable insights for long-term planning.