What you’re not being told about the Bitcoin (Cash) VS Bitcoin (Core) Debate

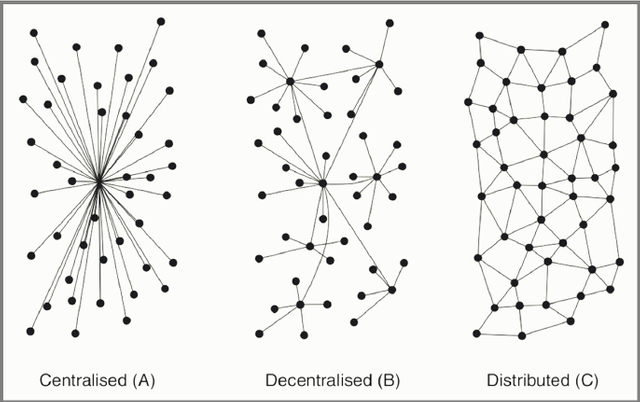

Bitcoin Cash is centralized

Bitcoin Cash and Bitcoin Core are decentralized by design. In a centralized system, there is one entity that has control of who is able to participate . In a decentralized or distributed system, no one can control the network. No one is prevented from mining on the BCH or BTC Network.

Decentralization generally speaking is not a Boolean. What people generally refer to as decentralization is decentralization within mining where miners have too much control over the network and thus control the majority of network mining power (hash rate). This being said, levels of centralization can take place in development and other areas influencing Bitcoins governance model i.e. with users, merchants, and exchanges. There will always be some level of centralization both on the Bitcoin and Bitcoin Cash network due to the competition inherent within a free market.

Vin Armani Explains the Decentralization of Bitcoin

Bitcoin Cash stole the name of Bitcoin from Bitcoin Core

You can’t plagiarize Bitcoin. It’s open source. Anyone can copy it, alter the code and spawn their own alt coin. Alternatively, if enough consensus is gained and a hard fork occurs, another chain of Bitcoin emerges. If Bitcoin cash generates enough hashing power through mining consensus and overtakes Bitcoin Core, it effectively by design becomes the new dominant Bitcoin fork. Therefore, all the hard forks have the potential to be candidates for the grand title of Bitcoin.

Bitcoin Cash like Ripple is Centralized

The architecture of Ripple is party centralized by design. Unlike Bitcoin Core or Bitcoin Cash, It has premined coins. The Ripple organization holds roughly 60% of the coins and release them as they want. Ripple has been adopted by banks and payment networks as settlement infrastructure technology. It has a very different objective and architecture than Bitcoin (Core/Cash).

Bitcoin is not suppose to be used as electronic cash but like digital gold

From the beginning, Bitcoin transactions were meant to be as cheap as possible. Bitcoin Core destroyed Bitcoin's usefulness as money by creating a system where $30 fees were celebrated by many of the developers within the community. Mining fees and congestion has come down significantly as of late however only due to the usage within the Bitcoin (Core) network being significantly reduced.

“Almost all transactions are free.. The average transaction, and anything up to 500 times bigger than average, is free. It’s only when you’re sending a really huge transaction that the transaction fee ever comes into play, and even then it only works out to something like 0.002% of the amount. It’s not money sucked out of the system, it just goes to other nodes.” – Satoshi Nakamoto

Double spending is likely to occur on Bitcoin (Cash) and Jihan Wu could perform this with a 51% attack

A 51% attack occurs when the majority of the miners are controlled by a single entity and that single entity has the power to attempt to decide which transactions get approved or not. This would allow them to prevent other transactions and allow their own coins to be spent multiple times, a process called double spending. Theoretically this is possible in any open network (Bitcoin Cash or Core) however the amount of computational power required to do this is astronomical. At current network mining difficulty levels, not even large scale governments could easily mount a 51% attack.

Jihan Wu is the largest manufacture of mining rigs that allow people to mine on the Bitcoin network, mines roughly 16% of BTC, is one of the biggest miners of Lite coin and mines the majority of Bitcoin Cash.

Even if we are to assume Jihan Wu is capable of launching a 51% attack on the Bitcoin (Cash) network, due to the nature of this attack diminishing trust in a network which would bring down the price of Bitcoin (Core / Cash), he would be massively economically disincentivesed to launch a 51% attack as he has the most to lose from it.

Further to note, double spend transactions are far more likely to occur on a congested network with slow confirmations. You’re more likely to experience network congestion on the Bitcoin Core network than on the Bitcoin Cash network.

Bitcoin Cash is a conspiracy by Roger Ver, Jihan Wu and Craig Wright

Satoshi Nakomoto turned over the Bitcoin repository and project to Gavin Andresen (Lead developer) who was nice enough to share the repository with other people on the team who later revoked his access. Gavin proclaims that Bitcoin Cash is the real Bitcoin and that Craig Wright has verified his identity by signing the first ever mine block with the private key of Satoshi. (Also verified by John Matonis).

The core developers inspected Gavin’s laptop fearing it had been compromised and after verifying that it hadn’t, have not reinstated Gavin’s access and proclaim Gavin has been duped. If there was ever a conspiracy ,it appears it was instigated by proponents of Bitcoin Core against Bitcoin Cash.

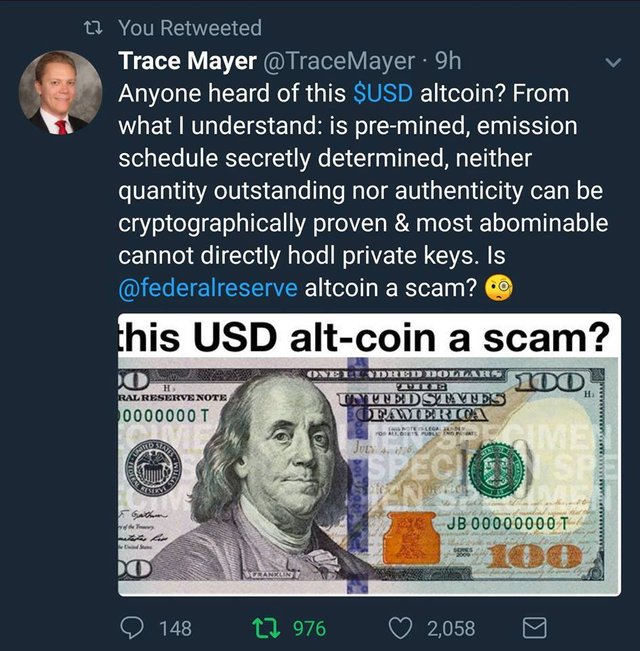

Bitcoin Cash is just another FIAT currency, if not worse

A FIAT currency is a currency regulated by a governing body. Crypto-Currencies like Bitcoin Cash and Bitcoin Core are regulated by the laws of mathematics, a blockchain, consensus algorithms and protected by cryptography. The fundamental distinction between FIAT and crypto-currencies to me is that the government forces you to use their FIAT currency and criminalize people that try to create their own currency as they don’t want competition. People can choose what crypto-currencies they want to use, centralized or decentralized, provided it’s voluntary.

Bitcoin Core applied Segwit to address the scalability issue. Bitcoin Cash by increasing blocksize is making Bitcoin more centralized

The more people that are able to run full nodes, the more decentralized and secure the network. This is the main reason Bitcoin Core does not want to increase block sizes. The majority of the miners however that are mining have invested tremendous resources into mining. Increasing the blocksize by 1 gigabyte would warrant concerns about centralization however increasing the block size by another megabyte or so is not going to greatly impact any miners ability to run full nodes within our present day technology.

It’s also worth mentioning that Bitcoin was following a road map on dealing with the scaling problem which was to increase the block size as a block was approaching full. The continual growth of computer hardware resulting in computing power doubling every 18 months (Mores Law) would more than handle people having adequate hardware to handle full nodes. The issue arose when certain people within the Bitcoin community did not want to increase the block size to 2 megabytes due to the concerns around decentralization. Effectively, what we now recognize as Bitcoin (Core) was where people within the community through consensus applied Segwit and branched away from what the developers had originally been doing since Bitcoins inception.

Bitcoin (Core) is more secure

The Bitcoin Core network may have the most hashing power at present however I don’t believe Bitcoin core is currently more secure than Bitcoin cash. Adding the segwit layer has actually impeded its security according to Craig Wright who has a better understanding of the architecture than anyone.

Bitcoin (Cash) using the name Bitcoin has only confused new adopters of Bitcoin and is fraudulent behavior.

Bitcoin was initially published by Satoshi Nakomoto under the name Bitcoin. It was renamed to Bitcoin Core to distinguish it from the network. Bitcoin Cash and Bitcoin Core both use the Bitcoin Network.

Regardless of which side you’re on in the Bitcoin debate. It’s worth considering that Bitcoin was initially adopted by Libertarians/Anarcho-Capitalists and these first adopters are ostensibly more in favour of Bitcoin (Cash).

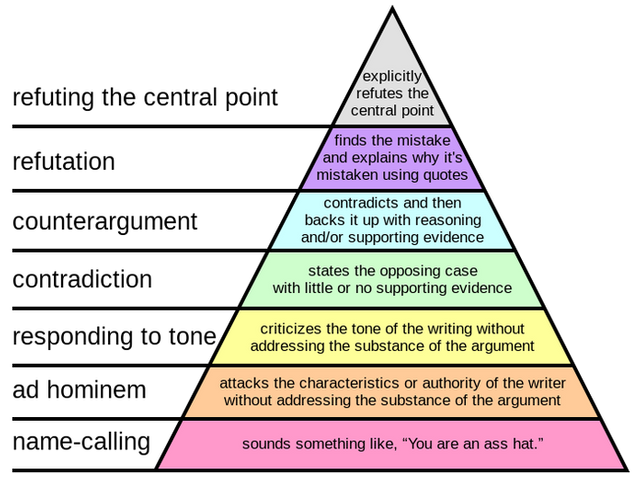

Though the arguments from supporters of Bitcoin Core have been some warranted concerns around centralization, the majority of the arguments you see floating around on social media tend to be theories built of air and imagination, emotional arguments and false accusations about Roger Ver, Craig Wright and Jihan Wu taking part in a conspiracy to defraud the Bitcoin users. Due to the massive censorship taking place on Bitcoin Reddit, many people are not being given a clear picture on the debate and have ended up parroting clichés and false arguments.

The effects of Censorship and Propaganda upon Bitcoin

It's so easy to get caught up with what the majority are saying and become hypnotized by the humm of the crowd. Anyone that's involved in a movement realizes just how emotionally charged people can be when discussing divisive issues however that shouldn’t excuse calumny, character assassination and low level argumentation. It’s incumbent upon us as individuals to think for ourselves.

Stop conforming to everything you read and hear. Do your own due diligence, research and refrain from judgement until you’re more conversant with the facts when making judgments on people and commenting on areas you’re unfamiliar with.

If people really looked into the heart of what's going on in the world of Bitcoin, they'd uncover a startlingly different story to what they are being told by the general public. It's strange that we live in a world where there is so much drive towards not rocking the boat and standing out as an individual, but the word 'individual' in etymological essence basically means non divided. To be an individual is to truly be at whole with oneself, for it is within ones wholeness that one finally sees the truth.

Don’t end up parroting the amorphous thoughts an ideas of the masses.

F Bcash

The lowest rung of argumentation. Thank you for help making my case :)

Added to my follow list. Keep up the good work and what do you think of the current market?

Thanks. The current market in regards to crypto has been more stable over the past couple of weeks and I'm expecting to see the major coins go up a good deal over the next few months but only time will tell.