How to trade with Bitcoin in 2018! THE BEST

A stellar year for Bitcoin, 2017, opened its operations to $ 966.6 levels in January 2017. From there, the cryptocurrency embarked on a rebound that reached up to $ 20,000. Even after the volatility of recent days , Bitcoin has outperformed all other asset classes by a wide margin.

The big question on everyone's mind now is: What will happen in 2018 and how should one market Bitcoin?

The experts are divided in their opinion. Aggressive bulls have set targets of more than $ 60,000 by 2018. That's an increase of 300% from current levels. On the other hand, skeptics continue to question the valuation of cryptocurrencies.

In addition, some expect sharp changes in the cryptocurrency in 2018. Saxo Bank's outrageous prediction lists a possible maximum of $ 60,000, followed by a fall to $ 1,000. Similarly, cryptocurrency entrepreneur Julian Hosp believes that Bitcoin will fall to $ 5 000, but tends to think that it will also touch $ 60,000. But he is not sure, at what level it will be reached first.

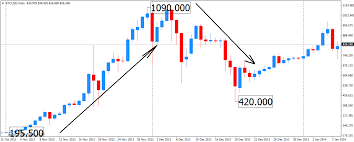

While predictions offer different opinions, it is difficult to negotiate outside of them. Therefore, we have tried to identify some unique patterns in the tables that were repeated in 2017. These can be used as guidelines by the traders to develop an adequate strategy for the 2108.

Watch for the 50-day simple moving average

In 2017, the 50-day simple moving average (SMA) acted as critical support. As seen in the table, this level was only exceeded four times.

In all other instances, the price hit the moving average or fell below during the day, but recovered quickly. So, a purchase close to the 50-day SMA offers a low risk purchase opportunity. Buy near the 50-day SMA and keep a loss minimization point below it. This may be one of the tools that can be used in 2018.

A decrease of the EMA of 200 days as a long-term entry opportunity

Bitcoin offered low-risk entry opportunities to long-term operators on the road to their 20-fold increase in 2017. It has not traded below the exponential 200 EMA (EMA) since October 2015, which It is a fundamental support.

In 2017, each time the cryptocurrency broke below the 50-day simple moving average, it was within striking distance of the 200-day EMA. This proved to be an excellent buying opportunity for long-term investors. Even next fall, a move close to the 200-day EMA should be seen as a buying opportunity.

The price will not necessarily reach the EMA of 200 days. On January 12, for example, it reached 6.5 percent above the 200-day EMA. Similarly, on March 25, it was 2.5 percent higher than the 200-day EMA. July 16 - the fund was formed at 10.7 percent above the 200-day EMA, and finally, on September 15, the fund was slightly more than 15 percent above the EMA 200 of days.

Although it is not perfect, traders can start their purchase at 15 percent above the 200-day EMA.

How do we calculate how high is the 200 day EMA price?

Although there is no specific indicator for it, we can use the "Price Oscillator" (PPO) by altering its values intelligently. The PPO offers the percentage difference between two exponential moving averages. Therefore, if we have to determine how high or low the price is from the EMA 200, we can feed the values of 1 200, which will give us the desired result.

What happens if Bitcoin breaks from the 200 day EMA?

If the price comes off the long-term moving average, it is a warning sign that things have changed. It indicates that Bitcoin is entering a bearish long-term trend or a limited-range stock, which will require a different trading strategy.

In commerce, profits are obtained by buying and selling at the right time.

While we have identified a low risk buying strategy, we still have to determine the best time to sell. Let's see, if we can identify an approximate place to sell, that will be close to the maximum.

The best place to sell

There was no indicator that would have given a consistent sales signal at the top. But it was noted that a simple trend line did the job perfectly.

As seen above, although a breakdown and a close below the trend line did not get it out of the correct position at the top, it certainly helped secure most of the gains.

Another indicator that could help is ADX.

BTC

Not only last year, a reading above 60 in the ADX has been a good selling point in Bitcoin, there for 2014. Even in 2017, readings close to 60 would have helped us

excellent post !! I leave my vote and I follow you I hope that you follow me and my next publications you can vote for me so we can grow together! a hug and success in steemit