What you need to know about cryptocurrency mining

Cryptocurrency news has been hot of late, thanks in no small part to the skyrocketing prices of Bitcoin and Ethereum, the two largest cryptocurrencies right now. Litecoin and other cryptocurrencies are also up in value, and given the prices on graphics cards that are supposed to be useful for gaming, some of you will inevitably wonder: should I get into the mining business?

That's a big, open-ended question, and the answer depends on many factors. I'm not going to try and cover every aspect, because Google is your friend, but let's quickly go over the basics of what you would need to get started, and I'll include some rough estimates of how much money you can make at the end.

Blockchains and the block reward

The core of mining is the idea of block rewards. For most coins, these are given to the person/group that finds a valid solution to the cryptographic hashing algorithm. This solution is a mathematical calculation that uses the results of previous block solutions, so there's no way to pre-calculate answers for a future block without knowing the solution to the previous block. This history of block solutions and transactions constitutes the blockchain, a sort of public ledger.

What is a block, though? A single block contains cryptographic signatures for the block and the transactions within the block. The transactions are collected from the network, typically with a small fee attached, which also becomes part of the block reward. There's a difficulty value attached to the solution for a block as well, which can scale up/down over time, the goal being to keep the rate of generation of new blocks relatively constant.

For Bitcoin, the target is to generate a block solution every 10 minutes on average. For Ethereum, block solutions should come every 16 seconds. That's obviously a huge difference in approach, and the shorter block time is one reason some people favor Ethereum (though there are others I won't get into). Simplistically, the number solution has to be less than some value, and with 256-bit numbers that gives a huge range of possibilities. The solution includes the wallet address for the solving system, which then receives all the transaction fees along with the block reward, and the block gets written to the blockchain of all participating systems.

Think of it as panning for gold in a stream—you might get lucky and find a huge gold nugget, you might end up with lots of flakes of dust, or you might find nothing. If the stream is in a good location, you make money more quickly. The difference is that with cryptocurrencies, the 'good location' aspect is replaced by 'good hardware.'

Setting up the software

There are many options for cryptocurrency mining. Some algorithms can still be run more or less 'effectively' on CPUs (eg, Cryptonight), others work best on GPUs (Ethereum, Zcash, Vertcoin), and still others are the domain of custom ASICs (Bitcoin, Litecoin). But besides having the hardware, there are other steps to take to get started with mining.

In the early days of Bitcoin and some other cryptocurrencies, you could effectively solo-mine the algorithms. That meant downloading (or even compiling) the wallet for a particular coin and the correct mining software. Then configure the mining software to join the cryptocurrency network of your choosing, and dedicate your CPU/GPU/ASIC to the task of running calculations. The hope was to find a valid block solution before anyone else. Each time a block is found, the calculations restart, so having hardware that can search potential solutions more quickly is beneficial.

These days, a lot of people forego running the wallet software. It takes up disk space, network bandwidth, and isn't even required for mining. Just downloading the full Bitcoin blockchain currently requires over 45GB of disk space, and it can take a while to get synced up. There are websites that take care of that part of things, assuming you trust the host.

In theory, over time the law of averages comes into play. If you provide one percent of the total computational power for a coin, you should typically find one percent of all blocks. But as Bitcoin and its descendants increased in popularity, difficulty shot up, and eventually solo-mining became an impractical endeavor. When you're only able to provide 0.00001 percent of the mining power, and that value keeps decreasing over time, your chance of finding a valid block solution becomes effectively zero. Enter the mining pools.

Join our mining guild!

If solo mining is like solo gaming in an MMO, block rewards have become the domain of large mining guilds, called mining pools. For blockchain security reasons, you don't want any single group—a mining pool or an individual—to control more than 50 percent of the computational power (hashrate) for the coin network, but for mining purposes, being in a bigger pool is almost always better.

The reason is that, unlike block rewards where everything goes to the winning system, mining pools work together and distribute the rewards among all participants, usually based on a percentage of the mining pool hashrate. Your hardware gets smaller portions of work from the pool, and submits those as shares of work. Even if you only contribute 0.00001 percent of the hashrate, you still get that percentage of every block the pool solves.

To give a specific example, suppose a coin has a total network hashrate of 1Phash/s (peta-hash), but you only provide 0.1Ghash/s. Your chance of mining a block solo is about as good as your chance of winning the lottery. If you join a pool that does 25 percent of the network hashrate, the pool should find 25 percent of blocks, and you'll end up with 0.00004 percent of the block rewards. If a block is worth 50 coins, that's 0.0002 coins from each block the pool finds—often minus a small (1-3) percentage for the pool operators. That might sound like a pittance, but when coins are worth hundreds or even thousands of dollars, it can add up quickly.

There are many places that will provide calculators for cryptocurrencies, so you can see how much you could potentially earn from mining. But ultimately, you'll want to join a mining pool. As a side note, I'd recommend using a new email address for such purposes, and then I'd create a unique password for every pool you happen to join—because cryptocurrency thefts are far too common if you're lax with passwords. #experience

If you want to actually collect a coin, like Ethereum, you'll need to take the additional steps of downloading the Ethereum client, syncing up to the blockchain, and setting up the mining pool to pay out to your wallet. It's possible to have pools deposit directly to a wallet address at a cryptocurrency exchange, but again, there are risks there and long-term I wouldn't recommend storing things on someone else's servers/drives.

If all this sounds time consuming, it can be—and the people who are really into cryptocurrency often do this as a full-time job. And the real money often ends up in the hands of the pool operators and exchanges, but I digress.

Doing the actual mining

You've got your hardware, you've joined a mining pool, and you're ready to rock the cryptocurrency world. All that's needed now is to download the appropriate software, give it the correct settings for your hardware and the pool, and then away you go. Sort of.

Most pools will provide basic instructions on how to get set up for mining, including where to download the software. But all software isn't created equal, and even things like drivers, firmware revisions, and memory clockspeeds can affect your mining speed. So if you're serious about mining, get friendly with scouring places like Bitcointalk, Github, and other forums.

The easiest way to mine a coin is to just point all your mining rigs at the appropriate pool and load up the necessary software. The problem is that the 'best' coin for mining is often a fleeting, ethereal thing—Ethereum's real value came because other market forces pushed it from $5-$10 per ETH up to $200+ per ETH during the past several months. Prior to that, it was only one of many coins that were potentially profitable to mine. But switching between coins can take a lot of time, so there's other software that will help offload some of that complexity.

One popular solution is Nicehash, which will lease hashing power to others that will pay for it in Bitcoin. In effect, it transfers the job of figuring out which coin/algorithm to mine to others, though again there are fees involved and the going rates on Nicehash are lower than mining coins directly. The benefit is that you don't end up holding a bunch of some coin that has become worthless.

A more complex solution is to set up multi-algorithm mining software on your own. To do this, you would typically have accounts for all the coins you're interested in mining, and then create rules to determine which coin is best at any given time. Sites like WhatToMine can help figure out what the currently best paying option is, but naturally others would be seeing the same data.

Bottom line—what's it cost and what can you gain?

The thing you need to know with cryptocurrency mining is that beyond the initial cost of the hardware, power and hardware longevity are ongoing concerns. The lower your power costs, the easier it is to make mining a profitable endeavor. Conversely, if you live in an area with relatively expensive power costs, mining can seem like a terrible idea.

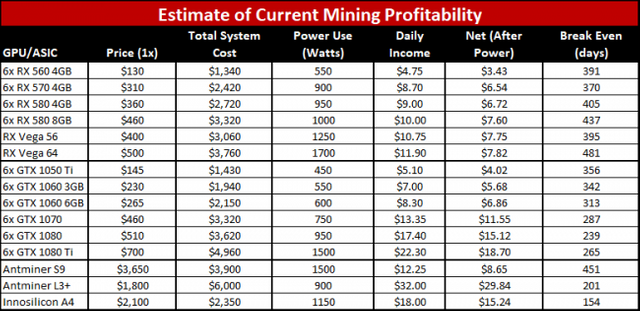

When many people think about cryptocurrency mining, the first thought is to look at Bitcoin itself. Now the domain of custom ASICs (Application Specific Integrated Circuits), Bitcoin isn't worth mining using GPUs. Where a fast CPU can do perhaps 40MH/s and a good GPU might even hit 1GH/s or more, the fastest ASICs like the Antminer S9 can do 14TH/s. But the Antminer S9 costs $2,100 or more, and still uses around 1350W of power (so you need to add your own 1500W PSU)—and you'll net about $8 per day.

Can you do better with mining using graphics cards? As you might have guessed given the current prices of RX 570/580 and GTX 1060/1070, the answer is yes, though not necessarily at the currently inflated GPU prices. But let's start with a basic system cost. You'll need a cheap CPU, motherboard with six PCIe slots, 4GB DDR4 RAM (maybe 8GB if you want), budget hard drive, six PCIe riser adapters, and 1350W 80 Plus Platinum PSU. For the case, you're usually best off building a mining rig using wire shelving and zip ties or something similar. Add all of that up and it will cost around $560 (with 4GB RAM).

The sticking point is the graphics cards. If you could buy RX 580 at the original MSRP of $230 for the 8GB card, $200 for the 4GB model, or $170 each for the RX 570 4GB—yeah, those are the actual launch prices!—that would be $1,380, $1,200, or $1,020. With prices skyrocketing on the RX cards, GTX 1070 became the next logical target, with prices increasing from $350 per 1070 a few months ago to $450+ per card today.

I've got good news for gamers, as I've put together a table showing expected returns using various forms of mining, using current graphics card and ASIC prices. Some of these (like the Antminer L3+) are difficult to find or are still pre-order, but you can sometimes pay a significantly higher price to get one. Here's what things currently look like:

Is there still money to be made as a cryptocurrency miner? I think a lot of this goes back to what happened with Ethereum this past year, with the value going from under $10 per ETH to a peak of nearly $400 per ETH. Selling all the coins you mine can earn money, but if you had the foresight to mine and hold ETH and sold near the peak value, you literally just hit the jackpot. Or if you prefer mining slang, you hit the motherload.

Ethereum prices have since dropped down to $200 (give or take), but there's this hope that eventually another bubble will occur, driving prices up into the thousands of dollars per ETH. Sound like fantasy land? Tell that to all the Bitcoin miners and investors who got in for hundreds of dollars. But without a price spike—and with the potential for the price to drop instead of going up—the above table is something of an optimistic view of the cryptocurrency market.

Price volatility combined with increasing difficulty could radically change things over the span of months. Instead of 200-400 days to recover your hardware investment, it might take several years. Or it could go the other way and take 3-6 months. I wouldn't count on most GPUs surviving 24/7 mining for several years, however.

The bottom line is that at current GPU prices, which remain supply constrained, it's no longer a 'safe' investment to put tons of money into new mining rigs. So the bubble has burst and things should be settling down again.

Perhaps even better (for gamers), early estimates of mining performance using the Vega Frontier Edition suggest it won't be substantially faster than current AMD cards, and with higher power draw it won't be particularly attractive either. But be warned that software optimizations could shake things up. If someone figures out a way to get twice the performance out of a Vega card, it could become the new mining wunderkind.

Should you quit gaming and start mining, then? I wouldn't recommend it—because if you haven't gotten started already, you're already behind the bubble and will may end up taking a loss. Besides, playing games is more fun, and doesn't serve to heat up your office. That unfortunately won't stop miners from continuing to buy graphics cards, so long as they see a potential profit in it.

Great write up. Wondering if you suffer from blockfolio addiction too? - https://steemit.com/cryptocurrency/@cryptocoinclub/confessions-of-a-blockfolio-addict