Bitcoin Profits vs. Any Other Investment Since 2013: Who’s The Champ?

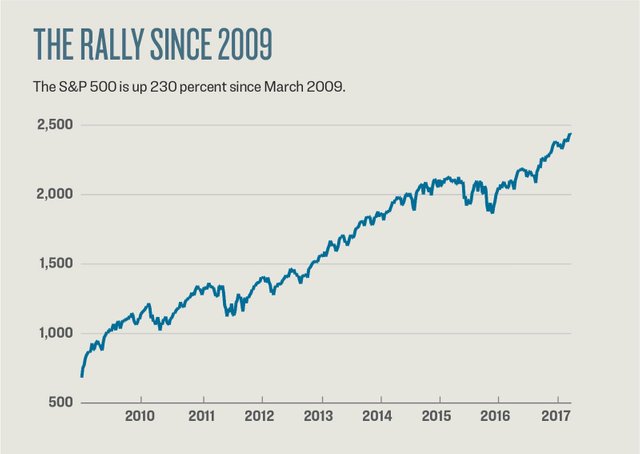

With Bitcoin hovering just below its new all time high of roughly $7700. We thought we’d take a look at how bitcoin has performed compared to some of the most popular traditional financial investment instruments over the past 4 years. First let’s take a look at the price of bitcoin compared to the performance of the S&P 500 over the past 4 years.

Source: The Epoch Times

The small line at the bottom running across, that’s the S&P. The difference between the two is quite noticeable. A Bitcoin investment opened in 2013 was 870x more profitable than an S&P. Index investment opened at the same time. Next let’s take a look at gold:

Source: Goldprice.org

Gold is roughly the same price now as in 2013, in fact, depending on when you mark the price, it’s lower. Assuming it’s the same price, bitcoin has outpaced gold 87,000 times. Gold is commonly known as a “hedge” but my question to that statement in 2017 is a hedge against what? If the answer is still, “a hedge against the USD.” Then how does bitcoin change its utility as such in 2017/2018. Next let’s take a look at bitcoin VS. real estate.

Source: http://www.in2013dollars.com/Housing/price-inflation/2013-to-2017?amount=100000

We didn’t expect real estate to have increased at such a marginally smaller rate to even the S&P. It would be easy to have once said “what’s foregone in profit is made up for in safety.” However, after the 2008 crash caused by mortgage backed securities and lenient lending practices it’s hard to justify that statement anymore. Since 2013 bitcoin outpaced real estate by 8,700x.

We could go on and compare things like bonds (negative real interest for the first time in history) or mutual funds. But Warren Buffet taught us that the S&P tends to outpace hedge and/or mutual funds over time anyway. Oil has been down more than 300% in the same time period and we won’t even entertain penny stocks or OTC securities. The only thing that can come close to bitcoin’s monstrous success since 2013 is Venture Capital where, according to Quartz Media, an average profit of 40% a year has been appreciated since 2013. The problem there, however, is that if you think it’s hard investing in bitcoin... try investing in a diversified venture capital fund. You’ll either have to jump through endless hoops or be deemed unqualified due to minimum income requirements. This option is not a realistic one for average Joe or Sally. People who invested in bitcoin in, or before, 2013 can only be labeled as prescient and/or wise, and you may want to rethink who’s managing your retirement plan at this point!

Optitoken is the first algorithmically traded, hyperdeflationary currency, that derives its value from a carefully curated token basket. Profits from the automatic trading of the portfolio are used to regularly buy Optitoken on exchanges, creating buy pressure and volatile price action. These tokens are then destroyed, creating further value. Our ICO is open to buy the initial token basket.

For more info on this and other related topics visit https://OptiToken.io and drop us a line.

Also give us a follow on our Medium blog for constant cryptocurrency/finance best-practices related updates.

You can find us on Twitter @OptiToken