Just like in the original gold rush, it's the ones selling the picks and shovels that get rich

In news out earlier today, it was revealed that Bitmain likely made close to $4 Billion last year.

If you are not familiar, Bitmain manufactures mining hardware, designed their own ASIC chip, and runs their own mining operations, including their own mining pool.

According to estimates by Bernstein Research released this week, Bitmain made roughly $3-$4 Billion last year alone.

For comparison's sake, that bests the 24 year old technology hot shot Nvidia, who was said to have made roughly $3 Billion in profits last year.

Bitmain has been around since 2013, to give you some perspective on how impressive that is.

How did they make their money?

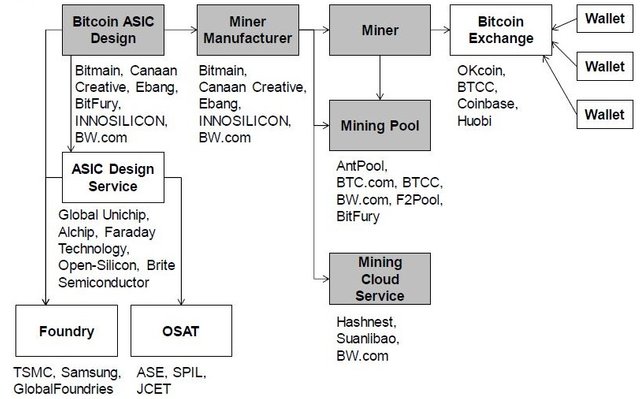

You can see a breakdown of their revenue sources here:

However, the bulk of that revenue likely came from the selling of their mining products.

On top of that, Bitmain was able to increase the price of their bitcoin AntMiner S9 as the price of bitcoin increased.

The beauty for them was that since there aren't many legitimate competitors, they are able to adjust the price of their miners depending on the market price of bitcoin.

(It is estimated that they currently have 70-80% of the bitcoin mining market.)

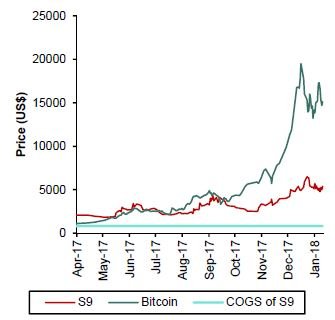

As you can see here, the S9 model was selling in the hundreds of dollars at the beginning of the year to costing over $5k when bitcoin was at all time highs:

The beauty for the company is that the cost of production for this product was basically unchanged.

Which means the increase in sale price is all profit for the company.

The original gold rush all over again.

Similar to what happened in the original gold rush days, instead of the people doing the gold mining becoming rich, it was the ones selling them the tools to mine the gold that really became rich.

IE, the ones selling the picks and the shovels.

In this case it is no different, the most profitable company in the cryptocurreny space was the one that was selling the mining equipment to the miners.

Not to mention it has already been reported that Coinbase made over a billion dollars last year as well.

Based on this information, it seems the ones that are really printing all the money right now are the ones that are facilitating the cryptocurrency markets as opposed to the ones strictly investing in in them.

Stay informed my friends.

Follow me: @jrcornel

Guess I better buy the software and get into mining 🤪💰🤪

its crazy to think that a company started a few years ago can beat the earning of Nvidia a giant... but bear in mind... fast up... fast down

Don't forget how much of their operation is subsidized by China... can't know the answer to that and it's probably a messy equation.

Just a few years ago Wallstreet had given NVDA up for dead. PC gaming was dying, cellphones were rising, etc. Amazing that now they are once again a wallstreeet poster boy with their AI, self-driving car, and gaming/ethereum mining exposure.

I have no position in NVDA at the current price even though it's a great company. If proof-of-work ever comes along, it'll hurt.

Yes i agree with u sir.as ur a crypto bull.u know a lot about it.thanks for sharing.

Are there serious competitors of Bitmain yet or not?

Mining itself is a mugs game and has been since 2012, unless you have free power. I bought one of the first butterfly labs ASICS. I paid in bitcoin and I think I paid around 40 btc. I only ever mined back around 20 with it but the dollar value was much higher. If I had of just held the btc I would have been much better off and the story hasn’t really changed since!!

When you get into a shooting war, the people making money are the arms dealers.

This comparison is quite clever. I would even go as far as to say that this might also apply to entrepreneurs who adapt and build based off of the Steem blockchain. Maybe, 5 years from now, these entrepreneurs will be in the hot seat of the next gold rush. However, it might be slightly different. You said that BitMain controls 70-80 percent of the mining market. I think that in the long run, there won't be just one company at the center of the Steem market. I think there will be hundreds, or maybe even thousands. But, that's what the creators intended. This post was informative though. Thank you!

That's a bit of a worrying trend if you ask me. If a company can control 70-80% of the mining market, than that can't be a very good thing in my opinion... These numbers are just out of control aswell. Do you know if this can really have a direct impact on the market? Is it really as bad as it sounds?

It just means it can't last if prices stay anywhere close to these levels. More competition is coming, which is a good thing.

@tuwore True, having 70-80% of the control of something means it is not decentralized, which is obviously in stark contrast to the whole idea of what this digital revolution is all about! I think once people gain so much power in a certain space in society it is very hard if not impossible to re-distribute that control out as well unfortunately.

I hope more competition is coming from Samsung and other chip manufacturers. I cannot imagine that any major chip manufacturer can afford to ignore a multi billion hardware market.

very true, good point :)

Enlightening post. I've been watching the crypto space since 2014 and there's been this ongoing rumor (probably true) that the mining companies build these ASIC machines, run them for themselves for a few days to weeks to "test them."

The "testing" conveniently results in their pocketing quite a bit of extra profit over time.

Wow!! That is quite the revelation. I truly never considered the impact from that link of the chain but it makes absolute sense. It really makes we wonder what value i could be getting on hashflare if it wasn't for the extreme costs for the mining equipment on the other side. The worst part is that as Bitcoin dropped the fees and cost to invest in hashflare remained the same. This caused me to turn off the reinvest feature for now because you no longer get value for your investment. I think looking back now at my experience with hashflare and with armed with information like this I would seriously reconsider my hashflare investment. Long term I think I would have been better off just investing the same amount of money straight into Bitcoin.

That's a lot of money for a 4-5 year old company. I wonder what their plan is for when the viability of mining decreases too much. Will they just close down the business or will they move onto other cryptocurrencies? I guess at some point mining will no longer be done - only a few coins will come out of this as solid, usable projects.

I think some fresh competition would be a good thing for the market. Though I have no idea how hard it is to enter the mining hardware manufacture segment at a state where the new company could also be a decent enough disruptor. It's already costly enough to buy graphics card because of cryptocurrency mining popularity and no one seems to be doing anything about that.