Bitcoin witnesses Largest Dollar-Value Retracement in History

Markets Update: Bitcoin Sees Largest Dollar-Value Retracement in History

By Samuel Haig

Between the 12th and 15th of June, bitcoin lost approximately 30% of it’s value, seeing the largest dollar-value retracement across 4 days in bitcoin’s history of approximately $900 – $950 USD on both USD market leading exchanges Bitstamp and Bitfinex.

The Past 7 Days Has Seen Bitcoin Experience Both Record-Breaking Price Gains, and Record-Breaking Price Losses

Also Read: Markets Update: Bitcoin Price Cools Down After Slight Correction

2017 has been an incredible year for bitcoins and cryptocurrency. Bitcoin’s price saw a 300% increase from the start of the year, and many altcoins have seen meteoric rises.

For bitcoin, it has been a year of records. The past 7 days has seen bitcoin experience both record-breaking price gains, and record-breaking price losses – with Bitstamp and Bitfinex dropping from approximately $3000 USD to test a low in the $2100 area.

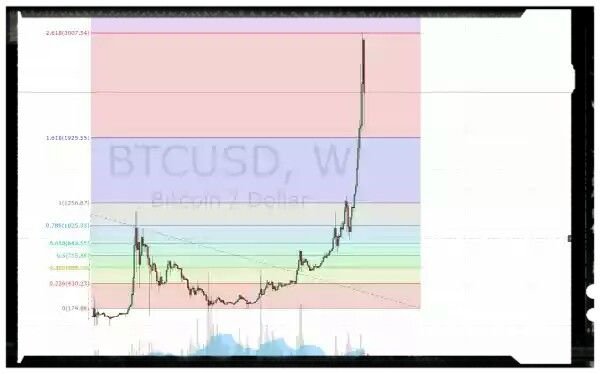

From the break of bitcoin’s preceding $1200 all-time to the establishment of $3000 as the local top, bitcoin had seen a spike in price that reached the 2.68 Fibonacci extension area.

This last week has seen price retrace down the 50 percent retracement area of the bull run from the previous all-time high, with the current price action appearing to be heading for a retest of the 78.6 Fibonacci retracement area of approximately $2600.

Healthy Retracement or Dead Cat Bounce?

The trading community now appears to be anxiously awaiting to see whether or not the current price action will come to comprise a healthy retracement, or a dead cat bounce.

Yesterday’s test of $2100 USD established an ascending trend-line on the 4-hour chart, signifying that the bull run may not be over. However, whether or not bitcoin can establish a new high remains to be seen, with many traders expecting the current bounce to encounter significant resistance in the $2600 – $2700 USD range. Should a lower top form, the question will be whether or not bitcoin can again bounce off the ascending trend-line and begin to form a symmetrical triangle formation, or it will break the trend-line and potentially form a head and shoulders formation.

Altcoin Markets Shed Dollar-Value

Although many of the altcoin markets, especially Ethereum, have seen dramatic price rises and record-breaking growth in total market capitalization, the recent reversal of the historic inverse correlation between bitcoin and altcoin price movements has seen other cryptocurrency markets lose dollar-value alongside bitcoin. As a consequence, ETH, ZEC, ETC, XMP, XRP, DASH, and REP all saw dollar-value losses off approximately 30% or higher alongside bitcoin between the 12th and 15th of June.

Although Ethereum looks as though it may be able to rival bitcoin’s total market capitalization, recent bitcoin volatility has seen ETH suffer significant dollar-value losses. During bitcoin’s 30% retracement from May 25-27, Ethereum lost 50% of its dollar-value, leading some to question the ability for Ethereum to sustain its dramatic growth long-term should bitcoin’s momentum begin to reverse.

Do you think that bitcoin will continue to break new highs? Share your thoughts below!

Congratulations @lovedayamos! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!