TIL: Bitcoin transaction fees vs. Ethereum transaction fees

Bitcoin transaction fees work quite a deal different from Ethereum transaction fees.

Both PoW coins transact faster when the associated fee is higher because miners are more likely to process a transaction.

HOWEVER!

In Bitcoin, you basically pay a fee for the amount of bytes your transaction adds to the blockchain. If a transaction does not get processed by miners, the entire transaction is cancelled, no funds are withdrawn and no fees are paid.

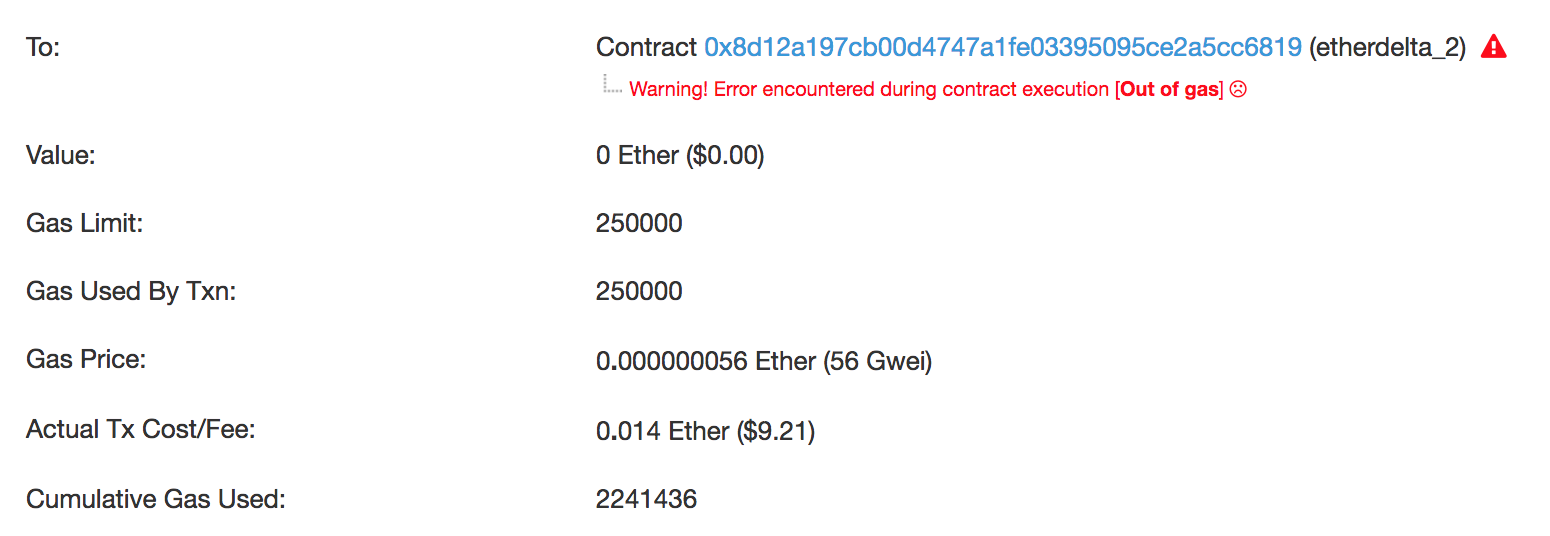

On Ethereum on the other hand, you pay a fee for miners executing a smart contract. This takes computing time. If you don't pay enough per GAS, miners might take long to pick up your transaction. If you don't supply enough GAS for each transaction the smart contract basically takes more computing power than you are willing to pay for. If a transaction block is found before your smart contract finished computing or your transaction is not included in the mined block, the network will try again to include your transaction. If your transaction runs out of GAS because of the calculations required for the smart contract, it gets cancelled at the expense of the GAS spent to calculate the smart contract and its outcome.

While Bitcoin basically refunds failed transactions, Ethereum will not execute the outcome of the smart contract but it sure enough will keep the fee associated with the failed transaction.

In the end, this means that you have to pay up more if you want to repeat a failed transaction by either raising the price per GAS and or the amount of GAS you are willing to pay for.

I hope this helps anyone who finds this.

Please leave a comment down below if this was helpful and please also leave a comment if it wasn't!